Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

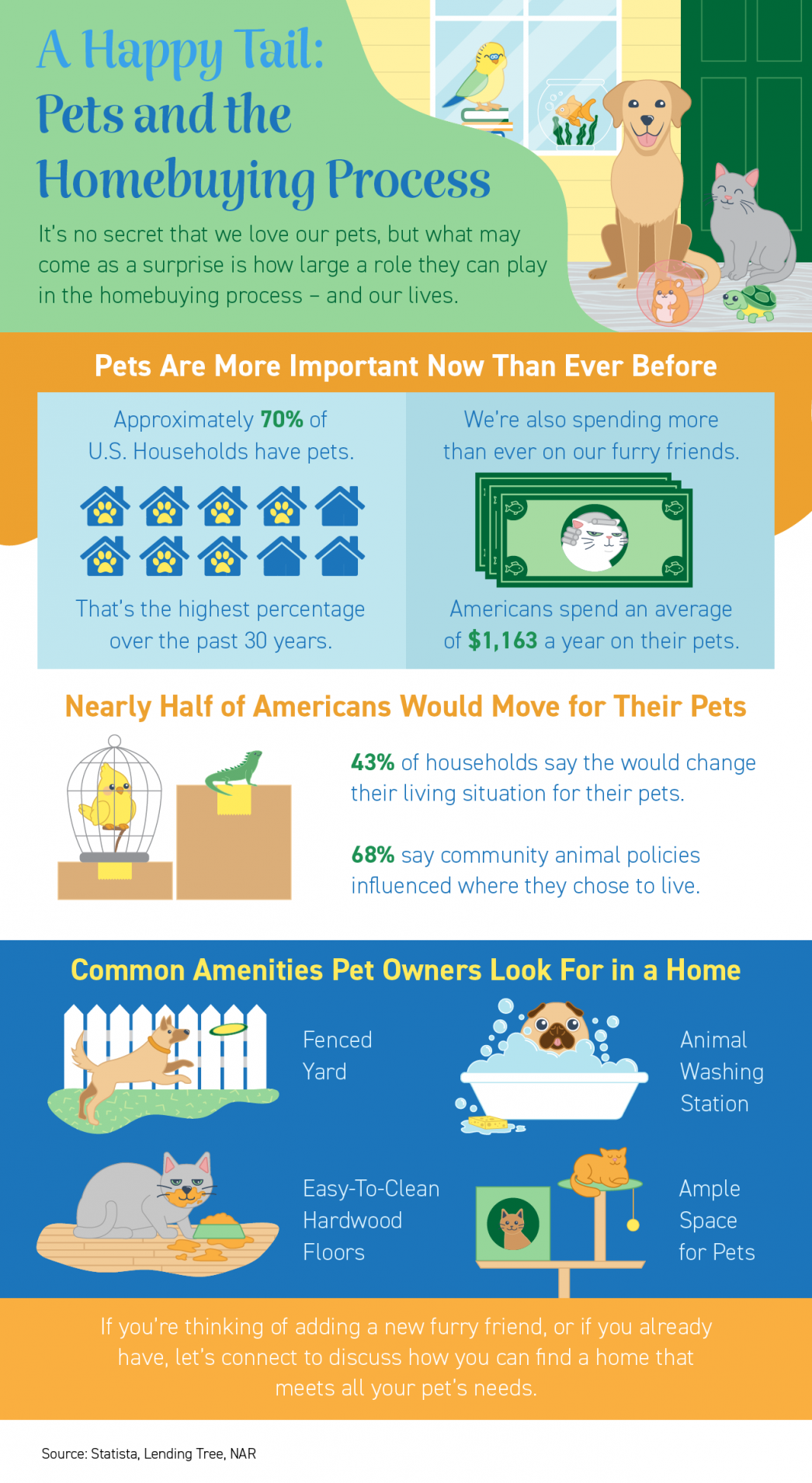

A Happy Tail: Pets and the Homebuying Process

A Happy Tail: Pets and the Homebuying Process Some Highlights It’s no secret that we love our furry friends - about 70% of U.S. households have pets. What may come as a surprise is how large a role they play in the homebuying process. Americans spend $1,163 a year on...

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market...

