Home Buyers are Optimistic About Homeownership!

When we consider buying an item, we naturally go through a research process prior to making our decision. We ask our friends and family members who have made similar purchases about their experience, we get opinions and insights, and we read reviews online. There’s no difference when considering a home purchase!

Most homebuyers start by listening to the news to hear what is being said about the real estate market. They check with family and friends about their experience. They spend time online reading reviews about their desired neighborhood.

The challenge is that comments from the news and those closest to us can contradict the data and reports. One source says one thing, while another source says something completely different.

There is a group of homebuyers that are not allowing comments about an upcoming recession to interfere with their decision to buy a home. According to a survey by realtor.com®,

“Nearly 70 percent of home shoppers this spring think the U.S. will enter a recession in the next three years, but that hasn’t stopped them from trying to close on a home…Despite the fact that they foresee an economic downturn, they generally expressed confidence that a future recession will be better than 2008 for the housing market.”

The report provides more insights from the survey:

- Nearly 30% of the active home shoppers* surveyed expect the next recession to begin sometime in 2020.

- 56% of shoppers believe home prices have hit their peak.

- 41% believe housing will fare better than 2008.

- 45% of home shoppers feel at least slightly more optimistic about homeownership.

- 33% reported no impact on their feelings about homeownership.

Homebuyers are aware and making decisions with their eyes wide-open. As the report mentioned,

“The fact that some [36%] home shoppers expect the next recession to be harder on the housing market than the last recession suggests that they are buying homes with eyes wide-open and very sober, if not slightly pessimistic, views of the housing market.

This is a stark contrast to the years leading up to the last recession when ‘irrational exuberance’ was more common and yet another reason to expect that the next downturn will be very different for the housing market than the last.”

Bottom Line

If you are considering buying a home, let’s get together to help you understand our local market and determine if buying a home is the right choice for you now.

*Active home shoppers are those consumers who responded that they plan to purchase their next home in 1 year or less.

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

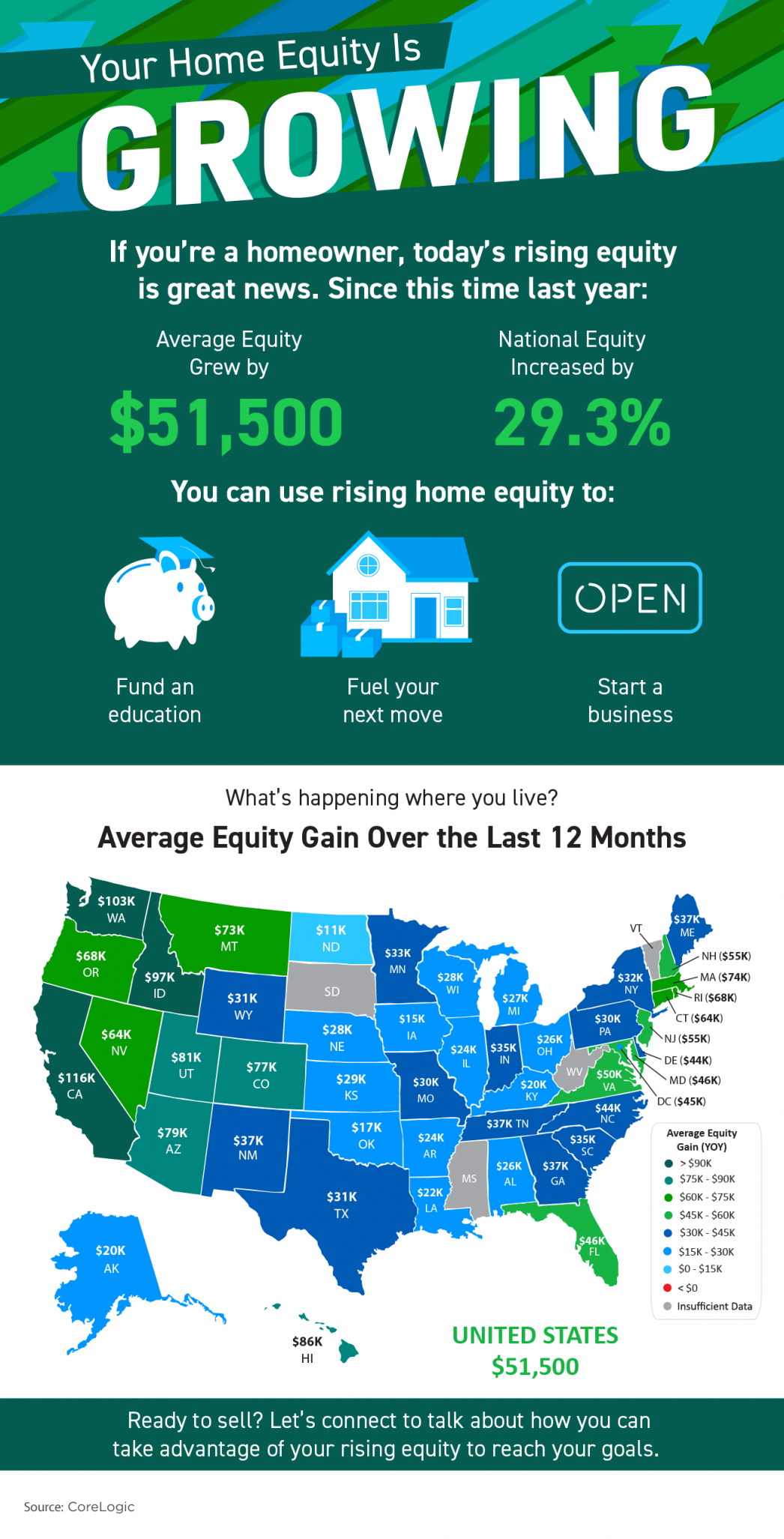

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent...

Perfect Combination

In today’s housing market, houses are selling quickly and are receiving multiple offers from eager buyers. That combination means it’s a great time to sell. DM me so we can discuss how your house plus today’s sellers’ market adds up to a great opportunity for you this...

Utah Local Market Update Utah County

Homebuyer Tips for Finding the One

Homebuyer Tips for Finding the One Some Highlights The best advice carries across multiple areas of life. When it comes to homebuying, a few simple tips can help you stay on track. Because of increased demand, you’ll need to be patient and embrace compromises during...