The 2 Surprising Things Homebuyers Really Want

In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though – there’s still an interest in the market for some key upgrades. Here’s a look at the two surprising things buyers seem to be searching for in today’s market, and how they’re impacting new home builds.

Homebuyers Are Not Giving Up Their Garages

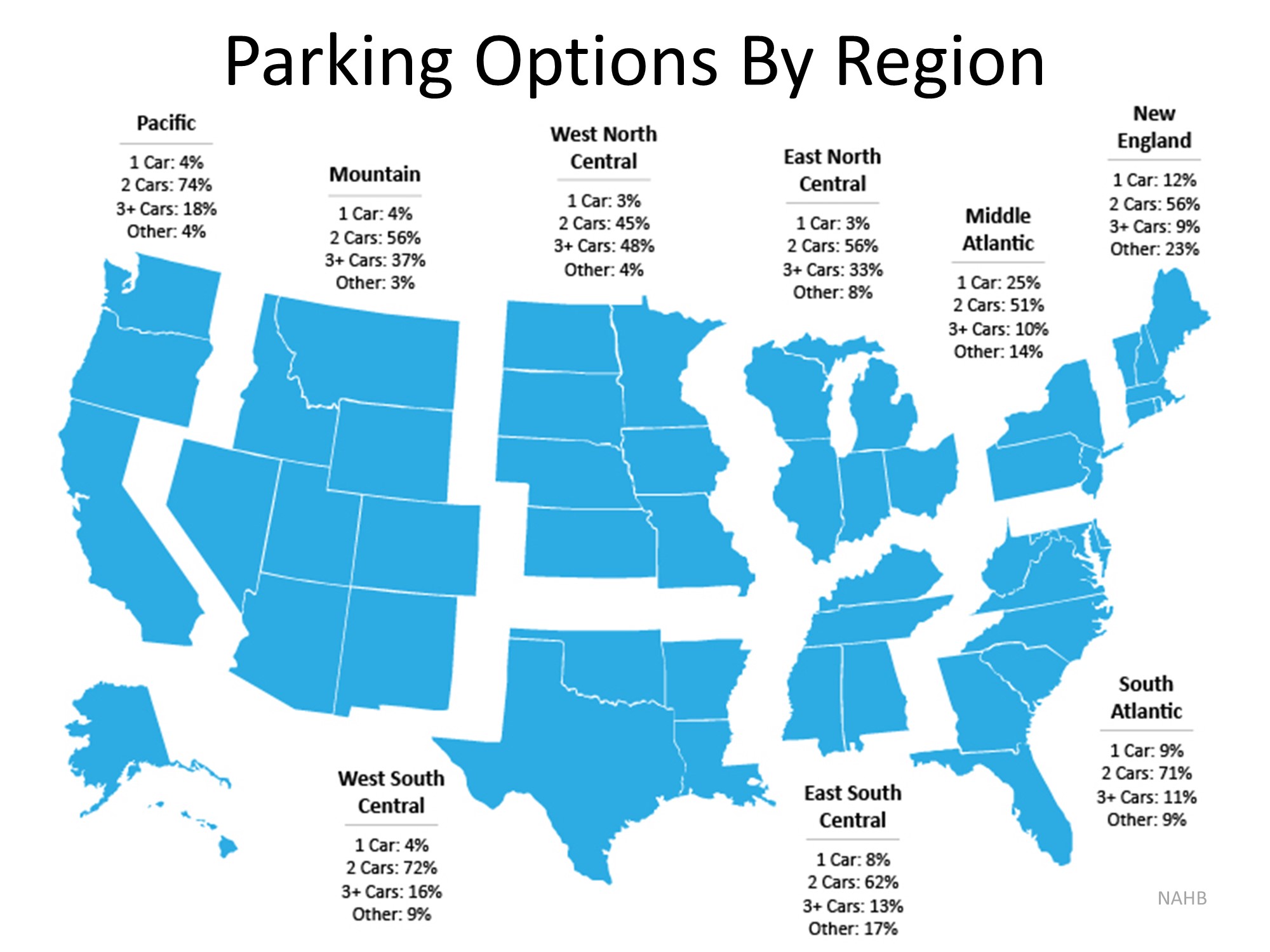

The National Association of Home Builders (NAHB) recently released an article showing the percentage of new single-family homes completed in 2018. The data reveals,

