3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.Utah Single Family Inventory has risen from 5775 to 5940 from April 5th to April 16th.Utah County Single Family Inventory April 5th was 1401, April 16th up a little to 1466Salt Lake County Single Family Home...

Think This Is a Housing Crisis? Think Again.

Think This Is a Housing Crisis? Think Again.With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it's logical to...

What If I Need to Sell My Home Now? What Can I Do?

What If I Need to Sell My Home Now? What Can I Do?Every day that passes, people have a need to buy and sell homes. That doesn’t stop during the current pandemic. If you’ve had a major life change recently, whether with your job or your family situation, you may be in...

Recession? Yes. Housing Crash? No.

Recession? Yes. Housing Crash? No.With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate...

More than half of homes in America have at least 50% equity. Wondering how much equity you have? Let’s connect.

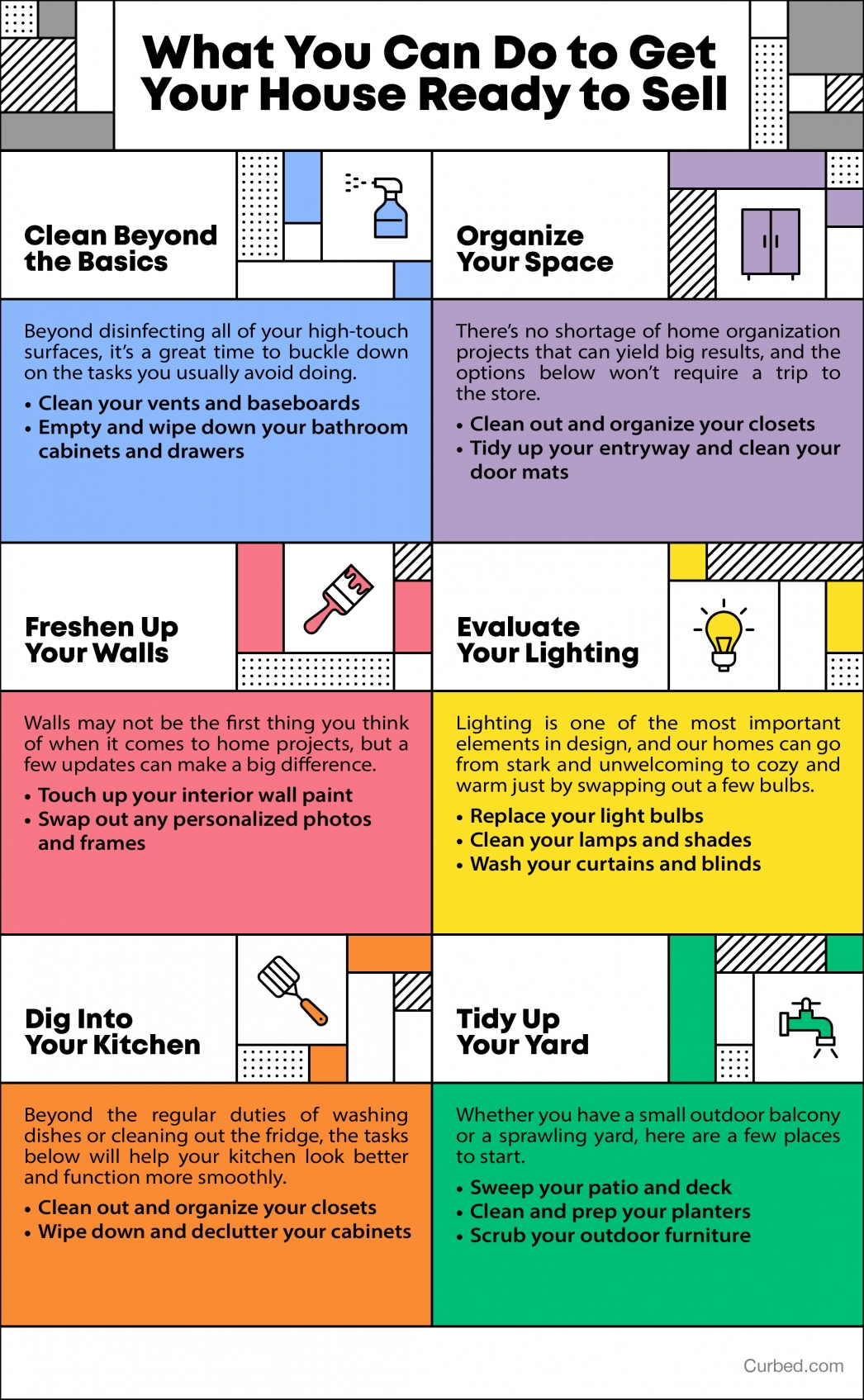

What You Can Do to Get Your House Ready to Sell

What You Can Do to Get Your House Ready to Sell Some Highlights: Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store. Your real estate plans don’t have to be completely on hold even while we’ve hit the...

