Please keep in mind that most listing status changes must be made within three (3) business days of the date the status change occurs, with the exception of listings which are Canceled (change within 24 hours) and listings which are Sold (change within 5 business days).

Active – The listing is available for sale or lease and no offers (with or without contingencies) have been accepted. A listing in the “Active” status must be available for showings within a reasonable period of time (which generally means within four business days) after the listing has been placed in the Active status. This is an on-market status, and Days on Market (“DOM”) will accumulate.

Active T/C – The listing is under contract with an accepted offer, but a “Time Clause” addendum is in place and the buyer and seller agree that the property is to remain on-market so that additional offers may be solicited. This is an on-market status and DOM will accumulate.

Backup – The seller has accepted an offer on the listing, but the seller requests that the property remain on-market to solicit additional, back-up offers. This is an on-market status and DOM will accumulate.

Under Contract – The listing is under contract with an accepted offer. This is an off-market status and DOM will not accumulate.

Off Market – The listing is temporarily not available for showings per the seller’s request. However, a valid listing agreement is in effect.

- Note: When in the Off Market status, DOM will not accumulate, photos are not required, and the listing will not be visible on UtahRealEstate.com or any IDX or syndication websites.

Withdrawn – A valid listing agreement is in effect, however, the seller and listing broker have agreed to withdraw the listing from being marketed through the MLS.

Canceled – The listing agreement has been terminated prior to the expiration date specified in the listing agreement.

Expired – The termination date of the listing agreement has passed, and a valid listing agreement for this listing is no longer in effect.

Sold – The listing has sold and title to the property has transferred from the seller to the buyer.

Leased – The listing has been leased.

Guide to downsizing for retirees’s

Single Level Living is the best choice for Retiree's Retirement marks a significant transition in life, often prompting reevaluation of one's living situation and possessions. Downsizing can offer a simplified, more manageable lifestyle that aligns with the needs of...

