Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

It’s Not Just About the Price of the Home

It’s Not Just About the Price of the HomeWhen most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the...

Salt Lake Home Sales Climb to Record High in July 2020

Salt Lake Home Sales Climb to Record High in July Salt Lake County home sales reached an all-time high in July at 2,093 homes sold, 15 percent higher than July 2019. It's the first time monthly sales surpassed 2,000 closings since the MLS began keeping records....

Utah Real Estate Tip – there are no “easy” transactions.

Real Estate Legal Tip - there are no "easy" transactions.Some people say that when the market is hot, "I can sell my home myself," or "I don't need an experienced agent because it costs money," or "how hard can it be?"Curtis Bullock From the Salt Lake Board of...

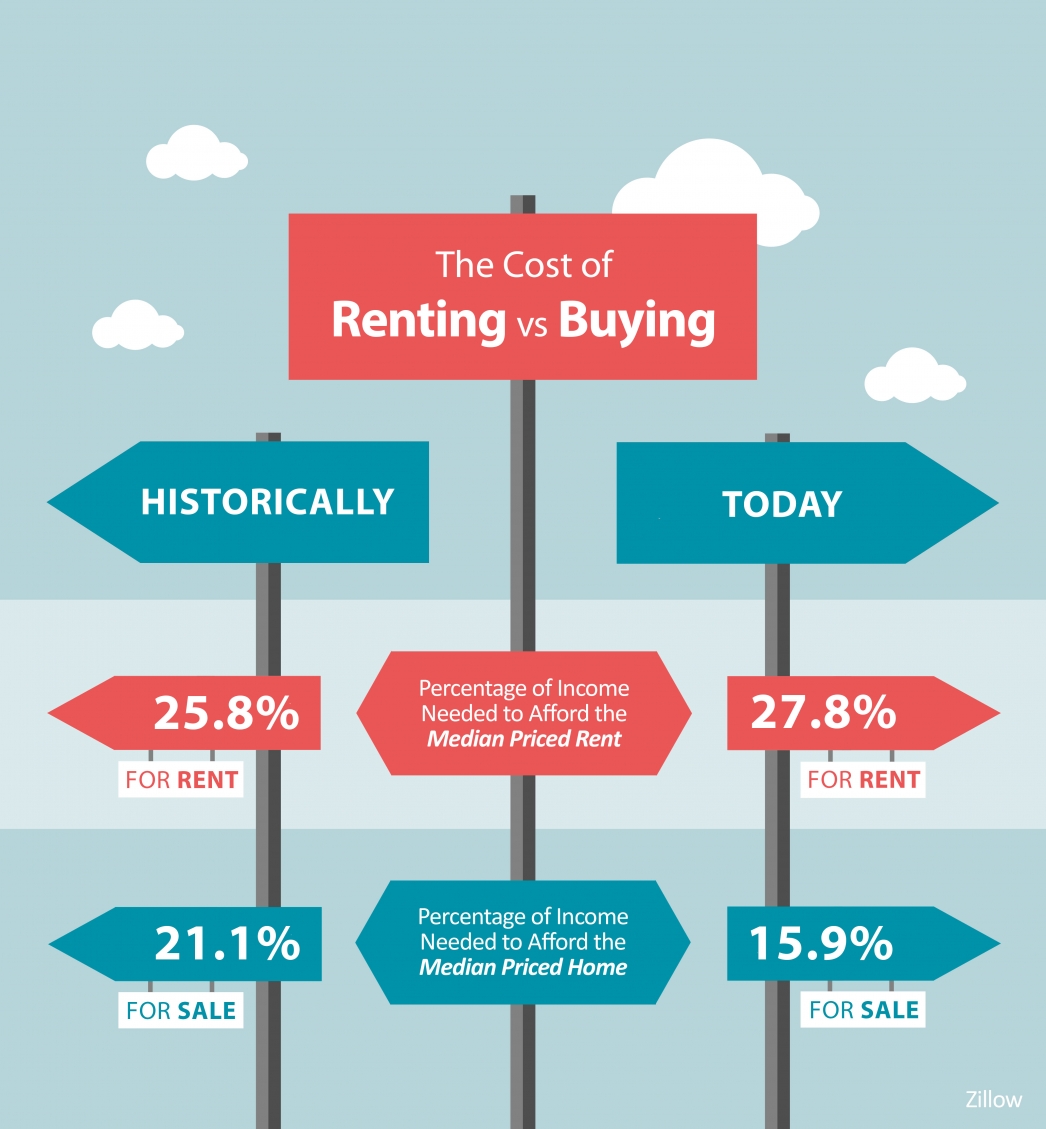

The Cost of Renting Vs. Buying a Home

The Cost of Renting Vs. Buying a HomeSome HighlightsThe percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.This is making buying a home an increasingly attractive option for many people, especially with...

