Housing is always a hot topic in Utah and the anticipated Fall housing market in Salt Lake County. As seasons change, so do the dynamics of real estate, and we are here to provide you with an insightful glimpse into what can be expected in this vibrant and dynamic market. From analyzing current trends to exploring key factors influencing the housing market, we aim to equip you with the knowledge necessary to navigate through the Fall season with confidence. Whether you are a buyer, seller, or simply a curious observer, join us as we uncover the potential opportunities and challenges that lie ahead in the exciting world of Salt Lake County’s housing market this Fall.

Current Real Estate Trends In Salt Lake County

The Salt Lake County housing market has seen significant fluctuations over the past few years. As we enter the fall season, it is essential to reflect on the current real estate trends in Salt Lake County to gain a better understanding of what to expect in the upcoming months.

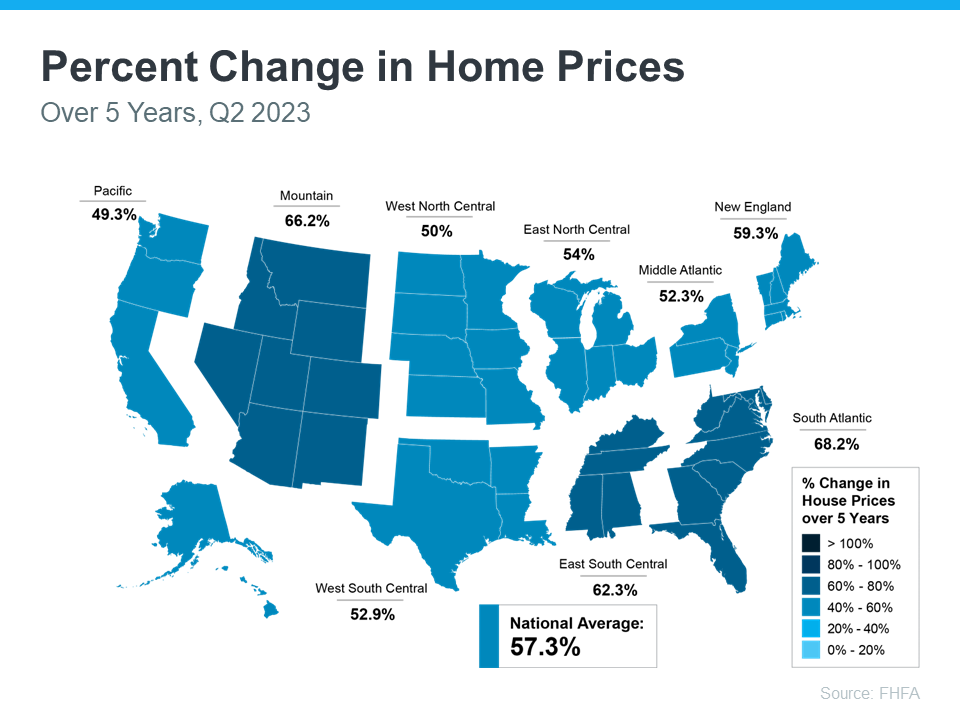

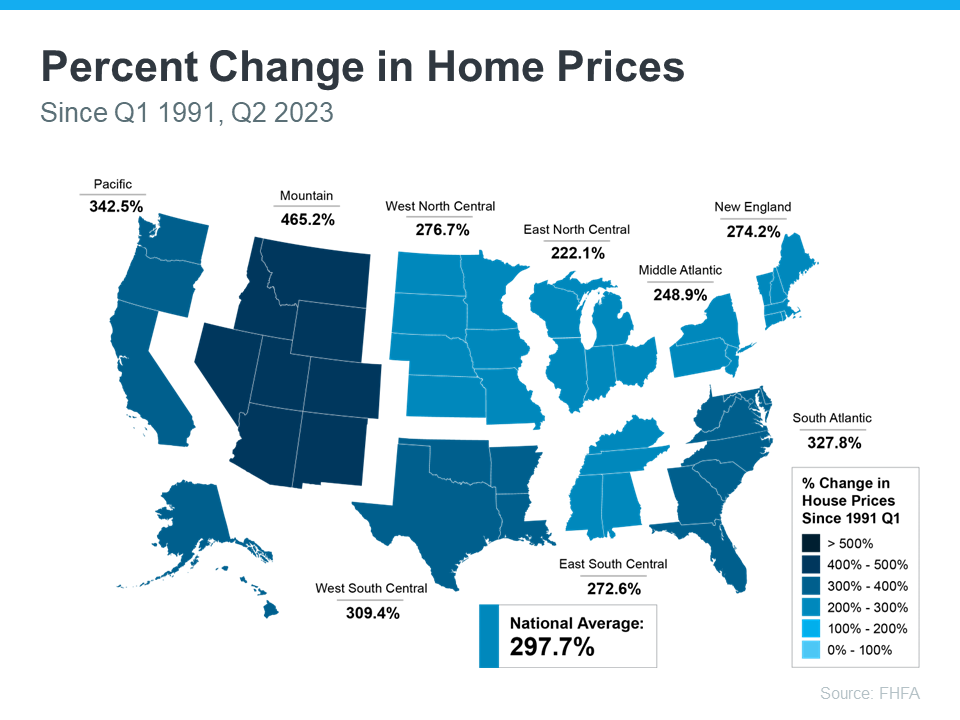

One of the notable trends in the Salt Lake County housing market is the steady increase in home prices. In recent years, the demand for housing in the area has surpassed the available supply, driving prices higher. This is primarily due to the county’s thriving economy, attractive job opportunities, and a desirable quality of life. As a result, homeowners can often expect a favorable return on their investments.

However, it is worth noting that the pace of home price appreciation has slightly eased in recent months. This can be attributed to the market finding a sense of balance between supply and demand. The market is still considered competitive, but buyers are now encountering more options and a slight cooling off from the previously rapid price growth.

Another significant trend that has impacted the Fall housing market in Salt Lake County is the increase in demand for smaller and more affordable homes. The pandemic has shifted homebuyers’ preferences, with many prioritizing larger living spaces to accommodate work-from-home arrangements and remote learning. As a result, the demand for single-family homes with more square footage has surged.

However, along with the growing demand for larger homes, there is also an increased interest in smaller properties. Many first-time homebuyers or those on a budget are seeking more affordable options, such as townhomes or condominiums. These properties typically offer more accessibility and a lower maintenance lifestyle, making them attractive to a wide range of buyers.

Another key factor affecting the Salt Lake County housing market is the historically low-interest rates. These rates have created favorable conditions for potential buyers, allowing them to secure mortgages with lower monthly payments. As a result, even with the rising prices, many buyers can still afford homeownership, which further fuels the demand for housing in the area.

