What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

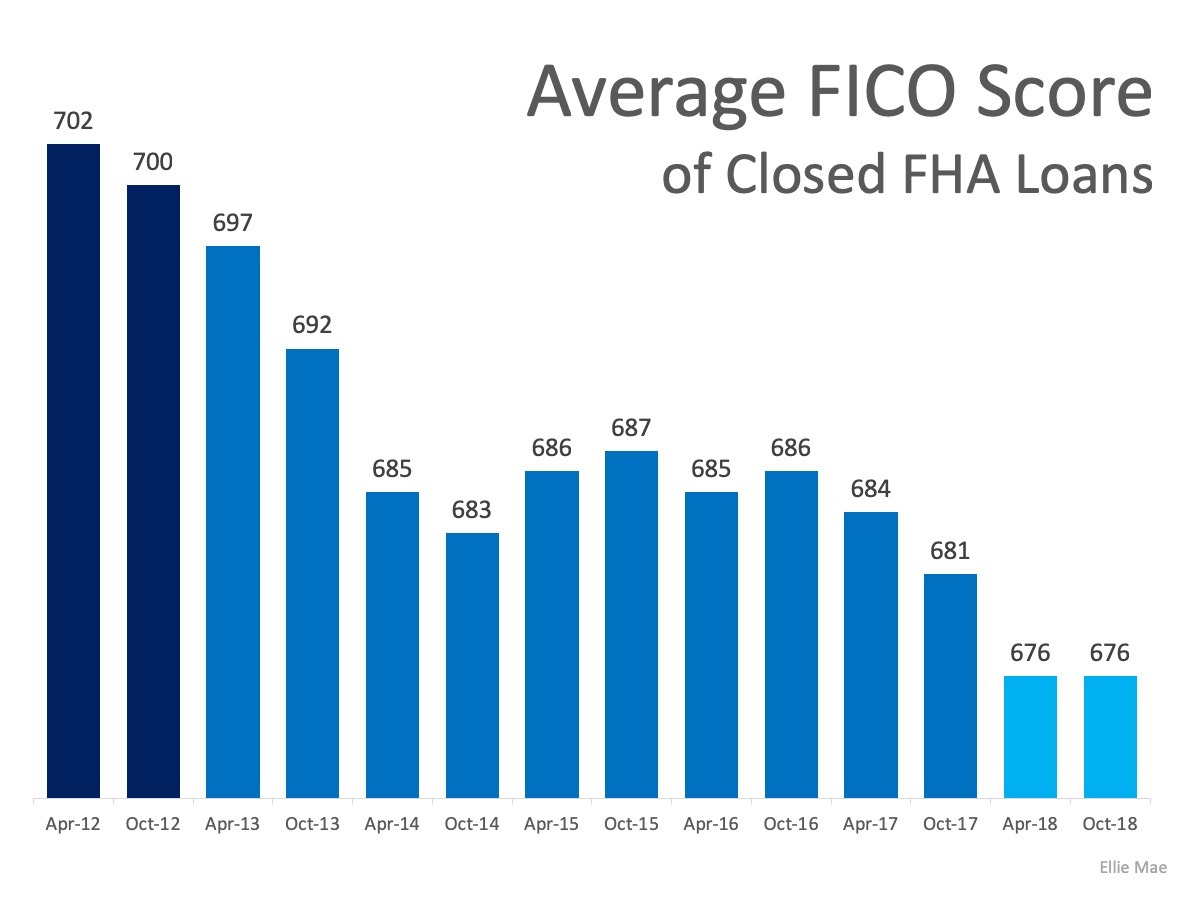

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

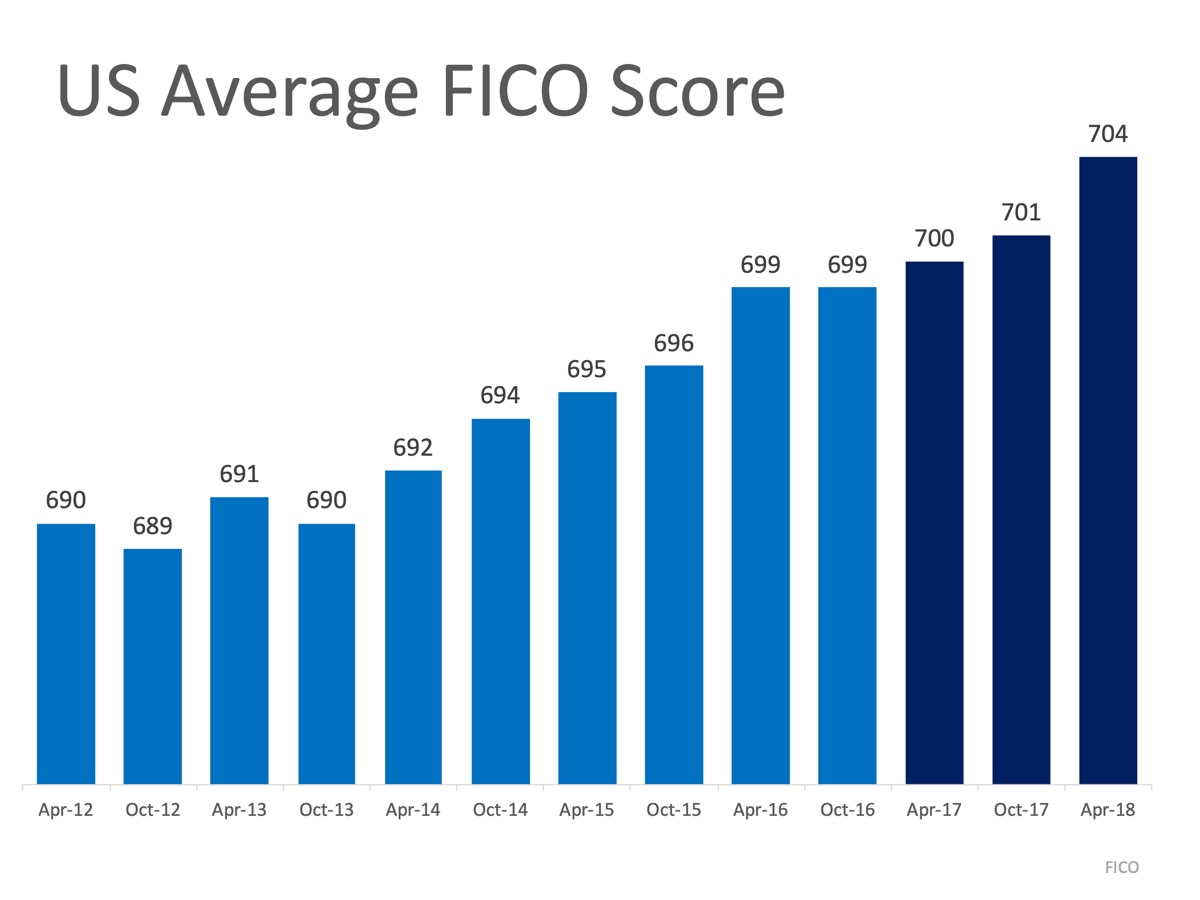

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

4 Smart Ways To Find a Reliable Real Estate Agent

Homebuyers and sellers can benefit from working with reliable real estate agents, as 89% of recent homebuyers chose to do so. To find a trustworthy agent, consider these strategies: 1. Research recent property sales in your area to identify active agents. 2. Call...

5-Year Forecast Favors Buying Over Renting

Buying isn’t just a home — it’s a wealth-building move for your future. Example: Buy a $300K home with 5% down = $82K equity in 5 years.

Do New Roofs Save Money and Energy?

Impact-resistant shingles and metal roofs extend roof life while safeguarding against costly storm damage. Solar-compatible roofs allow easier renewable energy adoption, even for homeowners not installing panels yet. Cool roofing systems lower household cooling bills...

Smart Steps to Buy Your First Home

Start with patience, flexibility, and assembling a trustworthy Real Estate team from day one. Work with a reliable realtor to avoid rushed or financially risky buying decisions. Compare lenders to find strong pre-approval options, like a pre-underwritten mortgage....

Steps to Take Between Mortgage Closing and Moving Day

