Utah Realty Blog & News

The Latest news for Real Estate both local and National.

Buyers

Sellers

Seniors

What’s Ahead for Mortgage Rates and Home Prices?

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible.

Mortgage Rates Will Continue To Respond to Inflation

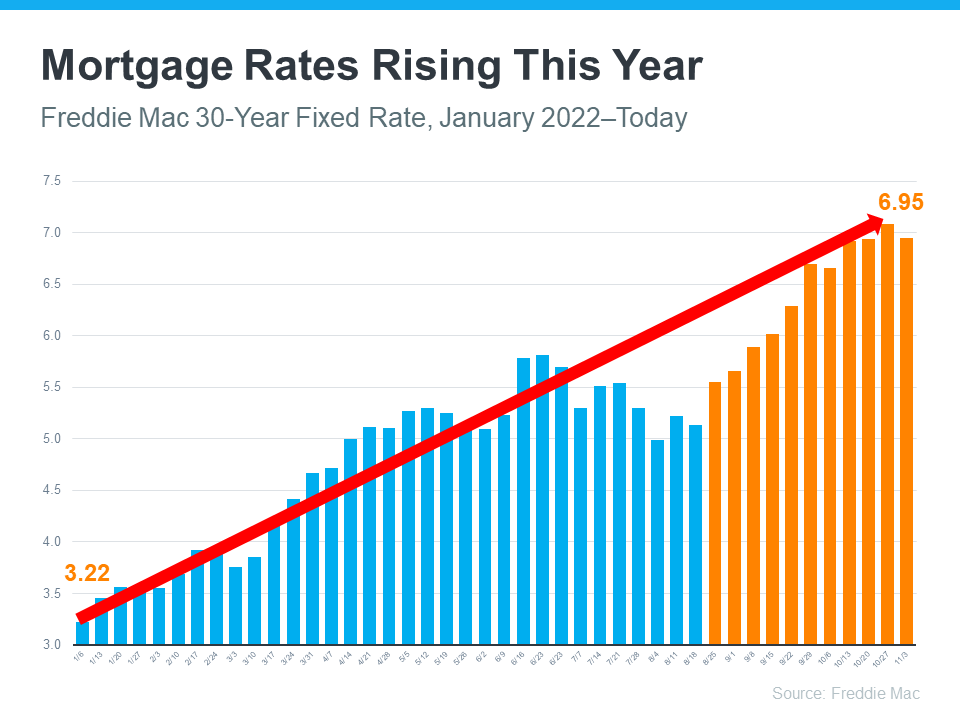

There’s no doubt mortgage rates have skyrocketed this year as the market responded to high inflation. The increases we’ve seen were fast and dramatic, and the average 30-year fixed mortgage rate even surpassed 7% at the end of last month. In fact, it’s the first time they’ve risen this high in over 20 years (see graph below):

In their latest quarterly report, Freddie Mac explains just how fast the climb in rates has been:

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Because we’re in unprecedented territory, it’s hard to say with certainty where mortgage rates will go from here. Projecting the future of mortgage rates is far from an exact science, but experts do agree that, moving forward, mortgage rates will continue to respond to inflation. If inflation stays high, mortgage rates likely will too.

