Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

The Average Homeowner Gained $64K in Equity over the Past Year

The Average Homeowner Gained $64K in Equity over the Past Year If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price...

More Americans Choose Real Estate as the Best Investment Than Ever Before

More Americans Choose Real Estate as the Best Investment Than Ever Before Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth...

Why the Growing Number of Homes for Sale Is Good for Your Move Up

Why the Growing Number of Homes for Sale Is Good for Your Move Up Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know....

June is National Homeownership Month

How Homeownership Impacts You June is National Homeownership Month, and it’s the perfect time to reflect on how impactful owning a home can truly be. When you purchase a house, it becomes more than just a space you occupy. It’s your stake in the community,...

Sellers Have an Opportunity with Today’s Home Prices

"IT'S THE EXPERIENCE" It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone. You may be wondering if prices are projected to rise or fall…or how much competition you may...

What’s on the Horizon for the Housing Market in the Second Half of 2022?

The One Thing Every Homeowner Needs To Know About a Recession

The One Thing Every Homeowner Needs To Know About a Recession A recession does not equal a housing crisis. That’s the one thing that every homeowner today needs to know. Everywhere you look, experts are warning we could be heading toward a recession, and if true, an...

How Homeownership Can Bring You Joy

How Homeownership Can Bring You Joy If you're trying to decide whether to rent or buy a home, you're probably weighing a few different factors. The financial benefits of homeownership might be one of the reasons you want to make a purchase if you’re a renter, but...

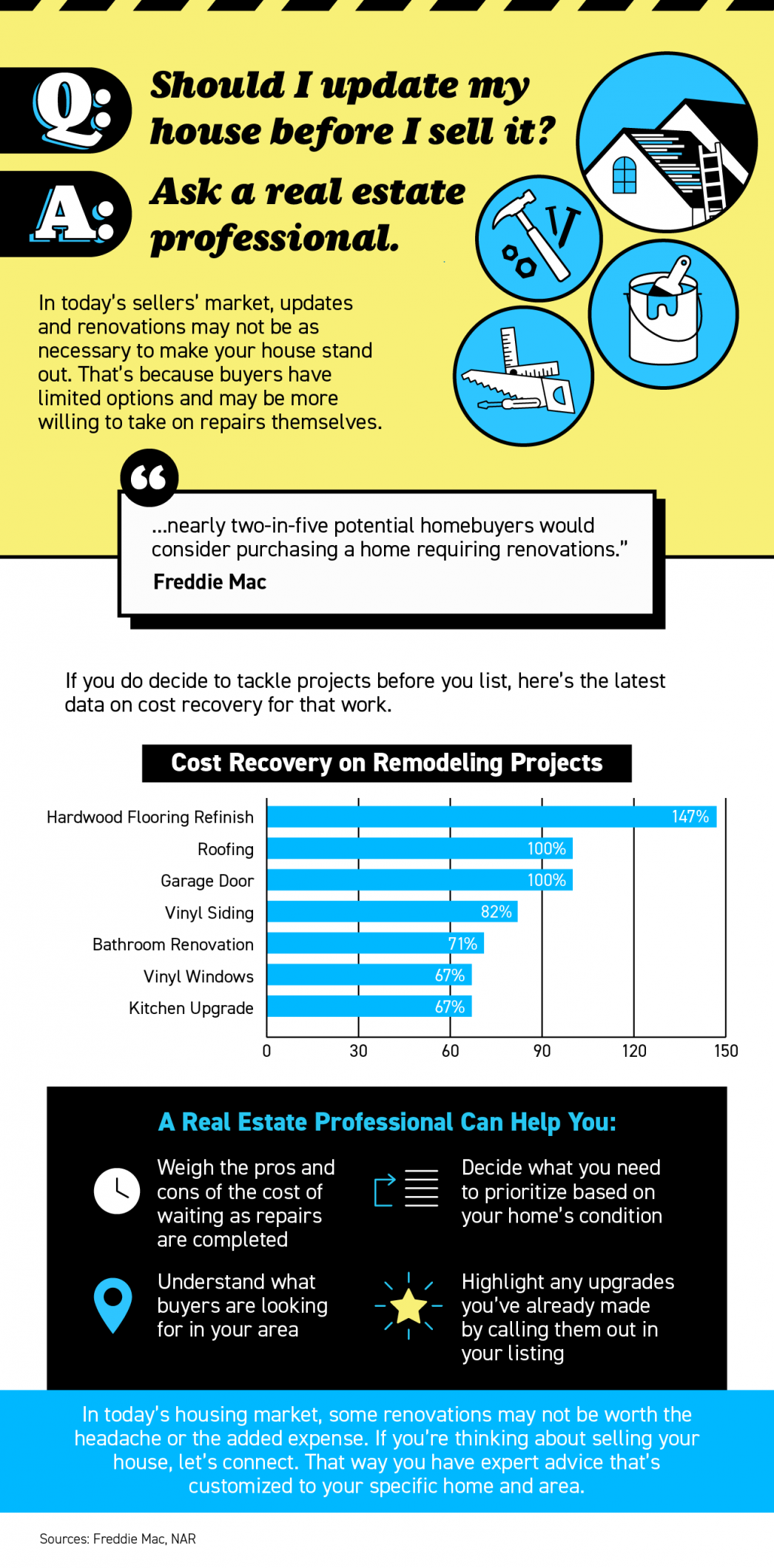

Should You Update Your House Before Selling? Ask a Real Estate Professional.

Should You Update Your House Before Selling? Ask a Real Estate Professional. Some Highlights If you’re deciding whether you should make updates before you sell your house, lean on your trusted real estate advisor to be your guide. In today’s sellers’ market, buyers...