- 64% of new homes offer a 2-car garage

- 21% have a garage large enough to hold 3 or more cars

- 7% have a 1-car garage

- 7% do not include a garage or carport

- 1% have a carport

The following map represents this breakdown by region: Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Homebuyers Are Not Giving Up Their Patios

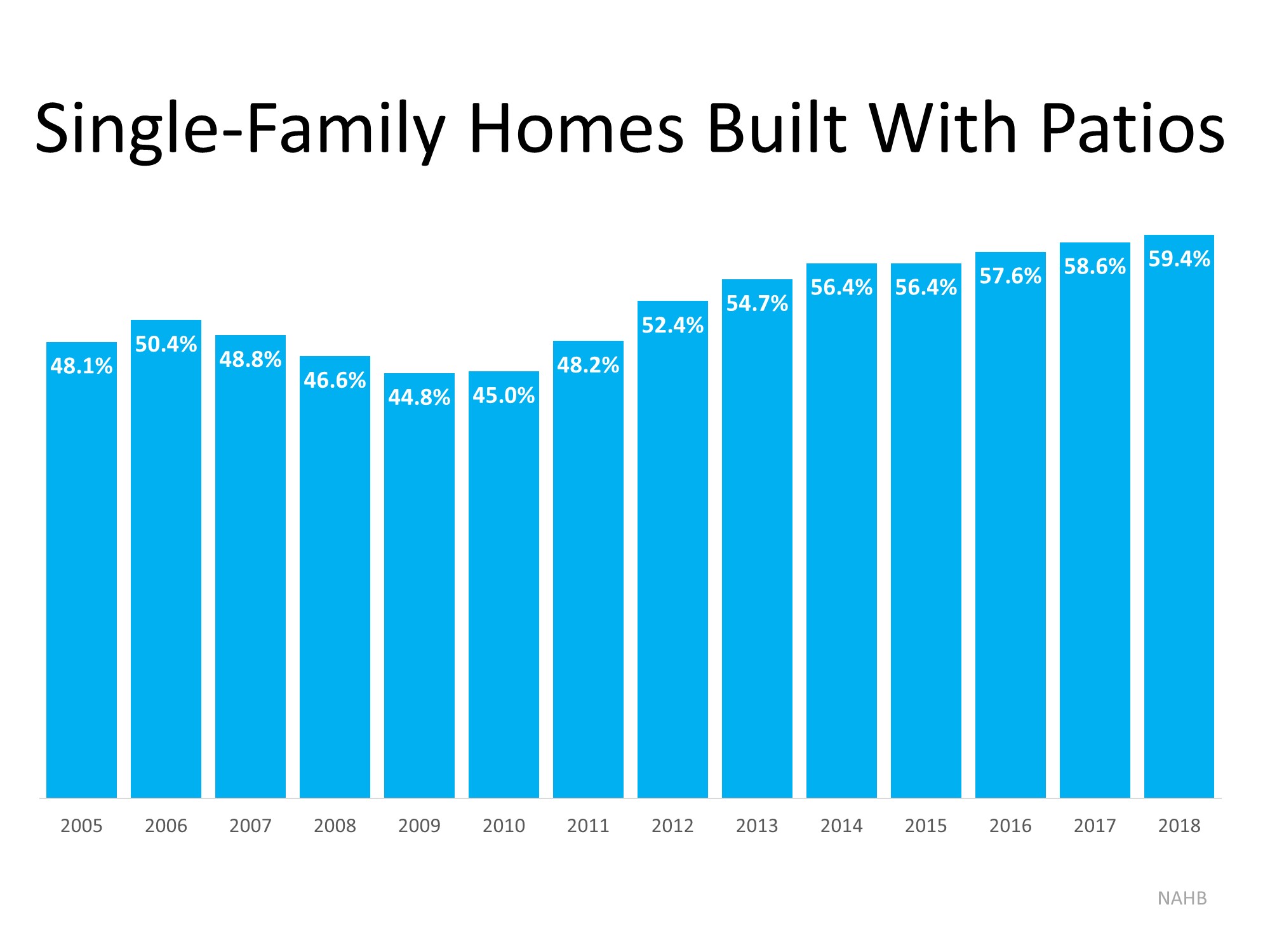

Patios are on the radar for buyers as well. Community areas are often common amenities in new neighborhoods, but as it turns out, private outdoor spaces are quite desirable too. NAHB also found that,

“Of the roughly 876,000 single-family homes started in 2018, 59.4% came with patios…This is the highest the number has been since NAHB began tracking the series in 2005.”