Forbearance Numbers Are Lower Than Experts Forecasted

Forbearances have stayed well under the rate experts initially forecasted. Let's connect if you have questions about your options.

Top Reasons People Are Moving This Year In 2020

The Top Reasons People Are Moving This YearToday, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate...

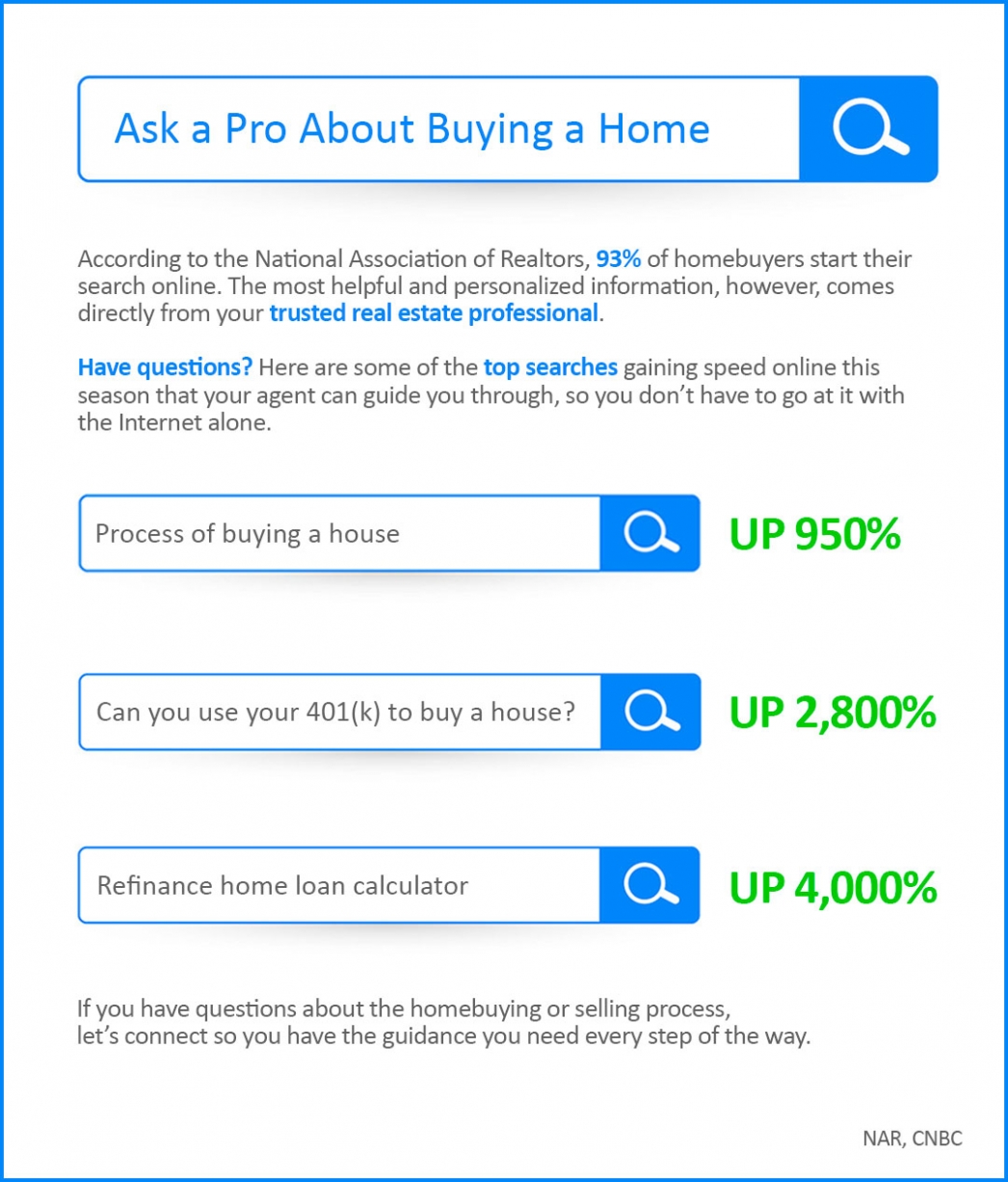

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....