Home Price Changes Will Vary by Market

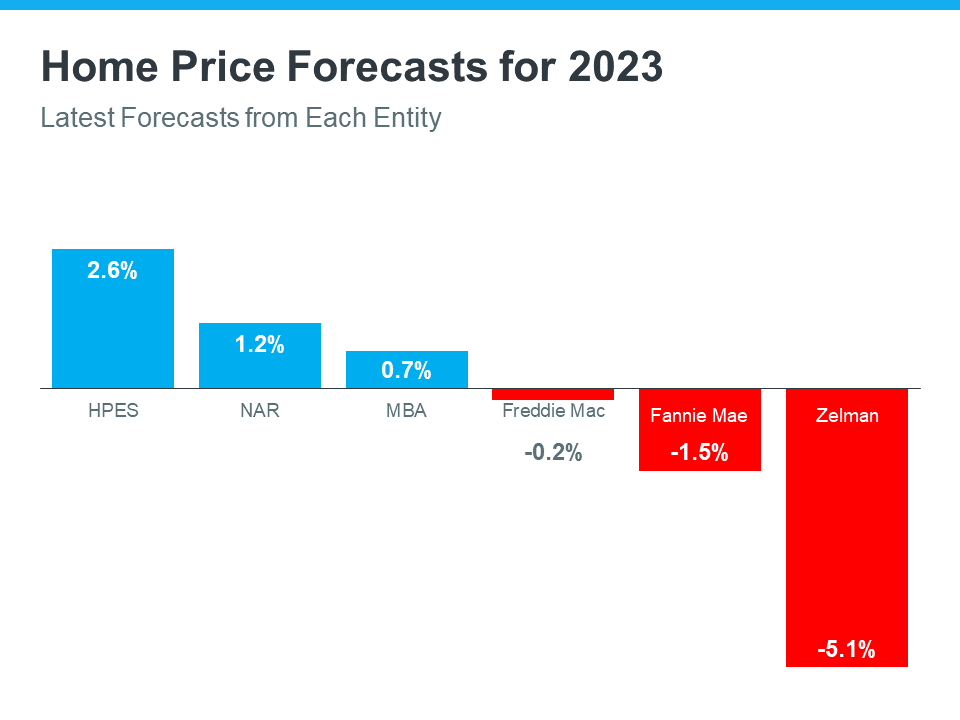

As buyer demand has eased this year in response to those higher mortgage rates, home prices have moderated in many markets too. In terms of the forecast for next year, expert projections are mixed. The general consensus is home price appreciation will vary by local market, with more significant changes happening in overheated areas. As Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Basically, some areas may still see slight price growth while others may see slight price declines. It all depends on other factors at play in that local market, like the balance between supply and demand. This may be why experts are divided on their latest national forecasts (see graph below):

Bottom Line

If you want to know what’s happening with home prices or mortgage rates, let’s connect so you have the latest on what experts are saying and what that means for our area.

Key Skills You Need Your Listing Agent To Have

Key Skills You Need Your Listing Agent To Have Selling your house is a big decision. And that can make it feel both exciting and a little bit nerve-wracking. But the key to a successful sale is finding the perfect listing agent to work with you throughout the process....

What’s in store for the Greater Salt Lake City housing market this fall?

Utah Realty has an exciting topic for our fall Season blog. As the leaves change colors and the temperatures start to cool, we find ourselves eagerly anticipating the shifts and trends that will shape the real estate landscape in one of Utah's most vibrant and...

Unpacking the Long-Term Benefits of Homeownership

Unpacking the Long-Term Benefits of Homeownership If you’re thinking about buying a home soon, higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if it still makes sense to buy a home right now. While those market factors...

Fitness Tips For Seniors

Fitness Tips Prevent Falls For Seniors As we age, maintaining our balance and stability becomes increasingly important to prevent the risk of falls. Falls can have serious consequences for seniors, leading to injuries and a loss of independence. But fear not,...

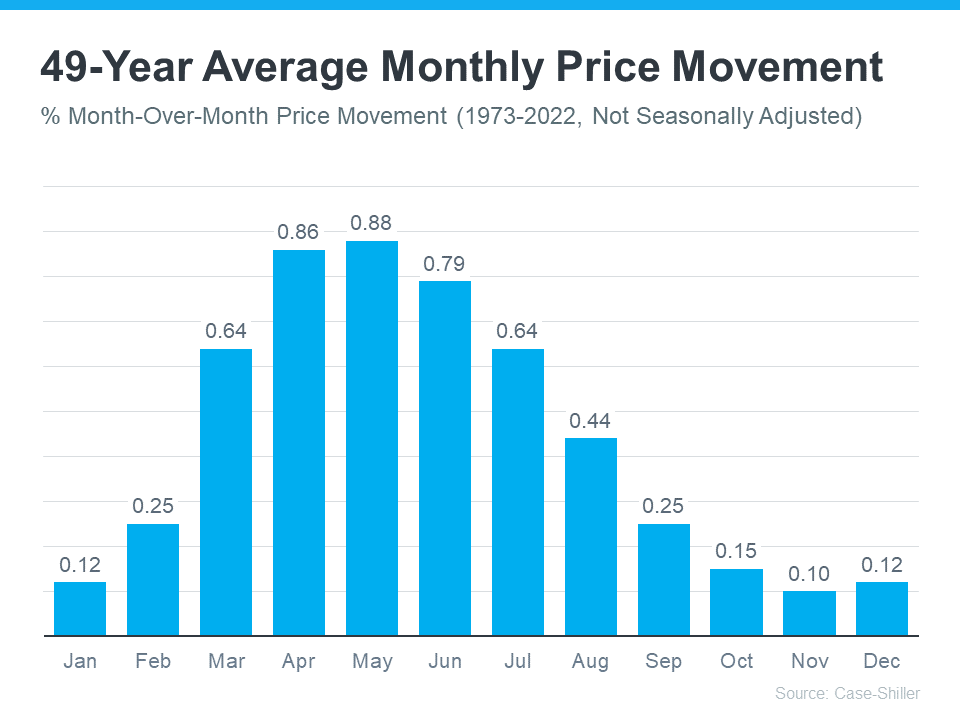

The Return of Normal Seasonality for Home Price Appreciation

The Return of Normal Seasonality for Home Price Appreciation If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices...

Beginning with Pre-Approval

Beginning with Pre-Approval If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and...

Join Our Newsletter

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus lacinia velit a feugiat finibus. Morbi iaculis diam id tellus iaculis, eu pretium metus fermentu