Why Home Office Space Is More Desirable Than Ever

Why Home Office Space Is More Desirable Than EverFor years, we’ve all heard about the most desirable home features buyers are looking for, from upgraded kitchens to remodeled bathrooms, master suites, and more. The latest on the hotlist, however, might surprise...

Will Surging Unemployment Crush Home Sales?

Will Surging Unemployment Crush Home Sales?Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many...

Auto DraftWhy Pre Approval Is a Great Step to Take Today

Why Pre Approval Is a Great Step to Take Today If you’re in the position to buy a home this year, pre-approval is something you can still do right now to get ahead in the homebuying process. Let’s connect to talk about your goals for 2020.

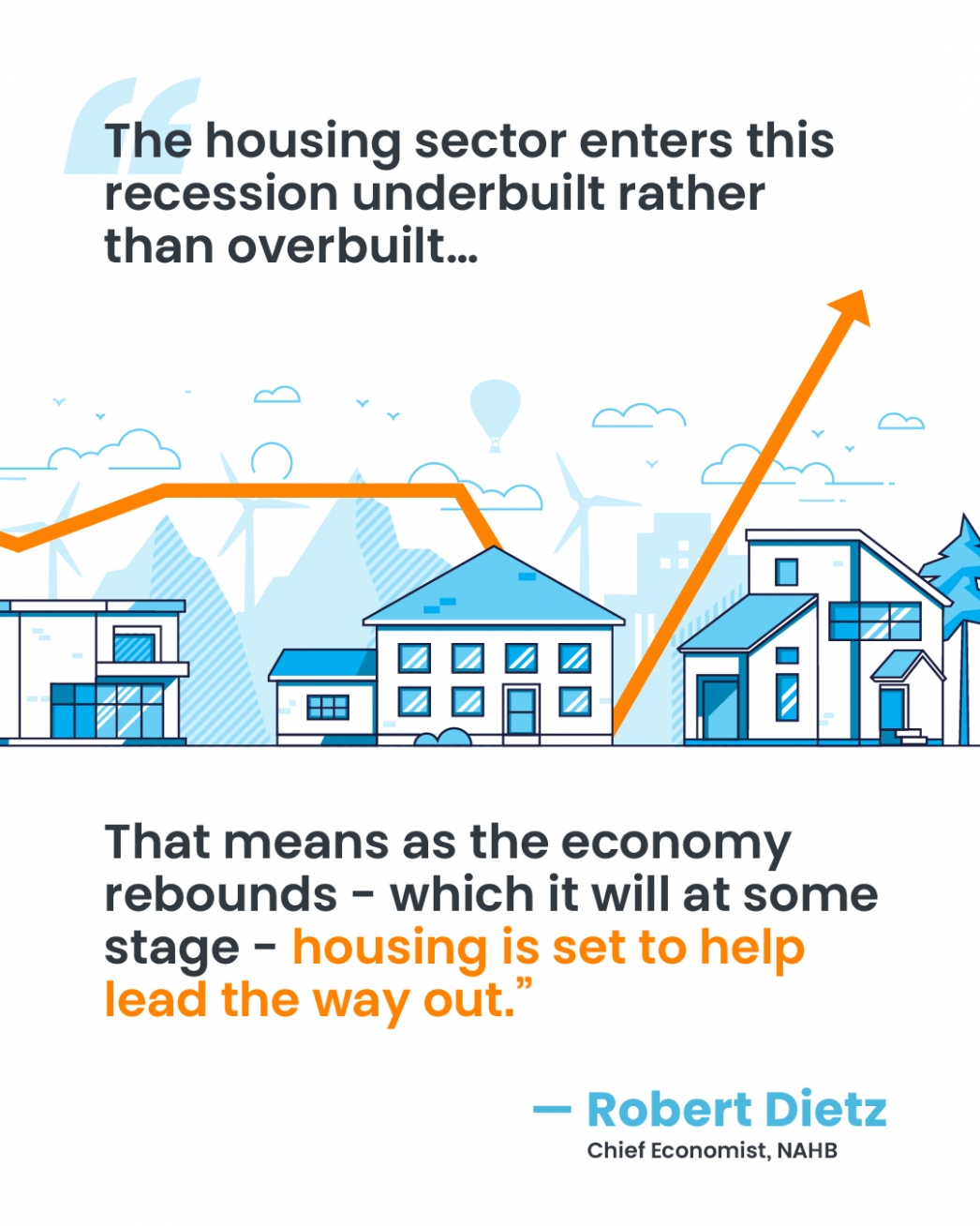

The Housing Market Is Positioned to Help the Economy Recover

The Housing Market Is Positioned to Help the Economy RecoverSome HighlightsExpert insights are painting a bright future for housing when the economy bounces back – and it will.We may be facing challenging economic times today, but the housing market is poised to help...