What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

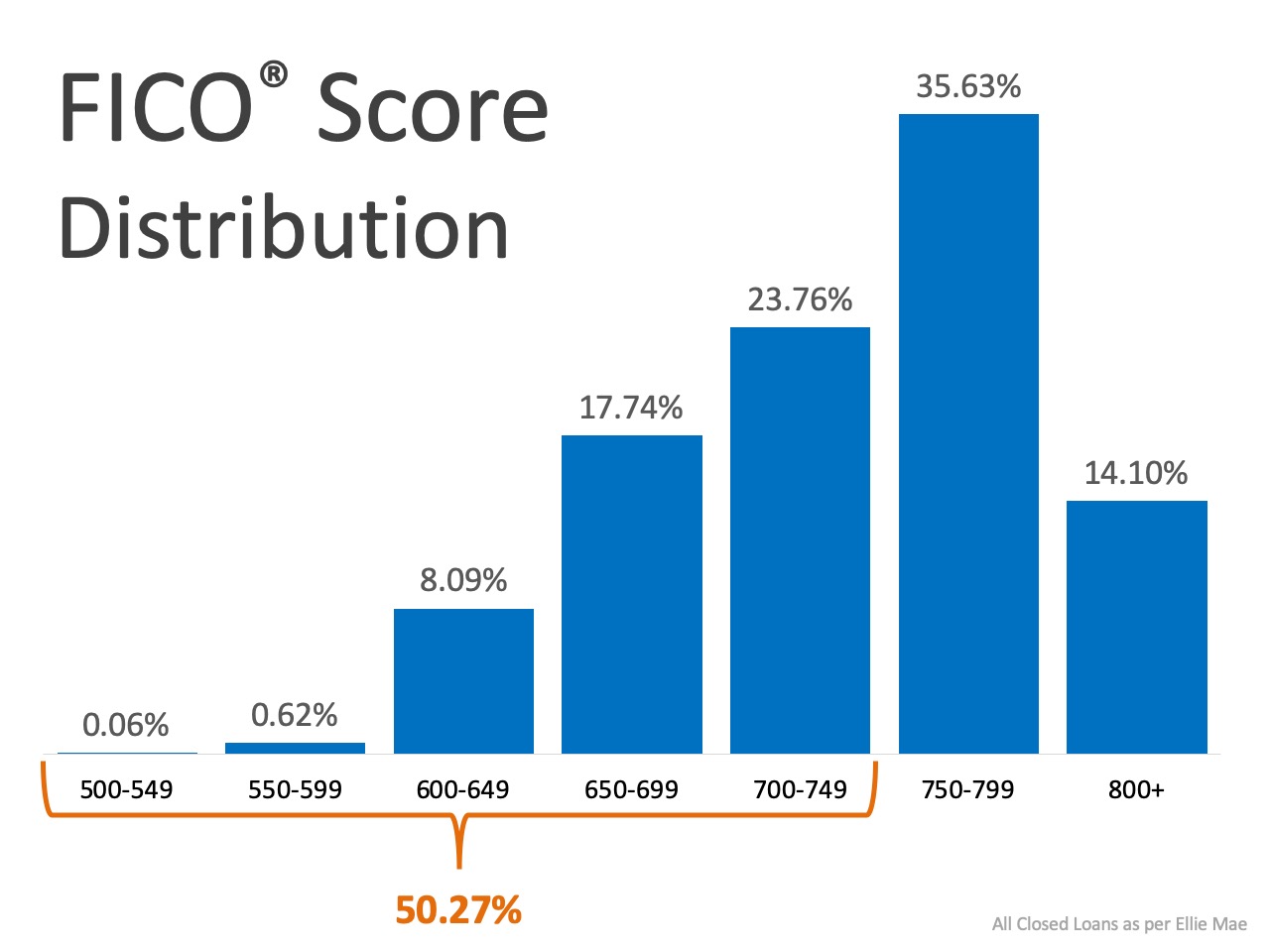

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

What are your Goals for 2024?

What are your Goals for 2024?

What Lower Mortgage Rates Mean for Your Purchasing Power

What Lower Mortgage Rates Mean for Your Purchasing Power If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly...

Achieving Your Homebuying Dreams in 2024

Achieving Your Homebuying Dreams in 2024 [INFOGRAPHIC] Some Highlights Planning to buy a home in 2024? Here’s what to focus on. Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you. Let’s connect so you have...

Why Pre-Approval Is Your Homebuying Game Changer

Why Pre-Approval Is Your Homebuying Game Changer If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future...

Thinking About Buying a Home? Ask Yourself These Questions

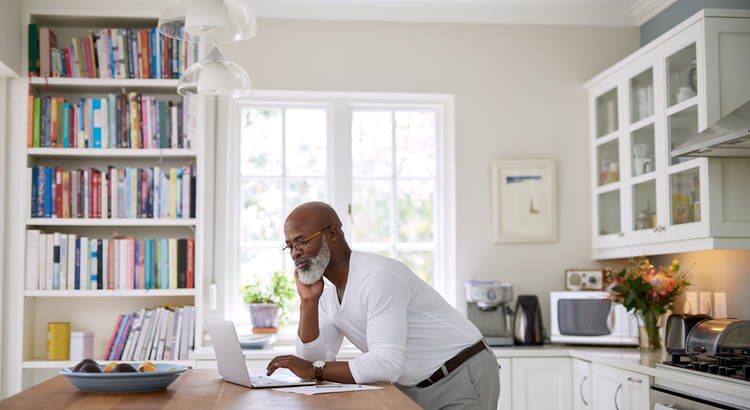

Thinking About Buying a Home? Ask Yourself These Questions If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media,...

Things To Consider If Your House Didn’t Sell

Things To Consider If Your House Didn’t Sell If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to...

What Experts Say About The Housing Market in 2024

The Benefits of Working With an Experienced Agent When You Sell Your House

The Benefits of Working With an Experienced Agent When You Sell Your House Some Highlights When it comes to selling your house, the expertise of a trusted real estate agent can make a big difference. They’ll explain what’s happening today, what that means for you, and...

Retiring Soon? Why Moving Might Be the Perfect Next Step

Retiring Soon? Why Moving Might Be the Perfect Next Step If you’re thinking about retirement or have already retired this year, it’s a good time to consider if your current house is still a good fit for the next chapter in your life. Fortunately, you may be in a...

Get Ready To Buy a Home by Improving Your Credit Score

Get Ready To Buy a Home by Improving Your Credit Score As the new year approaches, the idea of buying a home might be on your mind. It’s an exciting goal to set, and it's never too early to start laying the groundwork. One crucial step to prepare for homeownership is...