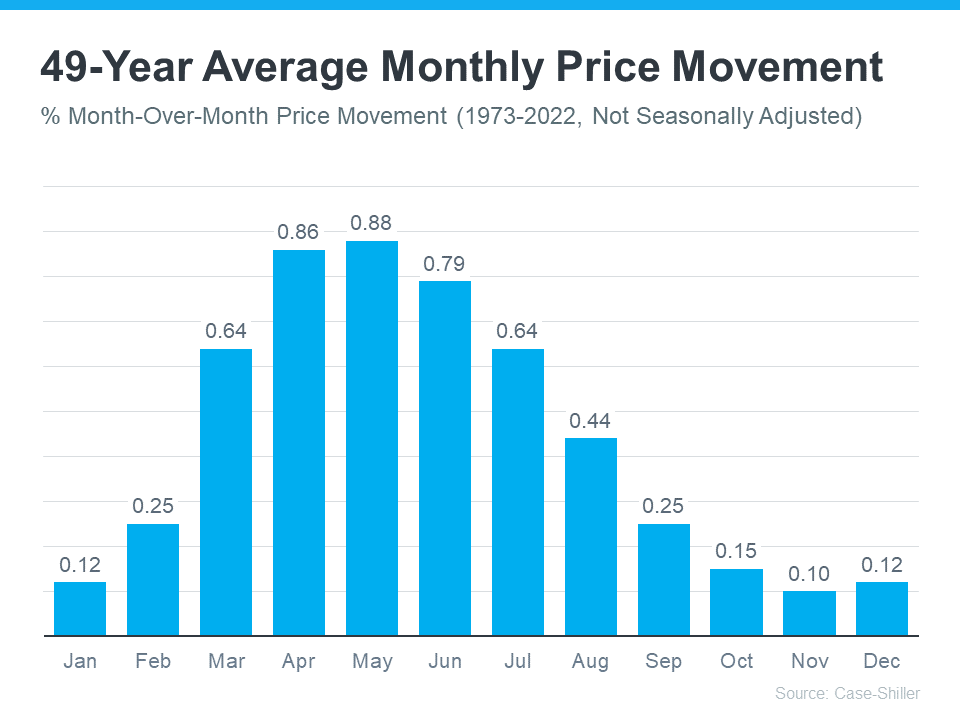

Additionally, the fall season may witness an increase in the number of homes hitting the market. Traditionally, the spring and summer months are considered the peak selling season; however, due to various circumstances, including the pandemic’s effects, some homeowners may postpone their listing until fall. This influx of inventory could potentially provide more opportunities for buyers to find their dream home.

Moreover, as the area continues to attract businesses and foster economic growth, the real estate market in Salt Lake County remains robust. The county has seen an influx of major corporations, tech companies, and startups, all contributing to job creation and economic stability. This, in turn, provides a steady stream of potential homebuyers and investors in the market.

In conclusion, the fall housing market in Salt Lake County is expected to continue its upward trajectory, albeit at a more moderate pace compared to previous years. The trends suggest that home prices will still appreciate, albeit at a slower rate, as demand remains strong. Additionally, the variety of housing options, from larger single-family homes to smaller condos, provides choices for buyers at different price points. With historically low-interest rates and an anticipated increase in inventory, the fall season presents an excellent opportunity for both buyers and sellers in Salt Lake County’s real estate market.

Factors Affecting The Supply And Demand For Homes

The Salt Lake County housing market has been steadily growing and evolving, attracting both buyers and sellers with its appealing mix of urban amenities and natural beauty. As we approach the fall season, many people wonder how the market will fare in the coming months. To gain insight into this, it is essential to examine the factors that affect the supply and demand for homes in Salt Lake County.

One crucial factor that can influence the fall housing market is the overall economic conditions in the area. Strong economic growth, low unemployment rates, and increases in wages and job opportunities tend to drive demand for housing. Salt Lake County has seen a robust economy in recent years, with various sectors experiencing growth, including technology, tourism, and healthcare. As a result, it is reasonable to expect that the demand for homes will remain steady or even increase during the fall season.

Another significant factor that can impact the housing market is population growth and migration patterns. Salt Lake County has witnessed a considerable influx of people in recent years, attracted by its natural scenery, recreational activities, educational opportunities, and vibrant cultural scene. This population growth contributes to a higher demand for housing, as more people are looking to settle down in the area. As fall approaches, this trend may continue, leading to increased demand for homes.

Additionally, changes in mortgage interest rates can have a profound impact on both the supply and demand for homes. Lower interest rates typically make borrowing more affordable, enticing more buyers to enter the market. Conversely, higher interest rates may discourage potential home buyers as they reduce purchasing power and increase the cost of borrowing. Monitoring the fluctuations in mortgage rates during the fall season can provide valuable insights into the direction the housing market in Salt Lake County may take.

Supply-side factors are equally essential to consider. One critical aspect is new construction and housing inventory. In recent years, Salt Lake County has experienced a shortage of housing inventory, leading to increased competition among buyers and rising home prices. However, developers have responded to this demand by constructing new homes and apartment buildings across the county. The pace and scale of new construction projects can influence the supply of available housing on the market. Monitoring these construction trends leading up to the fall season can give us insights into the direction of the supply side.

The regulatory environment and legislation related to real estate are additional factors that can affect the supply and demand equation. Changes in zoning regulations, tax laws, and building codes can impact housing development, influencing both the supply and demand for homes. Keeping an eye on any significant legislative changes during the fall season will provide valuable context for understanding the housing market in Salt Lake County.

Finally, local market conditions and trends should not be overlooked. Factors such as neighborhood desirability, school district ratings, and proximity to amenities like shopping centers, parks, and public transportation can all impact the demand for homes within specific areas of Salt Lake County. Analyzing these localized conditions can provide a more nuanced understanding of how the housing market may perform during the fall season.

In conclusion, several factors influence the supply and demand for homes in Salt Lake County during the fall housing market. Economic conditions, population growth, mortgage interest rates, new construction, regulatory changes, and local market conditions all play their part. By keeping a close eye on these factors, prospective buyers and sellers can gain valuable insights into what to expect and make informed decisions in the Salt Lake County housing market this fall.

Tips For Buyers And Sellers In The Fall Housing Market

As the fall season sets in, the real estate market in Salt Lake County is expected to experience some shifts and trends. Whether you are a potential buyer or seller, it’s essential to understand the dynamics of the fall housing market to make informed decisions. With that in mind, here are some tips to navigate the fall housing market in Salt Lake County.

For Buyers:

1. Do your research:

Before making any purchase, research the local market conditions and trends in Salt Lake County. Keep track of the median home prices, inventory levels, and the average days on the market. This information will help you set realistic expectations and negotiate effectively.

2. Work with an experienced agent:

Collaborating with a reliable real estate agent who has expertise in the Salt Lake County market is invaluable. They can provide you with insights, guide you through the buying process, and help you find properties that match your requirements and budget.

3. Remain flexible with your search:

Unlike the bustling spring and summer markets, the fall market usually offers fewer options for buyers. Being flexible with your criteria, such as location or specific amenities, can increase your chances of finding a suitable property. Expand your search radius or consider neighborhoods that might not have been on your radar.

4. Act swiftly:

Although the market may be slower compared to other seasons, desirable properties tend to sell quickly. Be prepared to act swiftly when you find the right home, as delays could result in missing out on a great opportunity.

5. Pay attention to interest rates:

Interest rates play a significant role in determining the affordability of a home. Keep an eye on the market trends and consult with lenders to lock in a favorable interest rate for your mortgage.

For Sellers:

1. Prepare your home:

To stand out among the competition, ensure that your home is in top condition before listing it for sale. Consider minor repairs, decluttering, and staging to appeal to potential buyers. Fall-themed decorations can also create a warm and inviting atmosphere.

2. Price it right:

Accurately pricing your home is crucial in the fall market. Study recent sales in your area, consult with your agent, and consider the current market conditions to determine a competitive listing price. Overpricing your property can result in extended time on the market and missed opportunities.

3. Showcase fall features:

Embrace the season by showcasing the unique features of your home. Highlight cozy fireplaces, comfortable outdoor spaces for autumn evenings, or any other aspect that makes your property desirable during the fall months.

4. Enhance curb appeal:

Enhancing your home’s curb appeal can go a long way in attracting potential buyers. Maintain your landscaping, clean up fallen leaves, and add seasonal touches like potted plants, colorful mums, or a tastefully decorated front porch to create a welcoming first impression.

5. Be flexible and open to negotiation:

While there may be fewer buyers during the fall season, those who are actively searching tend to be motivated. Be open to negotiation and consider offers that may be slightly below your asking price. Collaborating with your agent to assess the potential buyer’s qualification and negotiate favorable terms is crucial.

Navigating the fall housing market in Salt Lake County requires a thoughtful approach from both buyers and sellers. By staying informed, working with experienced professionals, and adapting to market conditions, you can position yourself for success in this season’s real estate landscape.

Housing in Salt Lake County is still in short supply

In recent years, the housing market in Salt Lake County has been characterized by its high demand and low supply. Unfortunately, this fall season does not seem to be any different. As we enter the final quarter of the year, prospective homebuyers and renters are faced with the ongoing challenge of finding suitable housing options in this thriving region. The scarcity of inventory continues to drive prices upwards, making it increasingly difficult for individuals and families to secure affordable housing in Salt Lake County.

One of the primary reasons for the shortage of housing is the rapid population growth Salt Lake County has experienced over the years. Utah has consistently ranked among the fastest-growing states in the country, and Salt Lake County, being the most populous in the state, has borne the brunt of this growth. With an influx of people moving to the area, the demand for homes has skyrocketed, placing pressure on the existing housing stock.

