2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

How Interest Rates Can Impact Your Monthly Housing Payments

How Interest Rates Can Impact Your Monthly Housing Payments Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage...

How Your Tax Refund Can Move You Toward Homeownership This Year

How Your Tax Refund Can Move You Toward Homeownership This Year If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this...

10 Steps to Buying a Home

10 Steps to Buying a Home Some Highlights: If you’re thinking of buying a home and you’re not sure where to start, you’re not alone. Here’s a guide with 10 simple steps to follow in the homebuying process. Be sure to work with a trusted real estate professional to...

How Much “Housing Wealth” Can You Build in a Decade?

How Much “Housing Wealth” Can You Build in a Decade? Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30...

Thinking of Selling? Now May Be the Time

Thinking of Selling? Now May Be the Time. The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a driving factor in that change. The average 30-year rate in 2019, according to Freddie Mac, was 3.94%....

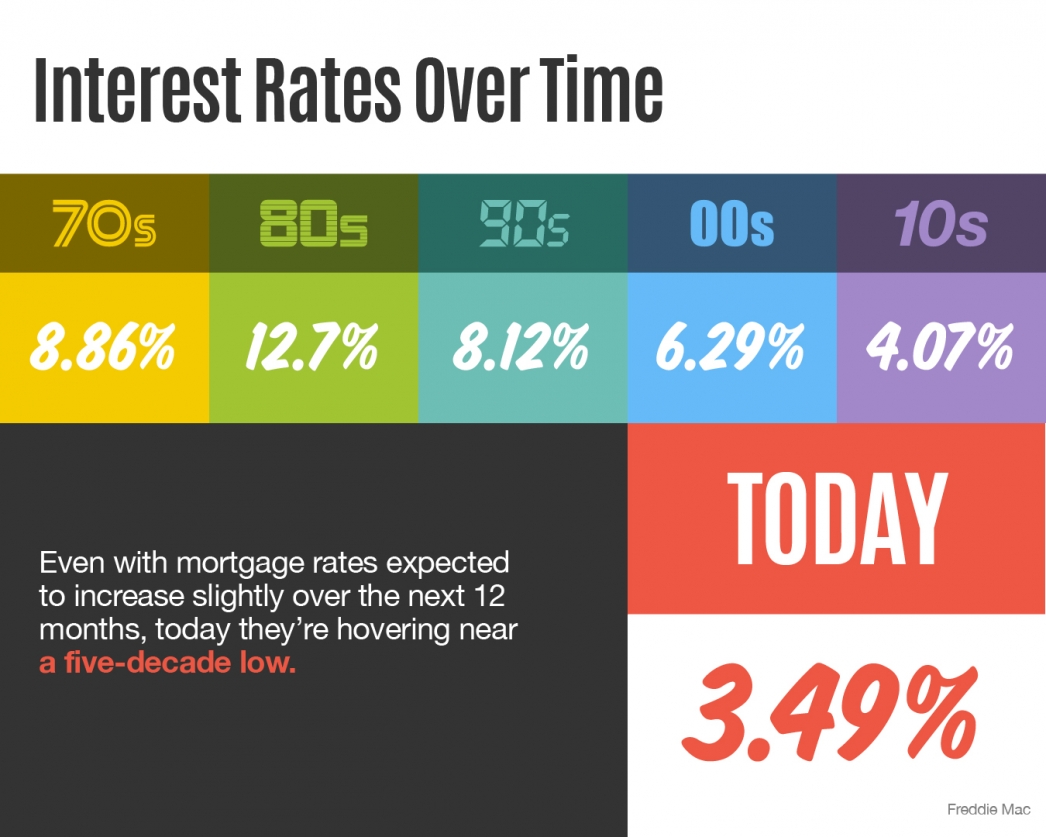

Income Rates Over Time

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The...

Entry-Level Homeowners Are in the Driver’s Seat

Entry-Level Homeowners Are in the Driver’s Seat One thing helping homeowners right now is price appreciation, especially in the entry-level market. In the latest Home Price Insights report, CoreLogic reveals how home prices increased by 4% year-over-year and projects...

Opportunity in the Luxury Market This Year

Opportunity in the Luxury Market This Year Homes priced in the top 25% of a price range for a particular area of the country are considered “premium homes.” At the start of last year, many of the more expensive homes listed for sale hadn’t seen as much interest, since...

Whats Trending in Outdoor Kitchens?

Outdoor kitchens have been popular for years. Not only do they give you an excuse to enjoy beautiful weather outdoors but they’re also great for entertaining. Having a nice outdoor kitchen can even improve the overall value of your home! While these kitchens...

Breaking News Housing Inventory

Breaking News! Housing Inventory Is Falling! February 2-22-20 Utah Active Homes From Utah Real Estate >>> 6161 Salt Lake County Active Homes for Sale >>> 1265 Utah County Active Homes for Sale >>> 1387 Davis County Active Homes for Sale...