A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

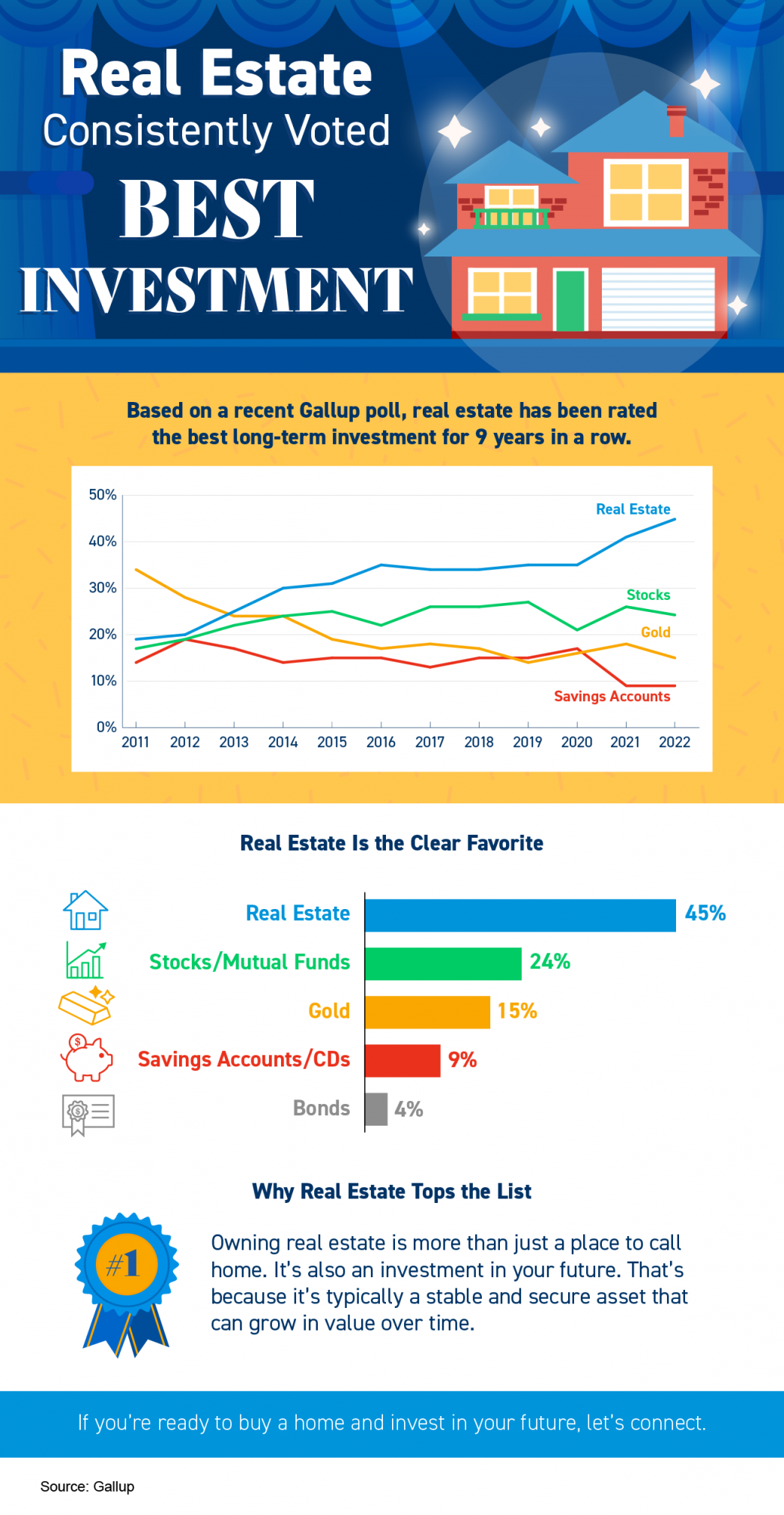

Real Estate Consistently Voted Best Investment

Real Estate Consistently Voted Best Investment Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Owning real estate is more than just a place to call home. It’s also an investment in your...

Why an Agent Is Essential When Pricing Your House

Why an Agent Is Essential When Pricing Your House Some Highlights When it comes to pricing your house, there’s a lot to consider. The only way to ensure you price it right is by partnering with a local real estate professional. To find the best price, your agent...

A Recession Doesn’t Equal a Housing Crisis

If you're following the news, you might be wondering what could happen to the housing market if there's a recession. Let's connect to discuss why history shows a recession doesn't equal a housing crisis.Buy or Sell with Marty Gale "Its The Experience" Principal Broker...

The Average Homeowner Gained $64K in Equity over the Past Year

The Average Homeowner Gained $64K in Equity over the Past Year If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price...

More Americans Choose Real Estate as the Best Investment Than Ever Before

More Americans Choose Real Estate as the Best Investment Than Ever Before Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth...

Why the Growing Number of Homes for Sale Is Good for Your Move Up

Why the Growing Number of Homes for Sale Is Good for Your Move Up Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know....

June is National Homeownership Month

How Homeownership Impacts You June is National Homeownership Month, and it’s the perfect time to reflect on how impactful owning a home can truly be. When you purchase a house, it becomes more than just a space you occupy. It’s your stake in the community,...

Sellers Have an Opportunity with Today’s Home Prices

"IT'S THE EXPERIENCE" It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone. You may be wondering if prices are projected to rise or fall…or how much competition you may...

What’s on the Horizon for the Housing Market in the Second Half of 2022?

The One Thing Every Homeowner Needs To Know About a Recession

The One Thing Every Homeowner Needs To Know About a Recession A recession does not equal a housing crisis. That’s the one thing that every homeowner today needs to know. Everywhere you look, experts are warning we could be heading toward a recession, and if true, an...