Utah Realty Blog & News

The Latest news for Real Estate both local and National.

Buyers

Sellers

Seniors

What’s Ahead for Mortgage Rates and Home Prices?

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible.

Mortgage Rates Will Continue To Respond to Inflation

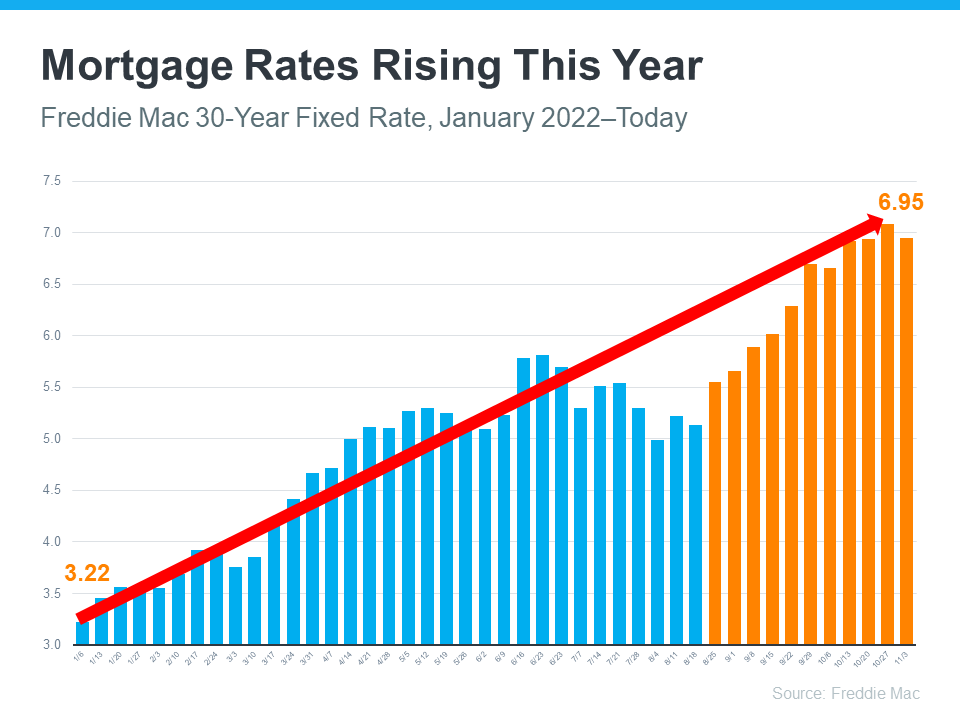

There’s no doubt mortgage rates have skyrocketed this year as the market responded to high inflation. The increases we’ve seen were fast and dramatic, and the average 30-year fixed mortgage rate even surpassed 7% at the end of last month. In fact, it’s the first time they’ve risen this high in over 20 years (see graph below):

In their latest quarterly report, Freddie Mac explains just how fast the climb in rates has been:

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Because we’re in unprecedented territory, it’s hard to say with certainty where mortgage rates will go from here. Projecting the future of mortgage rates is far from an exact science, but experts do agree that, moving forward, mortgage rates will continue to respond to inflation. If inflation stays high, mortgage rates likely will too.

Home Price Changes Will Vary by Market

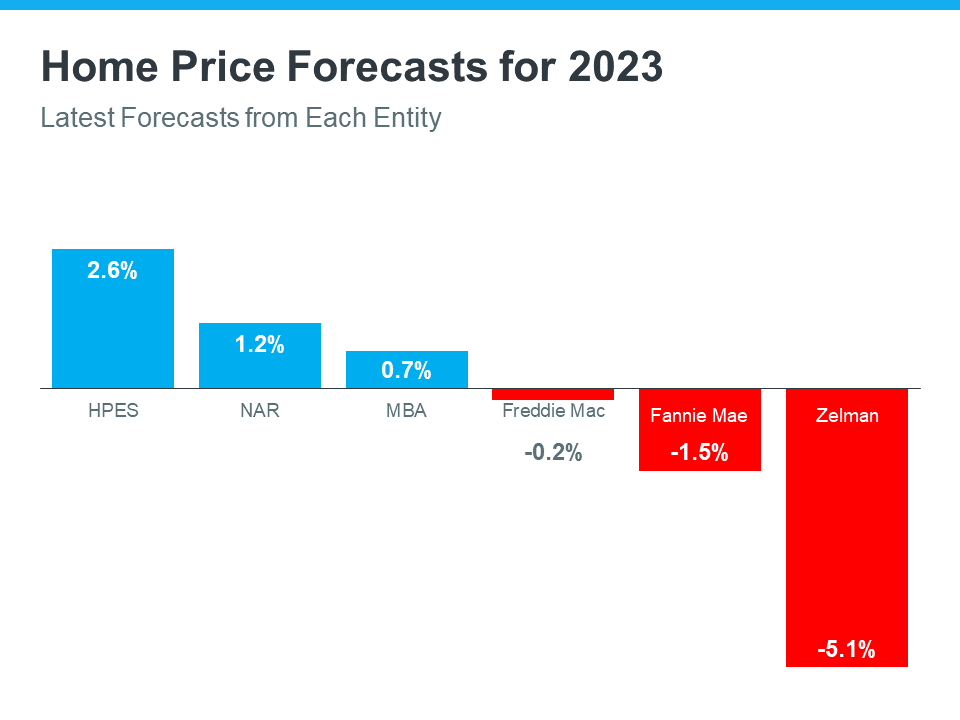

As buyer demand has eased this year in response to those higher mortgage rates, home prices have moderated in many markets too. In terms of the forecast for next year, expert projections are mixed. The general consensus is home price appreciation will vary by local market, with more significant changes happening in overheated areas. As Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Basically, some areas may still see slight price growth while others may see slight price declines. It all depends on other factors at play in that local market, like the balance between supply and demand. This may be why experts are divided on their latest national forecasts (see graph below):

Bottom Line

If you want to know what’s happening with home prices or mortgage rates, let’s connect so you have the latest on what experts are saying and what that means for our area.

Governors of Western states consider public lands for developing affordable housing

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Household debt in Utah rising at one of the fastest rates in the nation

A report reveals that Utah has one of the highest rates of household debt growth in the U.S., with residents adding over $1 billion in debt between the second and third quarters of 2024. The average household increased its debt by more than $1,000, ranking just behind...

Tips for Cutting Costs: Boost Savings for Home Buying!

Create a budget by listing income sources, tracking spending, and identifying non-essential expenses to reduce. Set financial goals by researching housing markets, breaking down savings into monthly or yearly targets.

Will You Owe Taxes When You Sell Your Home?

Homeowners may owe taxes if their profit exceeds the exclusion limits when selling their home. Single filers can exclude up to $250K in profits; couples filing jointly can exclude up to $500K.

Mortgage Calculator: How Much You Need To Buy a Home in Utah at a Rate of 6.60%

The average rate on a 30-year mortgage has decreased to 6.60%. In Utah, the median home price is $595,000, requiring a 20% down payment of $119,000, resulting in a monthly payment of $3,040. With a 10% down payment, the upfront cost is $59,500, leading to a monthly...

How to Maximize Profit When Selling a Damaged House

Selling a damaged house can still be profitable if you follow certain strategies. Start by staging the property to highlight its best features. Make necessary repairs without overspending. Improve curb appeal by cleaning up the exterior. Depersonalize and deep-clean...

Join Our Newsletter

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus lacinia velit a feugiat finibus. Morbi iaculis diam id tellus iaculis, eu pretium metus fermentu