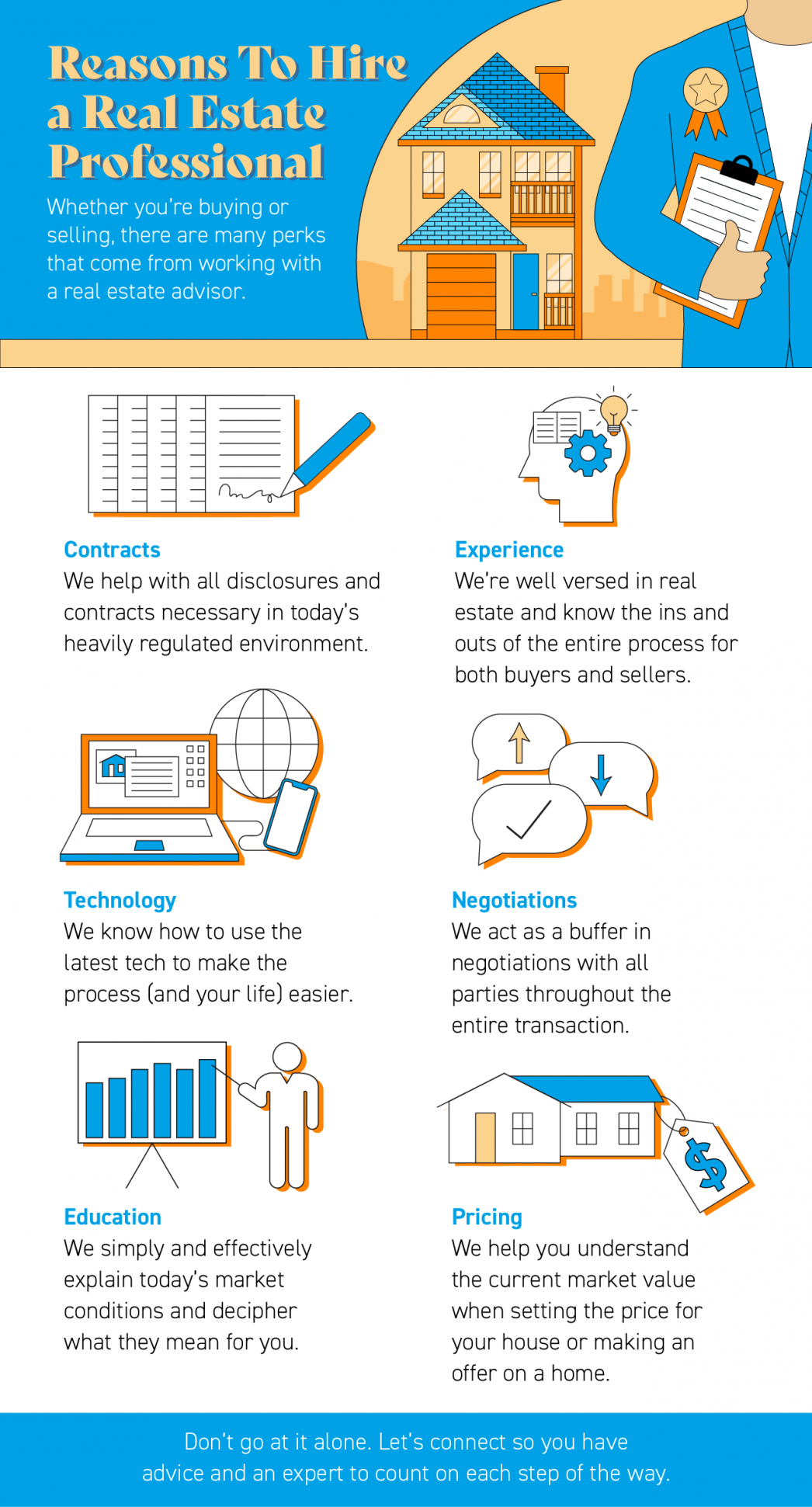

Reasons To Hire a Real Estate Professional

Reasons To Hire a Real Estate Professional Some Highlights Whether you’re buying or selling, there are many perks that come from working with a real estate advisor. Real estate professionals are experts at navigating all aspects of the buying and selling process,...

Happy Thanksgiving This 2021

thank·ful expressing gratitude and relief. "an earnest and thankful prayer OHANA is a Hawaiian term meaning "family" (in an extended sense of the term, including blood-related, adoptive or intentional). THANKSGIVING It began as a day of giving thanks and sacrifice for...

Home Sales About To Surge? We May See a Winter Like Never Before

Home Sales About To Surge? We May See a Winter Like Never Before. Like most industries, residential real estate has a seasonality to it. For example, toy stores sell more toys in October, November, and December than they do in any other three-month span throughout the...

Retirement May Be Changing What You Need in a Home

Retirement May Be Changing What You Need in a Home The past year and a half brought about significant life changes for many of us. For some, it meant entering retirement earlier than expected. Recent data shows more people retired this year than anticipated. According...

