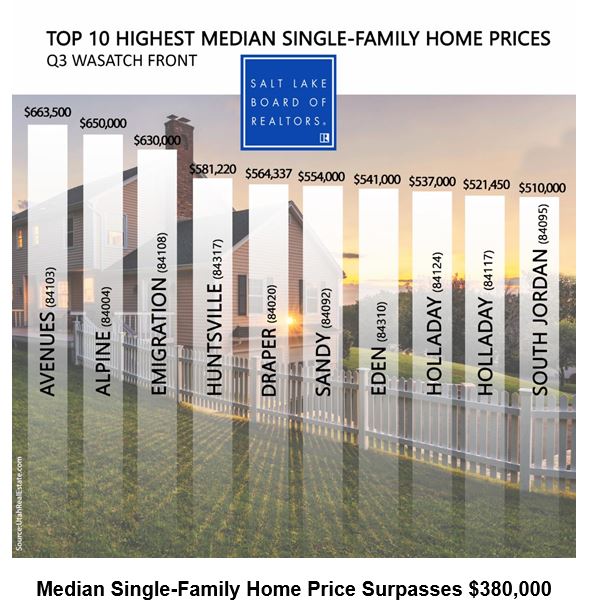

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front

Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the July-through-September period reached $381,500. That’s up 7.5 percent compared to a median price of $355,000 in last year’s third quarter. Just three years ago, the median single-family home price reached $300,000, which was then an all-time high price. The previous peak home price was in the third quarter of 2007, when home prices topped $256,000 (or $298,085 in inflation-adjusted dollars). Home prices increased across all Wasatch Front counties including: Davis, up 6.2 percent; Tooele, up 2.6 percent; Utah, up 4.4 percent; and Weber, up 10.3 percent. Sales of single-family homes in Salt Lake County were flat (up 0.7 percent) in the third quarter year-over-year. Davis County saw sales increase 9.8 percent. Sales in Tooele County were up 4.7 percent. Utah County sales were up 11.8 percent. Sales in Weber County were up 12.1 percent. In the third quarter, the typical Salt Lake home was on the market 37 days before it sold – six days longer than the average time for a home to sell during the third quarter of 2018

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day. In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints. Soon, All Saints'...

Relocation Trends: Why High-Net-Worth Buyers Are Choosing the Mountain West States

High-net-worth buyers are increasingly relocating to the Mountain West states—Idaho, Montana, Wyoming, Utah, and Colorado—attracted by tax advantages, privacy, natural beauty, and outdoor recreation. Luxury real estate has evolved from rustic cabins to sophisticated...

Buying or Selling: What’s Your Agent Strategy?

Visit Real Estate offices early and ask questions to gauge their professionalism and fit. Understand seller motivations to make offers with attractive terms that could win deals.

How to get a mortgage when you’re self-employed

Self-employed individuals can qualify for a home loan, but they may face additional challenges in proving income stability. To improve approval chances, consider non-conforming loans, make larger down payments, raise credit scores, and lower debts. Lenders require...

Most Affordable Cities to Buy a Home in Utah (2025)

Here is an overview of affordable cities in Utah for homebuyers in 2025, highlighting median prices, cost of living, and unique features for each city. This provides an at-a-glance guide to communities where your housing dollar might stretch further. Most Affordable...

Will the Housing Market Rebound? Predictions for 2025 and 2026

The U.S. housing market is expected to see gradual growth through late 2025 and into 2026, with no major price drops on the horizon. Existing-home sales rose 2% in July 2025, inventory is up 15.7% year-over-year, and the median price is holding steady at $422,400....

Global Real Estate: $19.5T by 2031

The global residential Real Estate market will reach USD 19.5T by 2031, growing at 9.2% CAGR. Urban growth in emerging nations will drive increased demand for residential Real Estate by 2030.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.