Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

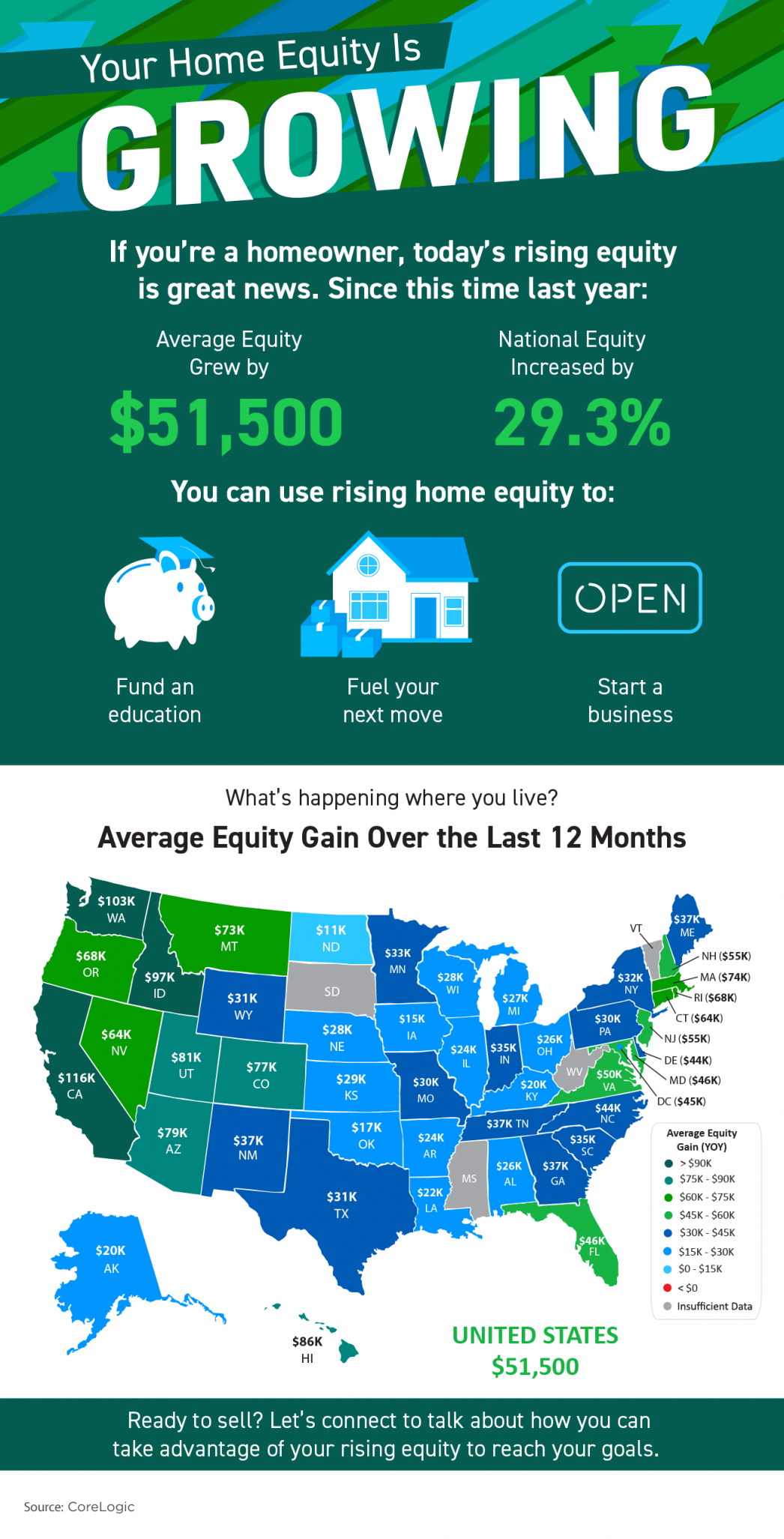

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent...

Perfect Combination

In today’s housing market, houses are selling quickly and are receiving multiple offers from eager buyers. That combination means it’s a great time to sell. DM me so we can discuss how your house plus today’s sellers’ market adds up to a great opportunity for you this...

Utah Local Market Update Utah County

Homebuyer Tips for Finding the One

Homebuyer Tips for Finding the One Some Highlights The best advice carries across multiple areas of life. When it comes to homebuying, a few simple tips can help you stay on track. Because of increased demand, you’ll need to be patient and embrace compromises during...

Local Market Update for September 2021

Auto Draft

What Do Past Years Tell Us About Today’s Real Estate Market?

What Do Past Years Tell Us About Today’s Real Estate Market? As you follow the news, you’re likely seeing headlines discussing what’s going on in today’s housing market. Chances are high that some of the more recent storylines you’ve come across mention terms...

The Big Question: Should You Renovate or Move?

The Big Question: Should You Renovate or Move? The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following: 70%...