As shown in the graph below, the number of new homes built with patios has been increasing for the past 9 years. Clearly, they’re a desirable feature for new homeowners too.

Bottom Line

Homebuyers are looking for garage space and outdoor patio living. If you’re a homeowner thinking of selling a house with these amenities, it appears buyers are willing to spring for those key features. Let’s get together today to determine the current value and demand for your home.

Key Benefits of Health Insurance in the U.S.

Health insurance covers essential medical expenses like doctor visits, hospital stays, and preventive care. It protects you from high out-of-pocket costs during unexpected medical emergencies.

Guide to downsizing for retirees’s

Single Level Living is the best choice for Retiree's Retirement marks a significant transition in life, often prompting reevaluation of one's living situation and possessions. Downsizing can offer a simplified, more manageable lifestyle that aligns with the needs of...

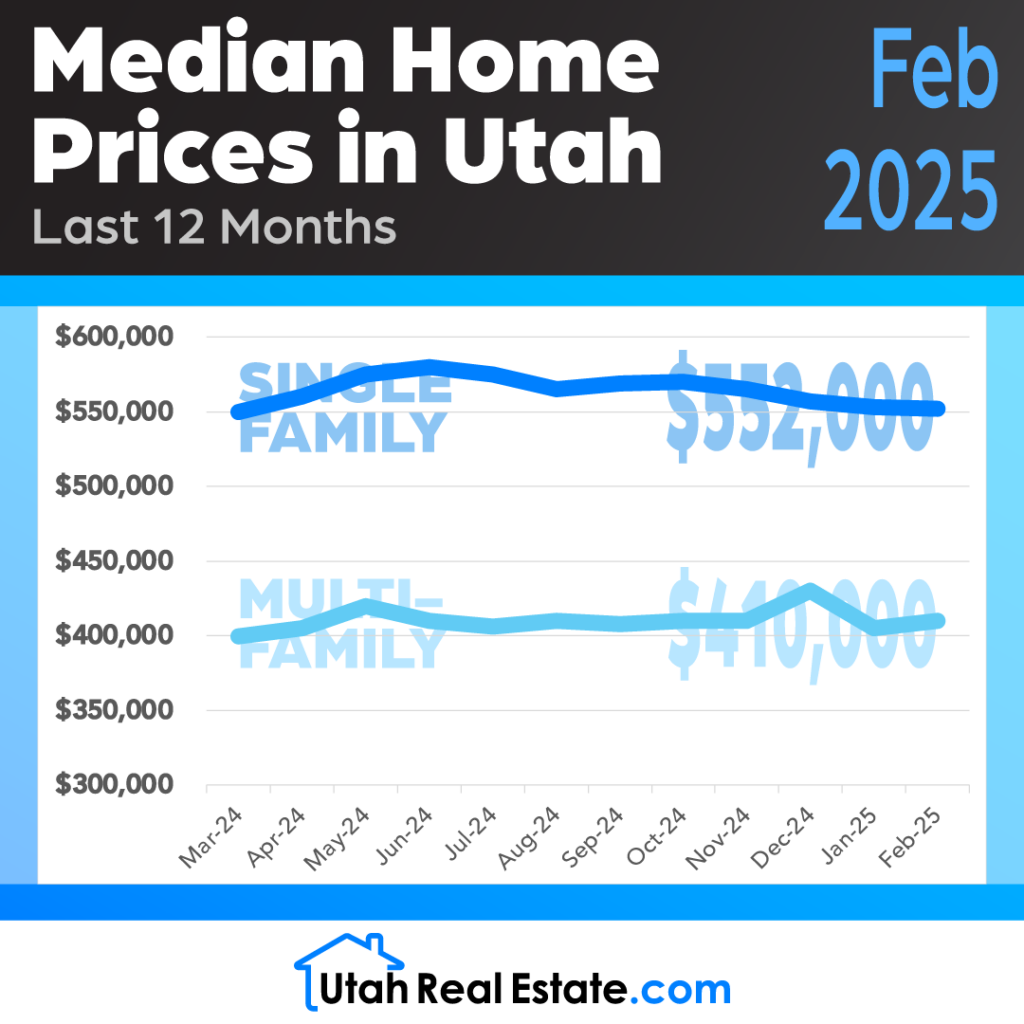

Median Home Prices February 2025

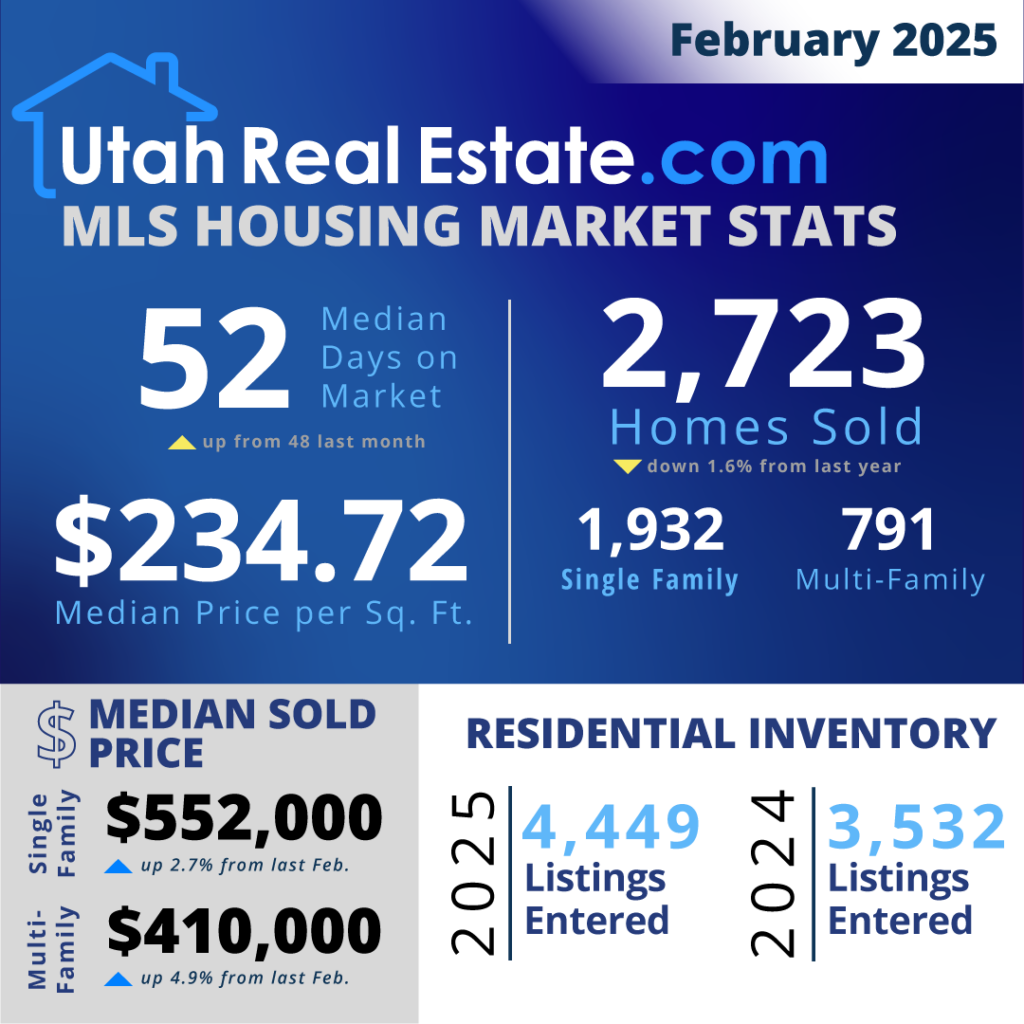

February 2025 Stats

Plans to Build 3 Million New Houses

Selling and leasing a small portion of federal land could lead to the construction of over three million houses in Western states, according to a right-leaning think tank. The Bureau of Land Management holds 267,000 square miles, and selling just 850 miles could...

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.