The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

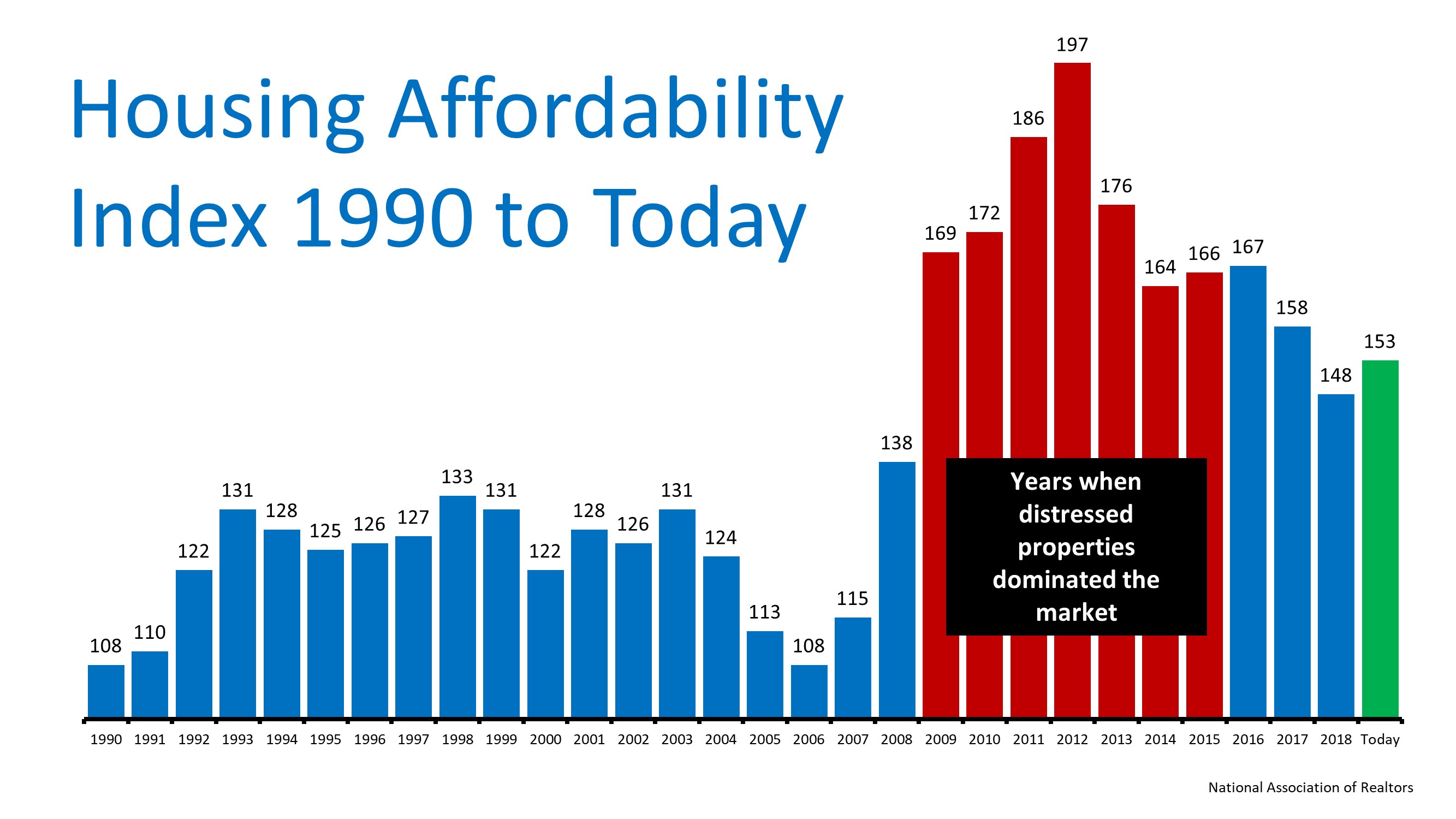

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Low Inventories Leave You Choices That Take Some TLC

With Inventory Low: Will Your Dream Home Need Some TLC? According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are...

Utah Realty can Knock out a Great Deal for You

Selling Your House: Here’s Why You Need A Pro In Your Corner! With home prices on the rise and buyer demand still strong, some sellers may be tempted to try to sell their homes on their own rather than using the services of a real estate professional. Real estate...

Homeowners – Now Is A Good Time To Sell Your House

Homeowners: Now Is A Good Time To Sell Your House Every month, the National Association of Realtors (NAR) releases their Seller Traffic Index as a part of their Realtors Confidence Index. In the latest release, NAR reported that homeowners have been reluctant to sell...

Buyer Demand Surging in Utah as Spring Market Begins

Buyer Demand Surging in Utah as Spring Market Begins Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade. However,...

Are Low Interest Rates Here to Stay

Are Low Interest Rates Here to Stay? Interest rates for a 30-year fixed rate mortgage have been on the decline since November, now reaching lows last seen in January 2018. According to Freddie Mac’s latest Primary Mortgage Market Survey, rates came in at 4.12% last...

3 Questions You Need To Ask Before Buying A Home

3 Questions You Need To Ask Before Buying A Home If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is...

Utah Has The Highest Employment Growth

Why should I use a Realtor® to sell my home

Why should I use a Realtor® to sell my home? By Marty Gale Does selling my home myself save me money? I recently received a call from a Mortgage originator (Loan Officer) that is a friend of mind. What prompted me to write this article was a discussion he had...

home price appreciation each month for over a year

Home Value Appreciation Stops Falling, Begins to Stabilize The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer. In a...

Celebrating a Closing

Yvonne is celebrating the purchase of her lovely rambler home. Congratulations Yvonne!