Starting the Search for Your Dream Home? Here Are 5 Tips!

In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared.

In a realtor.com article entitled, “How to Find Your Dream Home—Without Losing Your Mind,” the author highlights some steps that first-time homebuyers can take to help carry their excitement of buying a home throughout the whole process.

1. Get Pre-Approved for a Mortgage Before You Start Your Search

One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach.

This step will also help you narrow your search based on your budget and won’t leave you disappointed if the home you tour, and love, ends up being outside your budget!

2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

Before you start your search, list all the features of a home you would like and then qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help keep you focused on what’s most important.

3. Research and Choose a Neighborhood You Want to Live In

Every neighborhood has its own charm. Before you commit to a home based solely on the house itself, the article suggests test-driving the area. Make sure that the area meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

4. Pick a House Style You Love and Stick to It

Evaluate your family’s needs and settle on a style of home that would best serve those needs. Just because you’ve narrowed your search to a zip code, doesn’t mean that you need to tour every listing in that zip code.

An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

5. Document Your Home Visits

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy to document what you love and don’t love about each property you visit.

Making notes on the listing sheet as you tour the property will also help you remember what the photos mean, or what you were feeling while touring the home.

Bottom Line

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home.

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

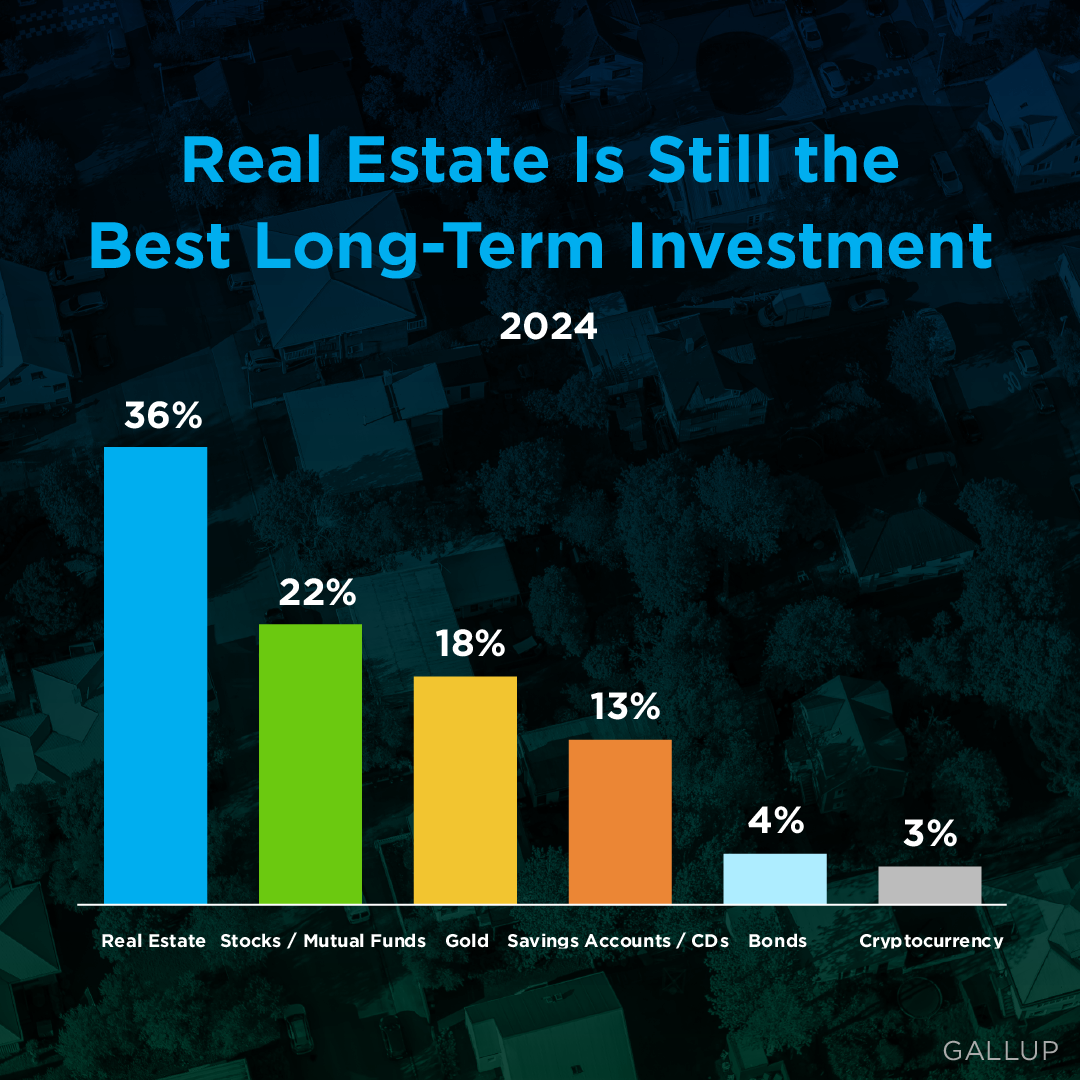

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...