2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Recession? Yes. Housing Crash? No.

Recession? Yes. Housing Crash? No.With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate...

More than half of homes in America have at least 50% equity. Wondering how much equity you have? Let’s connect.

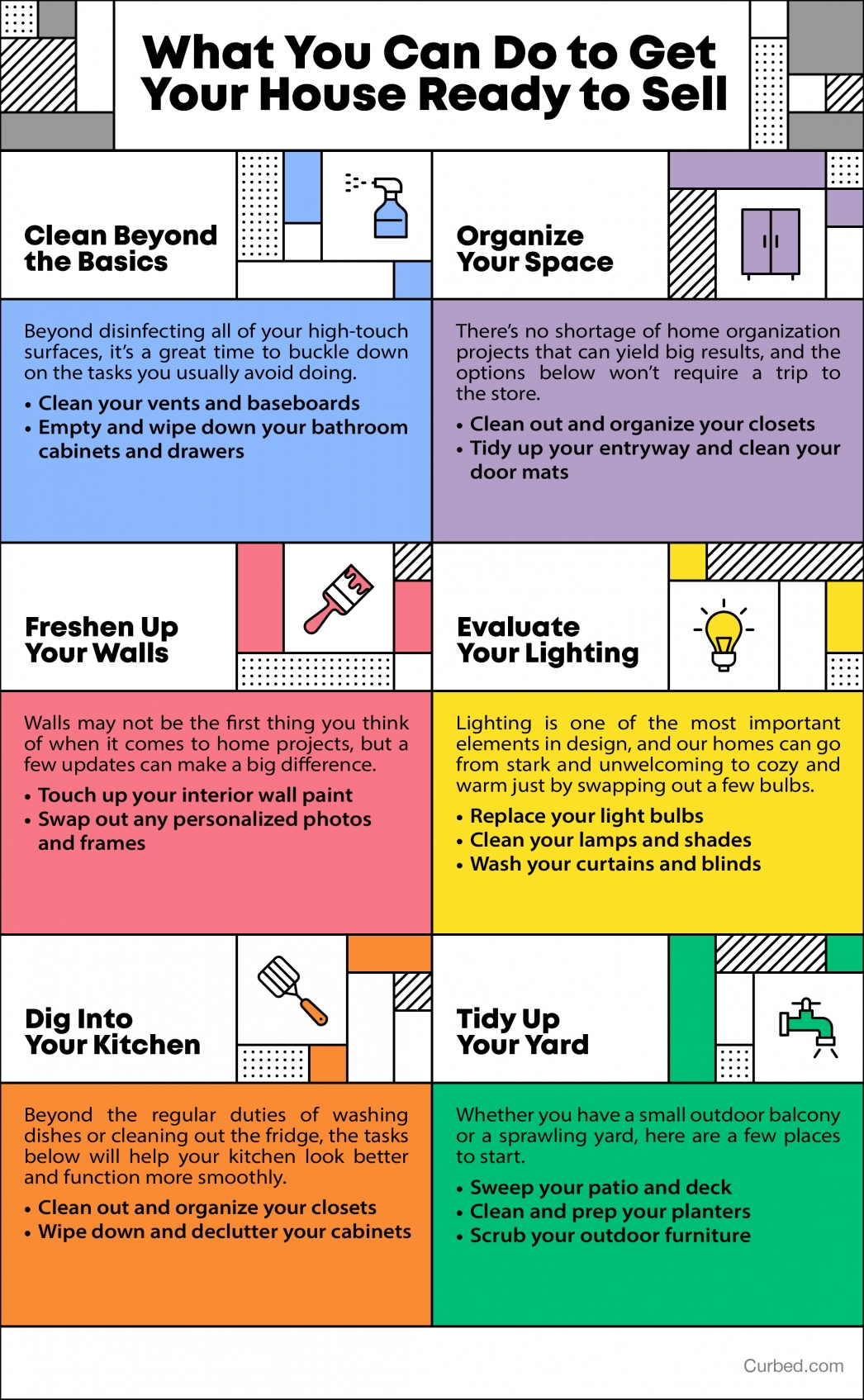

What You Can Do to Get Your House Ready to Sell

What You Can Do to Get Your House Ready to Sell Some Highlights: Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store. Your real estate plans don’t have to be completely on hold even while we’ve hit the...

Why Home Office Space Is More Desirable Than Ever

Why Home Office Space Is More Desirable Than EverFor years, we’ve all heard about the most desirable home features buyers are looking for, from upgraded kitchens to remodeled bathrooms, master suites, and more. The latest on the hotlist, however, might surprise...

Will Surging Unemployment Crush Home Sales?

Will Surging Unemployment Crush Home Sales?Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many...

Auto DraftWhy Pre Approval Is a Great Step to Take Today

Why Pre Approval Is a Great Step to Take Today If you’re in the position to buy a home this year, pre-approval is something you can still do right now to get ahead in the homebuying process. Let’s connect to talk about your goals for 2020.

The Housing Market Is Positioned to Help the Economy Recover

The Housing Market Is Positioned to Help the Economy RecoverSome HighlightsExpert insights are painting a bright future for housing when the economy bounces back – and it will.We may be facing challenging economic times today, but the housing market is poised to help...

Looking to the Future: What the Experts Are Saying

Looking to the Future: What the Experts Are SayingAs our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human...

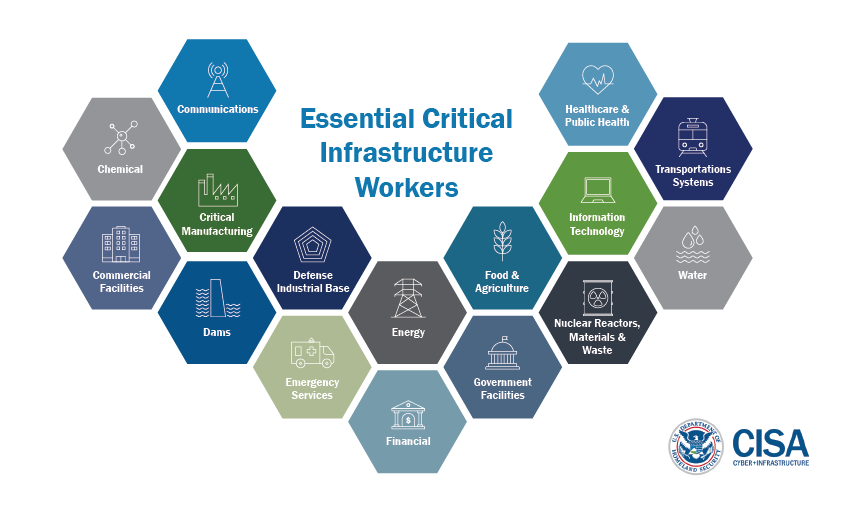

Real Estate Is an Essential Service According to U.S. Government

According to CISA (Cybersecurity and Infrastructure Security Agency)This list is advisory in nature. It is not, nor should it be considered, a federal directive or standard. Additionally, this advisory list is not intended to be the exclusive list of critical...

The Best Advice Does Not Mean Perfect Advice

The Best Advice Does Not Mean Perfect AdviceThe angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol...