What You Need to Know About Private Mortgage Insurance (PMI) Courtesy of Utah Realty

Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that allow buyers to purchase homes with down payments below 20%, you can never have too much information about Private Mortgage Insurance (PMI).

What is PMI?

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.

Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that:

“The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.”

According to the National Association of Realtors, the average down payment for all buyers last year was 13%. For first-time buyers, that number dropped to 7%, while repeat buyers put down 16% (no doubt aided by the sale of their homes). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes.

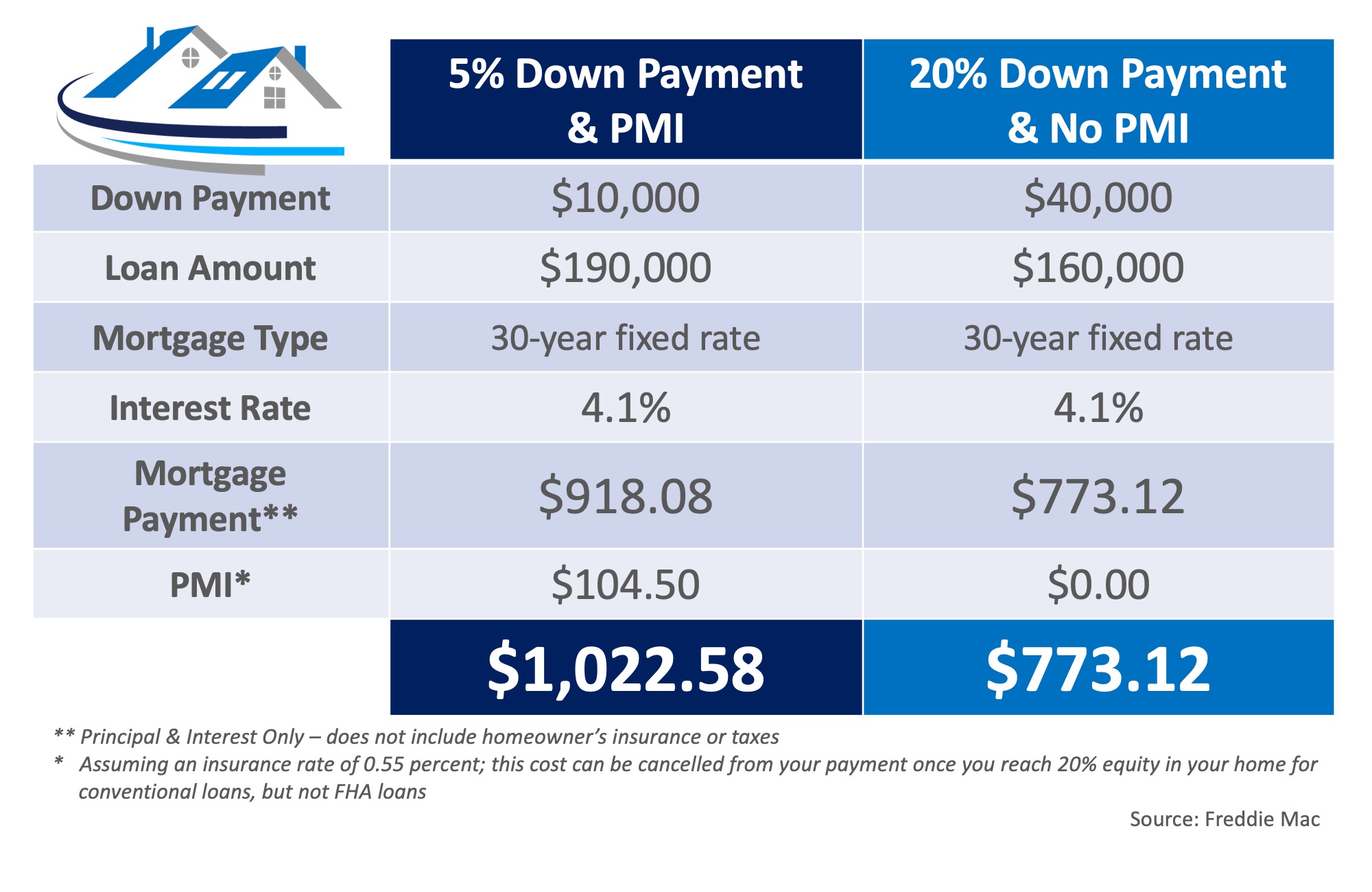

Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI: The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and help you make the best decision for you and your family.

Grants Down Payment Assistance Utah

List of ways to buy a home with little or no money down. https://utahhousingcorp.org/HTML/rbDownPaymentAssistance.shtml

Union Workers Make Our Nation Great!

Up to $2000 Cash Back when you sell your home with us! We are here to earn your respect as the trusted adviser when it comes to your home. Utah Realty has created a unique program that rewards you with cash at closing for calling us instead of another agent when you...

Top Agent in West Jordan Utah

Searching for a Top Realtor in West Jordan, Utah? When searching for a top agent or Realtor in West Jordan, Utah is it best to find the most popular or the most qualified? Believe it or not there is a difference. You can find the guy or gal the advertises on the...

Search Utah MLS Salt Lake City Listings

Search Salt Lake MLS Listings. We specialize in assisting buyers and sellers all over the state of Utah. Searching for Real Estate in Utah? Our website contains every listing that is active. ALL listings from ALL Real Estate Companies in Utah including Salt Lake...

The House The Pot Belly Pig, and the Crazy Aunt

BY MARTY AND LAURIE GALE Real Estate Broker/Owner with Utah Realty 5451933-PB00 Share: May 20, 2010 04:58 AM The characters consist of my past client, her grandmother (the retired librarian on oxygen), the grandma's caregiver (live-at-home bachelor son) and the aunt...

What to Check During the Final Walk-through:

Those 24 hours before closing — the home stretch to homeownership — is crucial. Preparation is key. The “final walk through” is your chance to make sure the buyer is getting exactly what they’re paying for. Bring a copy of your contract to ensure all included...

Tips for Moving Into Your New Home

Congratulations, you've bought your home and it's move-in time. Wait! Before you move in, read on to get some practical and important tips. Change the locks. You've closed escrow and the keys to your new home are yours. The first thing you should do is change the...

0 Comments