What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

When’s the Best Time of Year to Sell Your Home?

Spring and Early Summer Are Ideal: These seasons often see increased buyer activity and higher sale pricesLocal Market Variations Matter: Optimal selling times can differ based on regional demand and climate.

Is your homeowners association overstepping? Here are 6 unenforceable HOA rules — and how to protect your rights

An estimated 30% of the U.S. population lives in homeowners associations (HOAs), which can impose rules that may be overly restrictive. However, certain rules are unenforceable, including those that violate state and federal laws, infringe on political speech,...

Key Benefits of Health Insurance in the U.S.

Health insurance covers essential medical expenses like doctor visits, hospital stays, and preventive care. It protects you from high out-of-pocket costs during unexpected medical emergencies.

Guide to downsizing for retirees’s

Single Level Living is the best choice for Retiree's Retirement marks a significant transition in life, often prompting reevaluation of one's living situation and possessions. Downsizing can offer a simplified, more manageable lifestyle that aligns with the needs of...

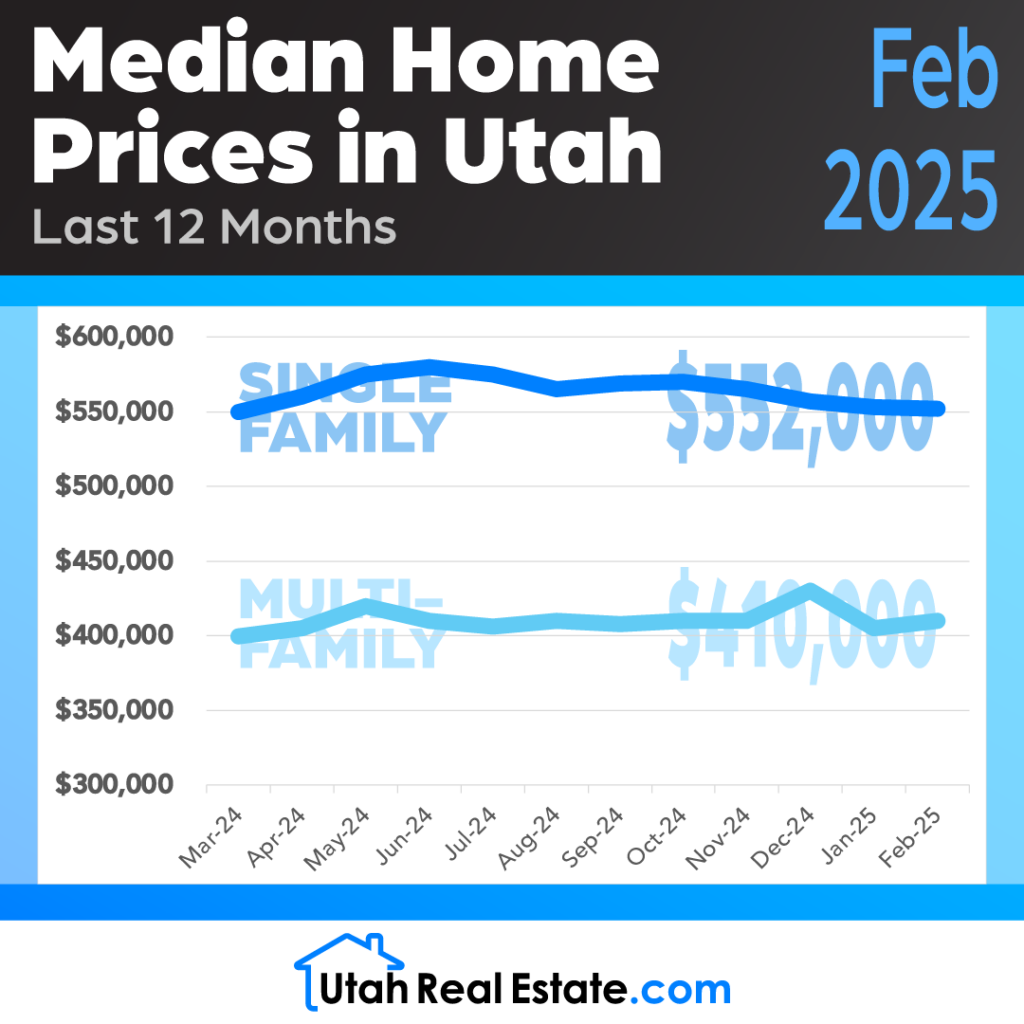

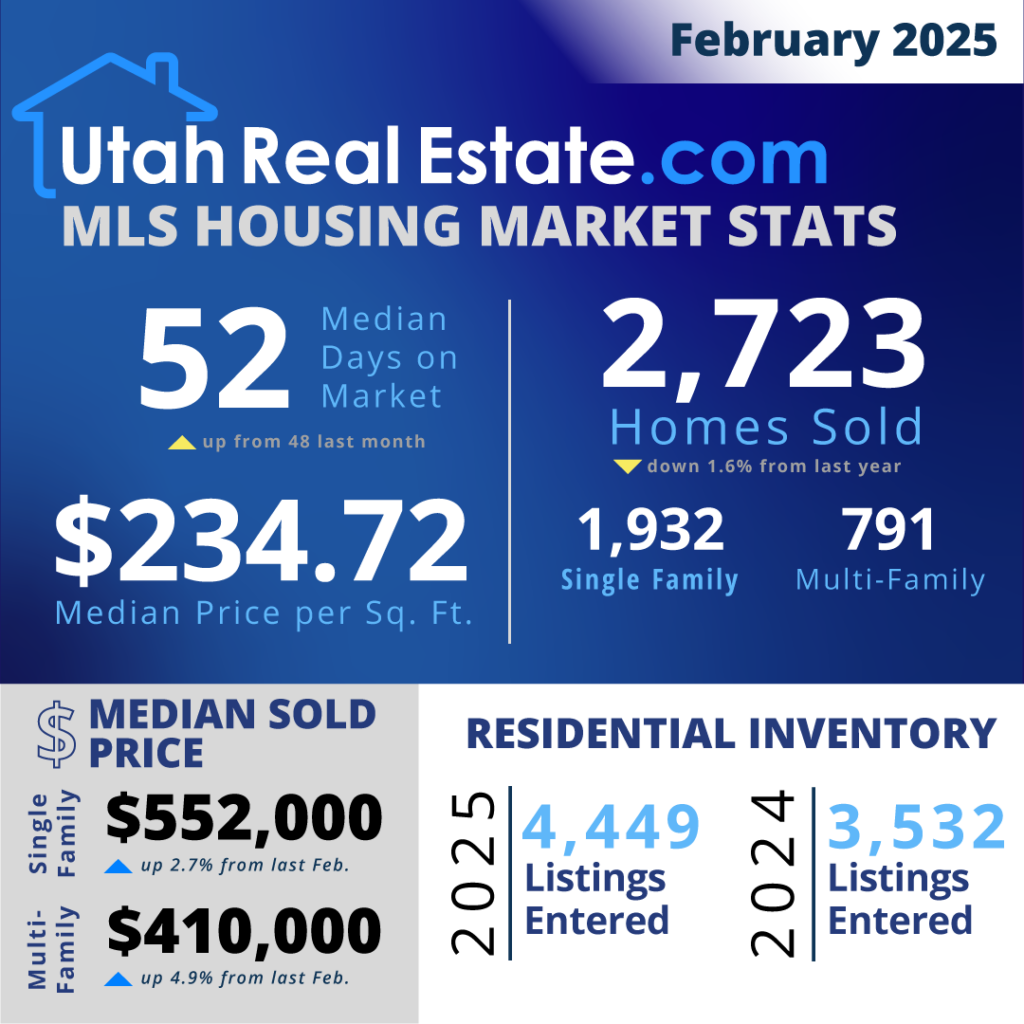

Median Home Prices February 2025

February 2025 Stats

Plans to Build 3 Million New Houses

Selling and leasing a small portion of federal land could lead to the construction of over three million houses in Western states, according to a right-leaning think tank. The Bureau of Land Management holds 267,000 square miles, and selling just 850 miles could...

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!