After closing on your mortgage, follow this checklist to prepare for moving into your new home. Change your address with the Post Office and update utilities. Review your inspection report for necessary repairs and create a maintenance schedule. Deep clean your new...

Guide for First-Time Homebuyers

Buying your first house can be both exciting and overwhelming. Resources are available to empower you with the knowledge needed for homeownership. You can save up to $1,250, and if you find lower costs elsewhere, there are incentives. Local experts are available to...

Housing Market Predictions 2025

In 2025, the housing market shows slow stabilization with mortgage rates declining from near 7%, boosting buyer interest. Home sales remain sluggish but may rise 6% by year-end, while prices continue modest growth due to limited supply. Inventory has increased,...

What Mortgage Rate Will Get Buyers Moving?

A 6% mortgage rate could make homes affordable for 5.5 million more households, potentially unlocking major buying activity across key U.S. metro areas. NAR forecasts rates falling to 6% by 2026, possibly increasing home sales 14%. Current high rates and inventory...

Homeowner Equity Grows Even as Home Prices Dip

After 3 quarters of slipping, equity-rich homes finally ticked up in Q2 2025. ~50% of U.S. homes with mortgages are now equity-rich. Equity-rich = owing less than 50% of your home’s value. In just one quarter, equity-rich homes jumped from 46.2% to 47.4% nationwide....

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...