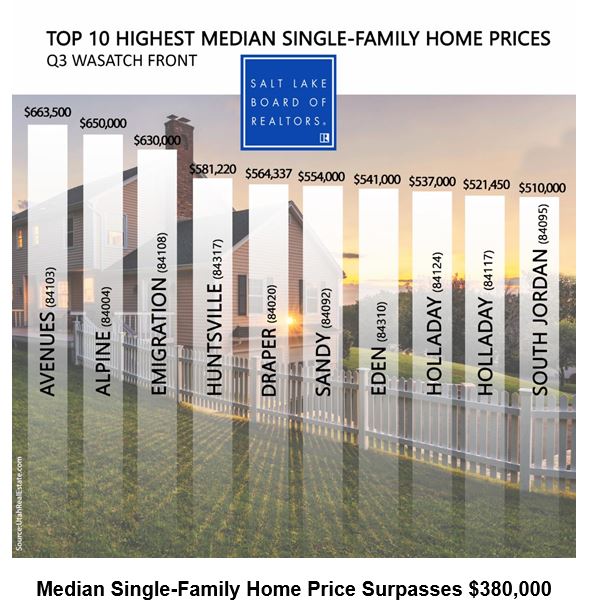

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front

Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the July-through-September period reached $381,500. That’s up 7.5 percent compared to a median price of $355,000 in last year’s third quarter. Just three years ago, the median single-family home price reached $300,000, which was then an all-time high price. The previous peak home price was in the third quarter of 2007, when home prices topped $256,000 (or $298,085 in inflation-adjusted dollars). Home prices increased across all Wasatch Front counties including: Davis, up 6.2 percent; Tooele, up 2.6 percent; Utah, up 4.4 percent; and Weber, up 10.3 percent. Sales of single-family homes in Salt Lake County were flat (up 0.7 percent) in the third quarter year-over-year. Davis County saw sales increase 9.8 percent. Sales in Tooele County were up 4.7 percent. Utah County sales were up 11.8 percent. Sales in Weber County were up 12.1 percent. In the third quarter, the typical Salt Lake home was on the market 37 days before it sold – six days longer than the average time for a home to sell during the third quarter of 2018

Utah House Committee Votes Against Bills That Make Housing More Affordable

A Utah House committee did not vote on two housing bills, HB 88 and HB 90, aimed at addressing the state's housing shortage, despite support from the governor's office. HB 88 would allow detached accessory dwelling units in urban residential zones, while HB...

Ready to Buy a Home in 2025? Get the Inside Scoop

Start preparing finances early: Ensure credit is good, calculate affordability, and get ready to make a competitive offer.Current market improvements: 2025 offers better opportunities for buyers after high prices and limited options in 2024.

Cut Your Insurance Premiums: Simple Savings Tips

Maintain a Good Credit Rating: Strong credit scores often lead to lower premiums for auto and homeowner insurance.Drive Safely: A clean driving record and good grades for students can significantly reduce insurance costs.

Utah lawmakers say no to ‘preemption,’ halt 2 housing bills aimed at allowing smaller homes

Utah lawmakers are facing challenges in addressing the housing affordability crisis, with two bills aimed at allowing smaller homes failing to progress in the legislative session. Rep. Ray Ward's proposals, which included permitting accessory dwelling units and...

Tips for Finding Bargain Houses in 2025

Start house hunting in January to benefit from lower prices and reduced buyer competition. Hire a local Real Estate agent with expertise in undervalued properties and market trends.

A Utah bill requiring 60 days notice to raise rent fails

A Utah bill requiring landlords to provide two months' notice before raising rent has been halted for the third consecutive year. The House Business, Labor, and Commerce Committee rejected HB182, which aimed to give tenants more security. The Utah Rental Housing...

Surprising Trend Pops Up in This State To Help Buyers Nab Their First Homes

A new housing trend in Utah is emerging, offering affordable options amid skyrocketing home prices, with the median list price in Salt Lake City at $550,000. Local employers are struggling to find workers due to high property costs. Homebuilder BoxHouse in St. George...

Get Your House Market-Ready

Consult a REALTOR®: A local agent helps price your home correctly and attract potential buyers. Complete Repairs: Fix any outstanding issues, like leaky faucets or worn-out flooring, for a polished look.

Conditions That Make or Break Your Home Contract

Specify mortgage details, interest rates, and loan types to avoid issues with earnest money deposits. Want seller assistance with closing costs? You must ask for it in your offer!

Does Home Insurance Shield Hurricane Damage?

Dwelling and personal property coverage repair your home and replace belongings, subject to policy limits and deductibles. Hurricane deductibles differ: Typically 1–5% of dwelling coverage, significantly impacting your out-of-pocket costs.