The Benefits of Growing Equity in Your Home

Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is the positive impact they have on home equity. Let’s break down three ways this is a win for homeowners.

1. Move-Up Opportunity

With the rise in prices, homeowners naturally experience an increase in home equity. According to the Homeowner Equity Insights from CoreLogic,

“In the first quarter of 2019, the average homeowner gained approximately $6,400 in equity during the past year.”

This increase in profit means if homeowners decide to sell, they’ll be able to put their equity to work for them as they make plans to move up into their next home.

2. Gain in Seller’s Profit

ATTOM Data Solutions recently released their Q2 2019 Home Sales Report, indicating the seller’s profit jumped at one of the fastest rates since 2015. They said:

“A look at the national numbers showed that U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since the original purchase of $67,500…the average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of the original purchase price.”

Looking at the amount paid when they bought their homes, and then the amount they received after selling, we can see that some homeowners were able to walk away with a significant gain.

3. Out of a Negative Equity Situation

Negative equity occurs when there is a decline in home value, an increase in mortgage debt, or both. Many families experienced these challenges over the last decade. According to the same report from CoreLogic,

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $485.7 billion since the first quarter 2018, an increase of 5.6%, year over year.

In the first quarter of 2019, the total number of mortgaged residential properties with negative equity decreased…to 2.2 million homes, or 4.1% of all mortgaged properties.”

The good news is, many families have moved beyond a negative equity situation, and no longer owe more on their mortgage than the value of their home.

Bottom Line

If you’re a current homeowner, you may have more equity than you realize. Your equity can open the door to future opportunities, such as moving up to your dream home. Let’s get together to discuss your options and start to put your equity to work for you.

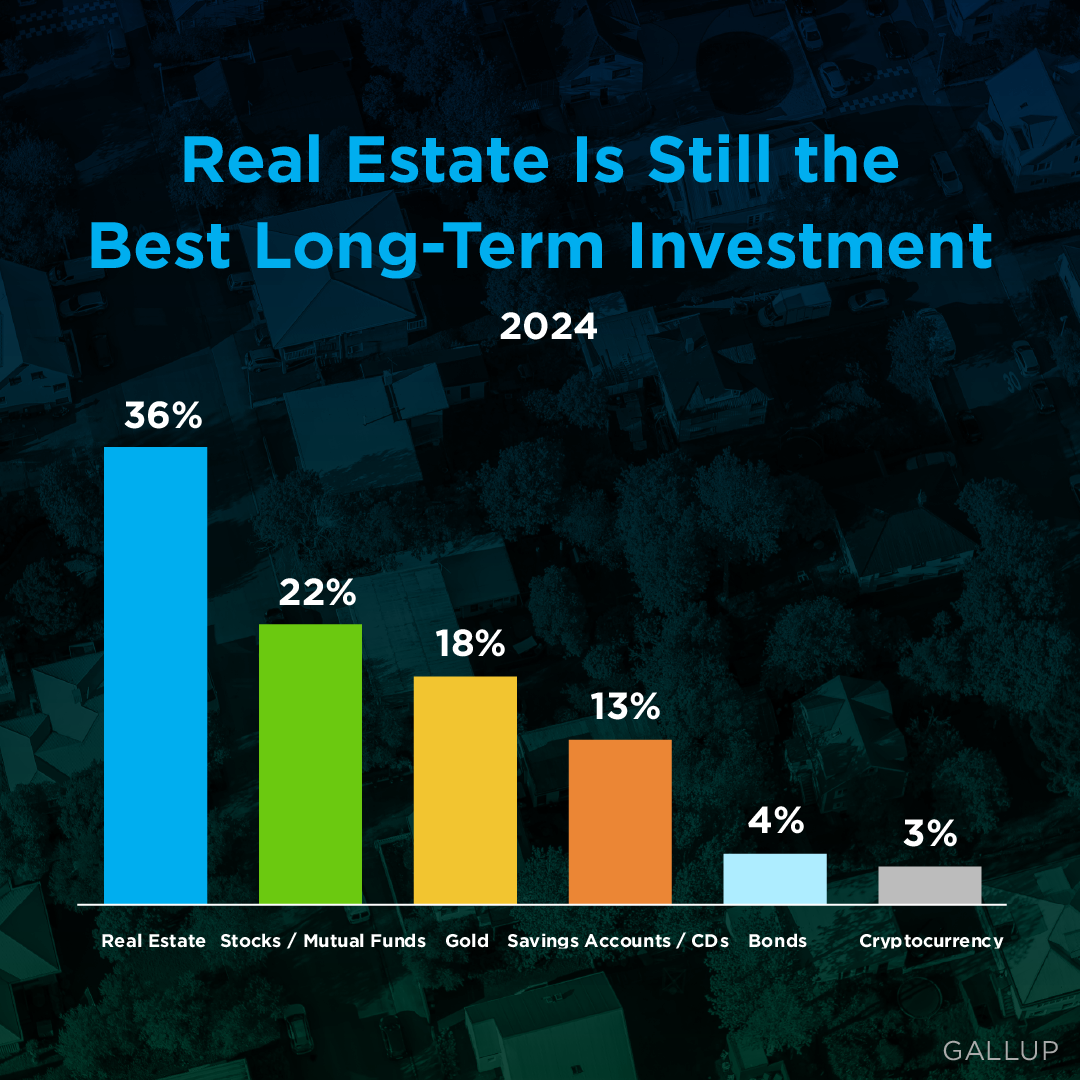

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...

Home Prices Rising in the Next 5 Years

Wondering about the future of home prices? Here's the scoop. Experts forecast a steady rise in home prices until at least 2028. That means buying now sets you up to gain equity as values climb. But, if you wait, the price of a home will only be higher later on. If you...

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...