Sellers: You’ll Likely Get Multiple Strong Offers This Season

Sellers: You’ll Likely Get Multiple Strong Offers This Season Are you thinking about selling your house right now, but you’re not sure you’ll have the time to do so as the holidays draw near? If so, consider this: even as the holiday season approaches, there are...

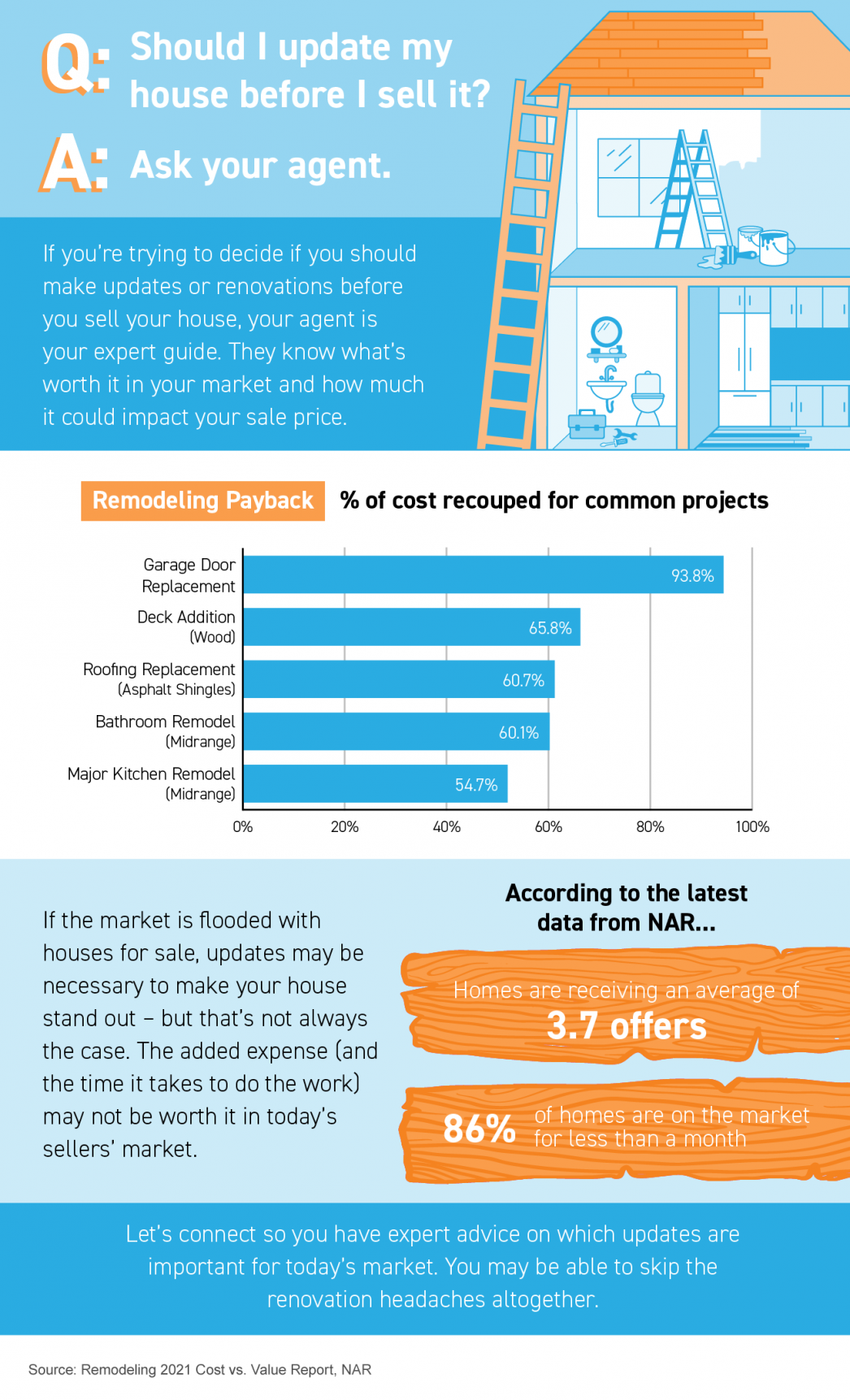

Should I Update My House Before I Sell It?

Should I Update My House Before I Sell It? Some Highlights If you’re deciding whether you should make updates before you sell your house, lean on your agent to be your guide. If the market is flooded with houses for sale, updates...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since...