Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there, watching entire seasons of “Love it or List it,” “Million Dollar Listing,” “House Hunters,” “Property Brothers,” and so many more all in one sitting.

When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Reality TV Show Myths vs. Real Life:

Myth #1: Buyers look at 3 homes and decide to purchase one of them.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors the average homebuyer tours 10 homes as a part of their search.

Myth #2: The houses the buyers are touring are still for sale.

Truth: Everything is staged for TV. Many of the homes being shown are already sold and are off the market.

Myth #3: The buyers haven’t made a purchase decision yet.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Myth #4: If you list your home for sale, it will ALWAYS sell at the open house.

Truth: Of course, this would be great! Open houses are important to guarantee the most exposure to buyers in your area but are only a PIECE of the overall marketing of your home. Keep in mind that many homes are sold during regular listing appointments as well.

Myth #5: Homeowners decide to sell their homes after a 5-minute conversation.

Truth: Similar to the buyers portrayed on the shows, many of the sellers have already spent hours deliberating the decision to list their homes and move on with their lives/goals.

3 Must-Do’s When Selling Your House in 2024

3 Must-Do’s When Selling Your House in 2024 If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to...

Buying Real Estate With Crypto Currency In Utah

Buying Real Estate With Crypto Currency In Utah As the world continues to evolve, so too does the way we invest and transact. In recent years, cryptocurrencies such as Bitcoin and Ethereum have emerged as prominent investment vehicles for tech-savvy individuals....

Key Terms Every Homebuyer Should Learn

Key Terms Every Homebuyer Should Learn Some Highlights Buying a home is a big deal and can feel especially complicated if you don't know the terms used during the process. If you want to become a homeowner this year, it's a good idea to learn these key housing...

3 Key Factors Affecting Home Affordability

3 Key Factors Affecting Home Affordability Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most...

Why the Price of Your House Matters When Selling

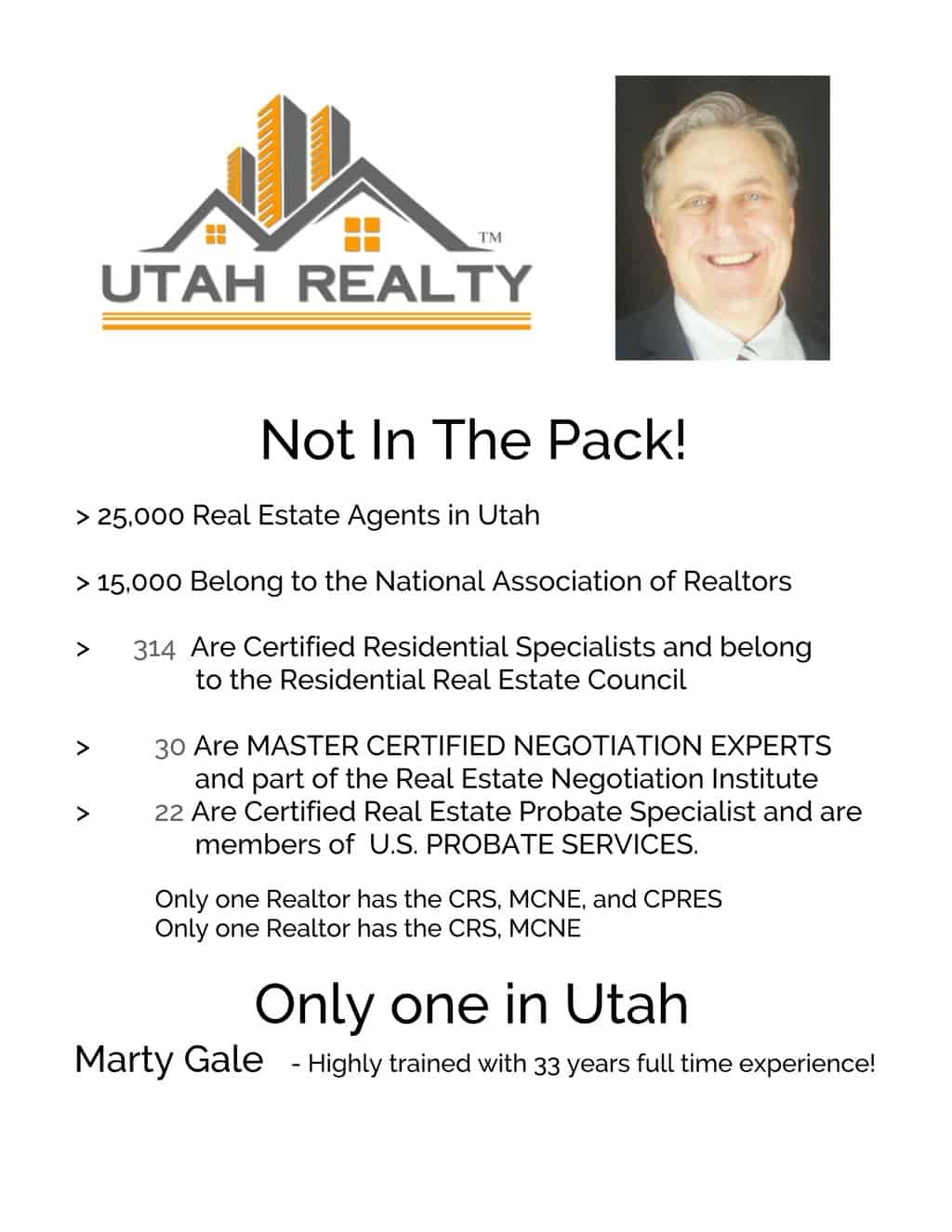

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

Home Prices Forecast To Climb over the Next 5 Years

Home Prices Forecast To Climb over the Next 5 Years Some Highlights If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house...

The Dramatic Impact of Homeownership on Net Worth

The Dramatic Impact of Homeownership on Net Worth If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision. Every three years, the Federal...

Avoid These Common Mistakes After Applying for a Mortgage

Avoid These Common Mistakes After Applying for a Mortgage If you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. But before you get too far down the emotional path, there are some key things to...

What are your Goals for 2024?

What are your Goals for 2024?

What Lower Mortgage Rates Mean for Your Purchasing Power

What Lower Mortgage Rates Mean for Your Purchasing Power If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly...