How To List Your Home for the Best Price

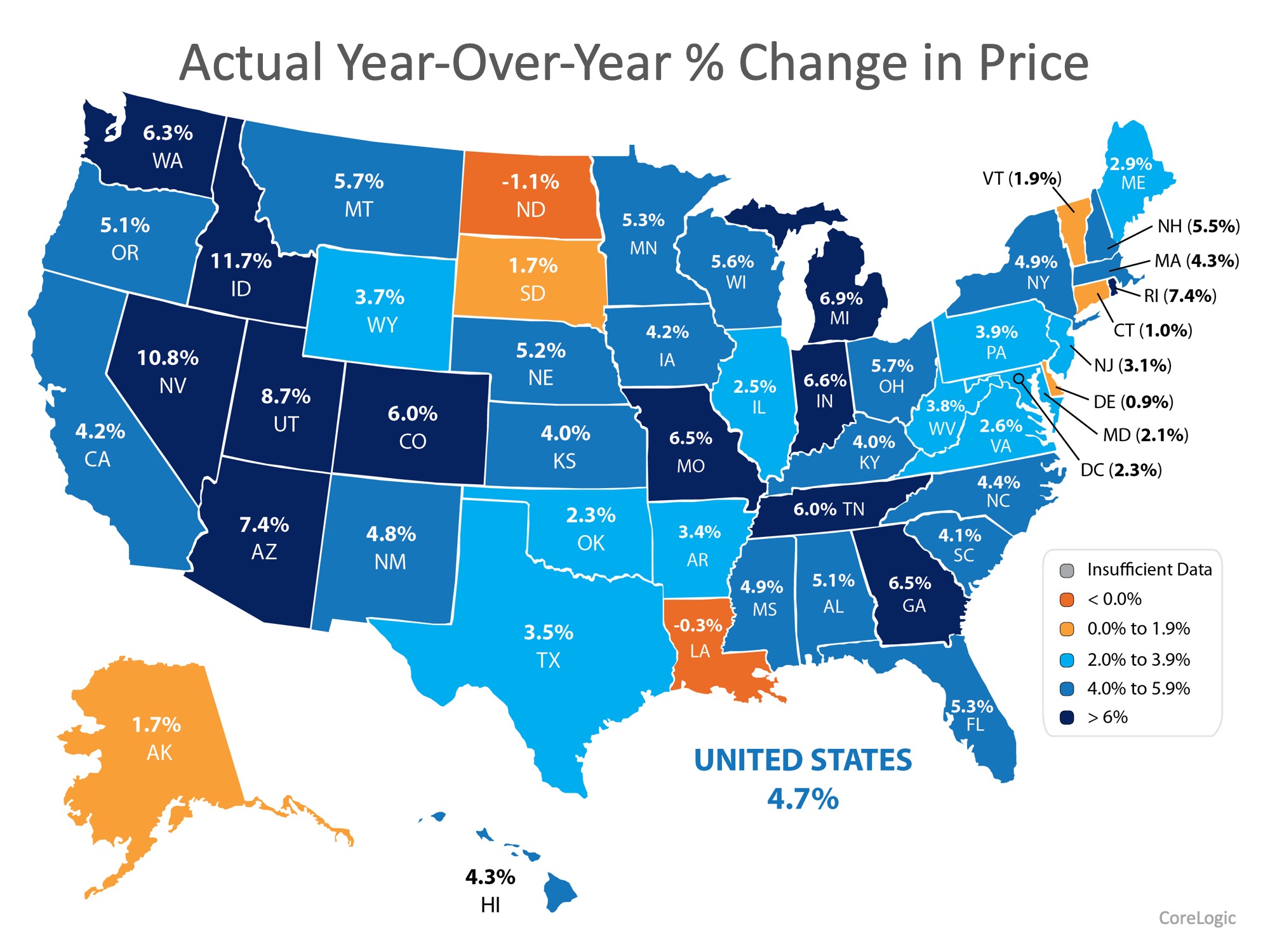

If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the course of 2018.

The map below shows the results of the latest index by state.

Real estate is local. Each state appreciates at different levels. The majority of the country saw at least a 2.0% gain in home values, while some residents in North Dakota and Louisiana may have felt prices slow slightly.