Additionally, the shortage of available housing can be attributed to the limited supply of new construction projects in Salt Lake County. Various factors, including strict zoning regulations, labor shortages, and rising construction costs, have hampered the construction industry’s ability to keep pace with the demand. This disparity between supply and demand has resulted in a highly competitive housing market, where homes often receive multiple offers and sell above their listing prices.

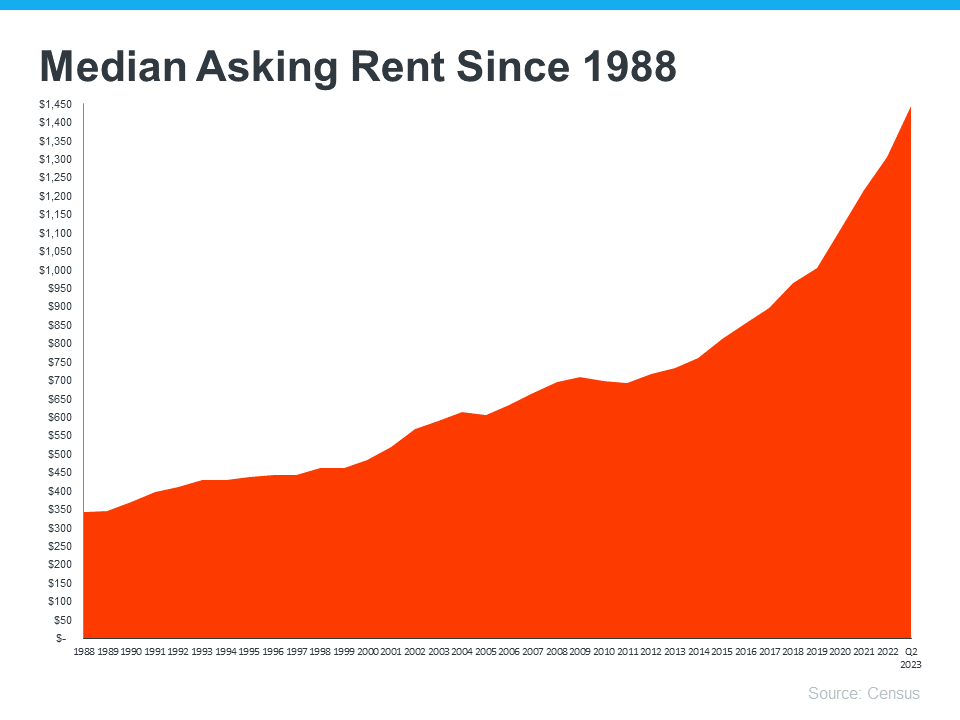

The impact of this shortage is particularly acute for certain segments of the population, such as first-time homebuyers and individuals with lower incomes. The limited availability of affordable housing options forces many to rent instead, thereby driving up rental prices as well. This trend further exacerbates the affordability crisis for those who are looking to establish roots in Salt Lake County but are faced with the prospect of ever-increasing housing costs.

Furthermore, the shortage of housing in Salt Lake County not only affects individuals and families looking for primary residences but also has broader implications for the overall economy. A well-balanced housing market is crucial for attracting businesses and maintaining a healthy local economy. Without adequate housing options, both existing and potential residents may be deterred from living and working in the area, hindering further economic growth and development.

As we approach the fall housing market in Salt Lake County, it is essential for prospective buyers and renters to be prepared for the challenges they may face. With limited supply and high demand, it is advisable to act swiftly when a suitable property becomes available. Staying informed about new developments and regularly engaging with local real estate agents can increase the chances of finding an ideal housing option in this competitive market.

On a positive note, efforts are being made to address this housing shortage. Local organizations and government entities are working together to implement strategies aimed at increasing the supply of housing in Salt Lake County. Initiatives such as the construction of affordable housing units, regulatory reforms, and incentives for developers are underway to alleviate the pressure on the market and promote housing affordability.

In conclusion, the fall housing market in Salt Lake County is expected to reflect the ongoing housing shortage that has plagued the region for some time. The high demand for housing, coupled with limited inventory and rising prices, presents significant challenges for prospective buyers and renters. It is crucial that individuals and families seeking housing in Salt Lake County are well-prepared, informed, and proactive in their search to secure a suitable and affordable living arrangement.