Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

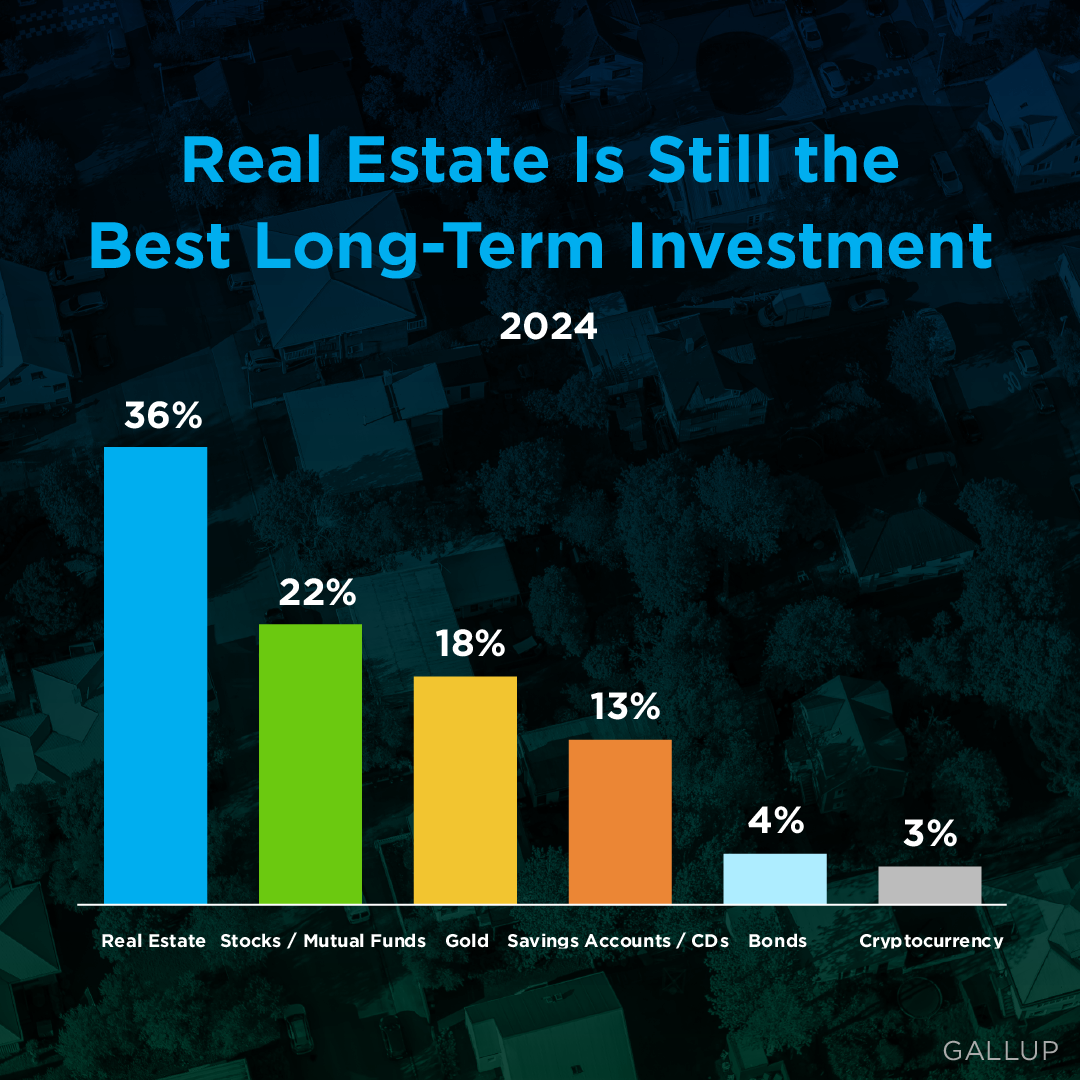

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...

Home Prices Rising in the Next 5 Years

Wondering about the future of home prices? Here's the scoop. Experts forecast a steady rise in home prices until at least 2028. That means buying now sets you up to gain equity as values climb. But, if you wait, the price of a home will only be higher later on. If you...

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...