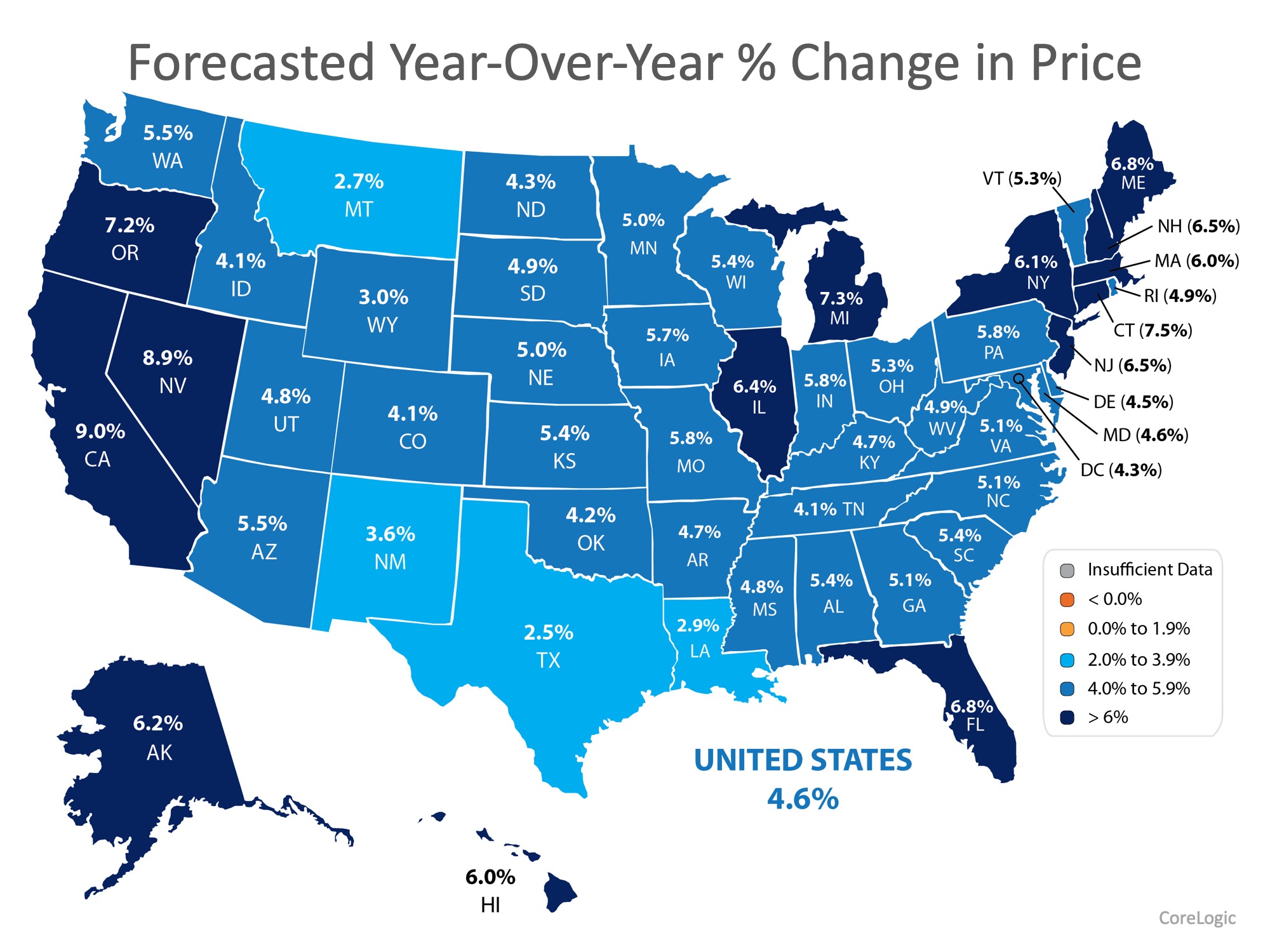

This effect will be short lived. In the same report, CoreLogic forecasts that every state in the Union will experience at least 2.0% appreciation, with the majority of the country gaining at least 4.0%! The prediction for the country comes in at 4.6%. For a median-priced home, that translates to over $14,000 in additional equity next year! (The map below shows the forecast by state.)

So, how does this help you list your home for the best price?

Armed with the knowledge of how much experts believe your house will appreciate this year, you will be able to set an appropriate price for your listing from the start. If homes like yours are appreciating at 4.0%, you won’t want to list your home for more than that amount!

One of the biggest mistakes homeowners make is pricing their homes too high and reducing the price later when they do not get any offers. This can lead buyers to believe that there may be something wrong with the home, when in fact the price was just too high for the market.

Bottom Line

Pricing your home right from the start is one of the most challenging parts of selling your home. Once you decide to list your house, let’s get together to discuss where home values are headed in your area!

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...

2.25% Fed Rate: Coming by 2027?

Fed projects a 2% in rate cuts by end of 2027. Forecast: Fed funds rate to decline to 2.25%–2.50% by late 2027. Despite tariff-driven inflation bumps, slowing growth will push Fed to cut further. 10-year Treasury yield forecast to fall to 3.25% by 2028, down from 4.2%...

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.

Will 2026 Finally Jumpstart Home Sales?

High mortgage rates in 2025 slowed home sales, but improvement is expected starting in 2026. Experts predict existing home sales may ↑ 10–15% as conditions improve in 2026.

Homebuyers, Don’t Wait for a Miracle Rate

Mortgage rates increased after five weeks of declines, driven by stronger-than-expected economic indicators. Experts forecast minimal rate relief through late 2025 despite Federal Reserve predictions of future cuts. Waiting for rate drops may backfire as housing...

Slight Dip Ahead for U.S. Home Prices

U.S. home prices are projected to decline by 0.9% by Early-Q2 2026. The forecast reverses earlier predictions of price increases, signaling a cooling housing market.

Mortgage Rate Predictionsfor Q3 2025

Long Forecast predicts slight drops: July 6.84%, August 6.79%, September 6.74%. MBA expects 6.7% average in Q3; NAR, Realtor.com see 6.2%–6.4% by year-end. 15-year fixed rates forecasted to drop from 6.01% in July to 5.88% in September. Experts expect gradual rate...

Are mortgage rates falling? What homebuyers need to know

Mortgage rates for 30-year fixed loans have dropped to around 6.63%, the lowest since April, due to a weaker-than-expected jobs report causing Treasury yields to fall. Experts suggest this dip may be temporary but advise buyers to act now rather than wait for perfect...