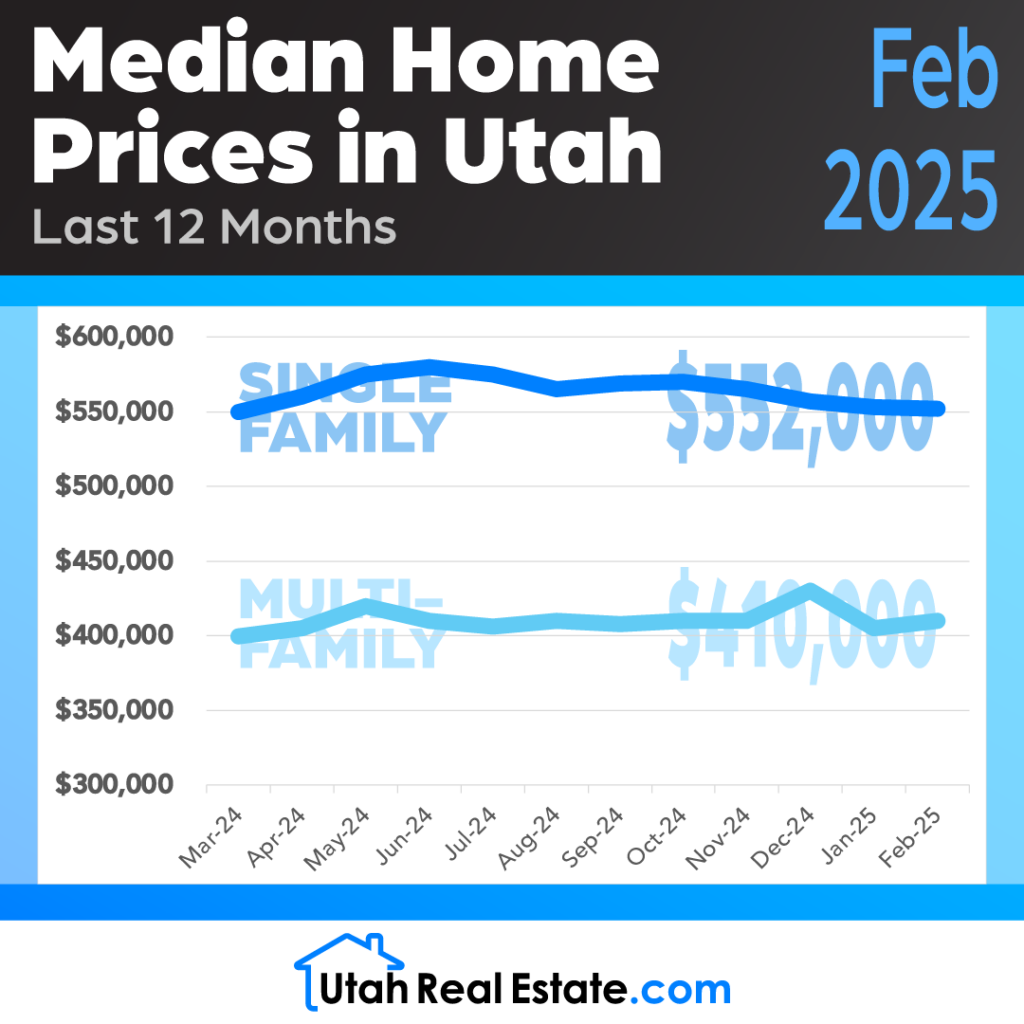

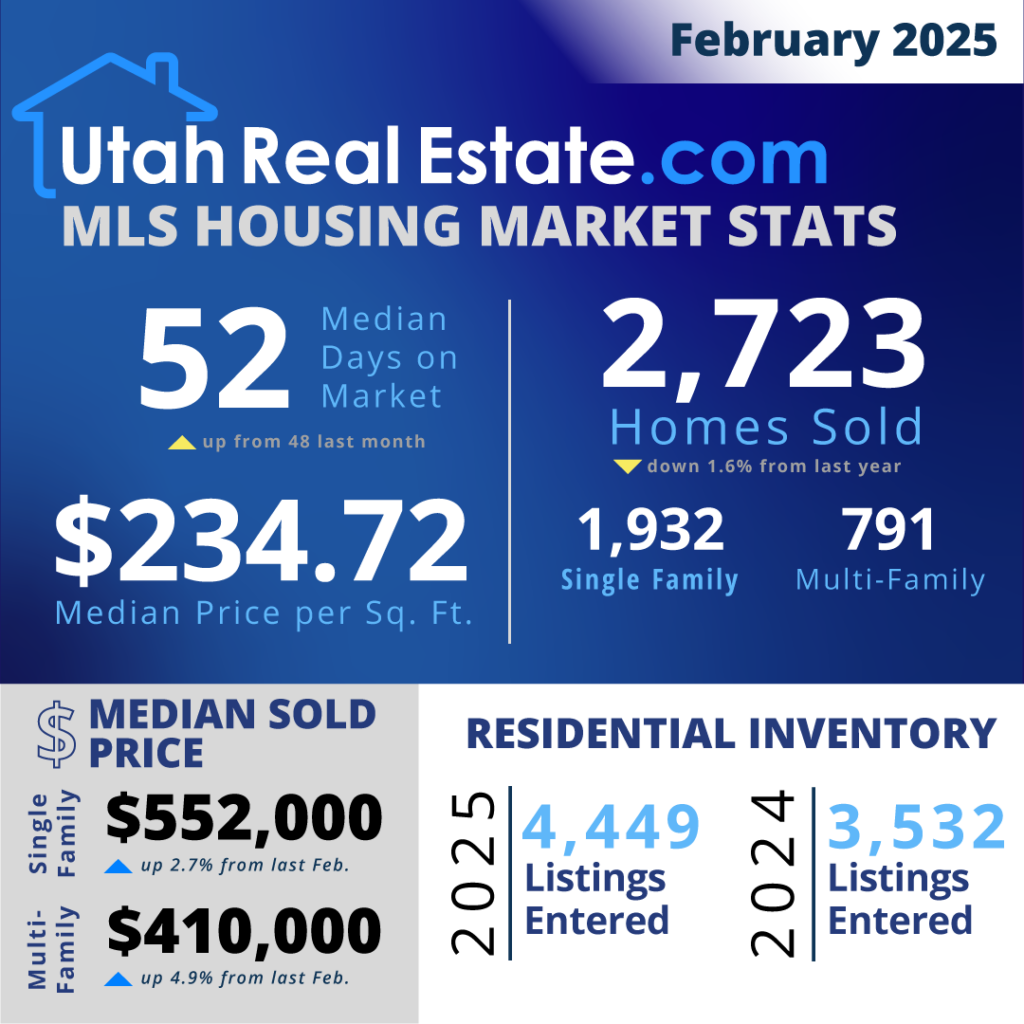

Median Home Prices February 2025

February 2025 Stats

Plans to Build 3 Million New Houses

Selling and leasing a small portion of federal land could lead to the construction of over three million houses in Western states, according to a right-leaning think tank. The Bureau of Land Management holds 267,000 square miles, and selling just 850 miles could...

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.

New Year, New Home: Buying & Selling Tips

Start Early: Sellers should begin the process early, evaluating their home and preparing for the market.Home Preparation: Sellers should invest in updates, cleaning, and professional staging to increase appeal.