3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

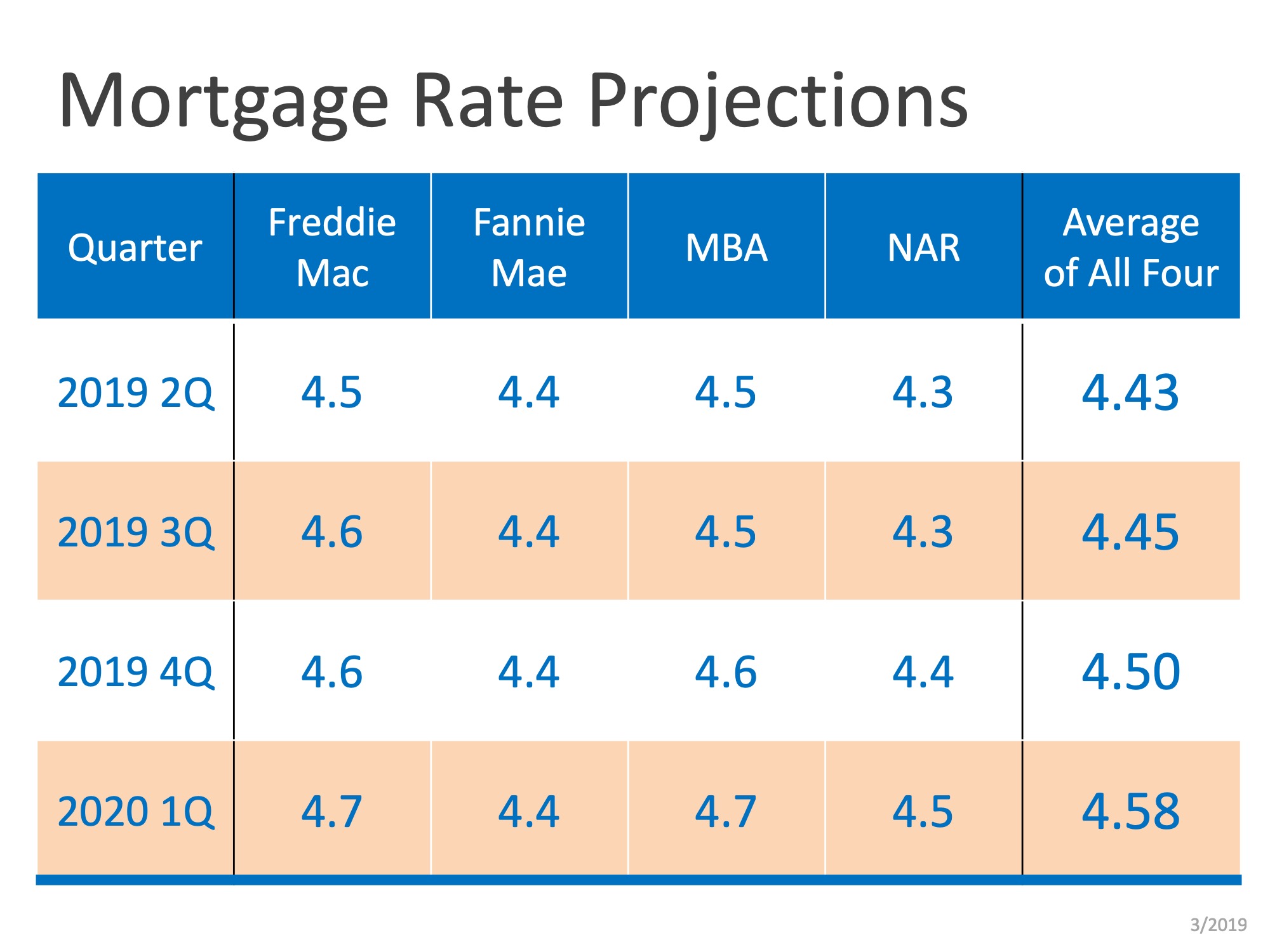

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

Top 8 most asked questions from Home Buyers and Sellers.

Top 8 most asked questions Home Buyers and Sellers ask From Home Buyers 1. **What is the current market condition?** Buyers want to know whether it’s a buyer’s or seller’s market to gauge competition and pricing. 2. **What are the property taxes and homeowners...

Navigating Complex Transactions: The Broker Benefit over using a Real Estate Agent

Navigating Complex Transactions: The Broker Benefit In the intricate world of real estate transactions, the distinction between opting for a broker over an agent plays a pivotal role in not just simplifying the process, but in elevating the entire experience....

Five Key Factors Driving The Improvement In Home Affordability

Five Key Factors Driving The Improvement In Home Affordability In recent years, the landscape of home affordability has undergone tangible transformations, with several key factors contributing to a more accessible real estate market for a broader demographic. This...

Insights Into The Dynamic Shift: Home Values Rise As Median Prices Fall

In the ever-evolving landscape of the real estate market, a surprising trend has emerged—one that defies conventional wisdom and prompts a closer examination of underlying factors. This article delves into the complexities behind the seemingly paradoxical...

Secrets to a Successful Sale of Your Home

In the intricate dance of real estate, where emotion meets investment, the art of selling your home demands a blend of strategy, finesse, and keen insight. As navigators through the ever-evolving property landscape , homeowners poised to make their move must...

Why Buying Beats Renting in Salt Lake County Utah

In the current real estate climate, making the decision between buying a home and renting is more crucial than ever, particularly within the vibrant communities of Salt Lake County. This article delves into the five fundamental reasons why purchasing a property...

Evaluating Your Options: Should You Sell Your Home In 2024?

In contemplating the future of one’s real estate investments, the decision to sell a home in 2024 demands a meticulous evaluation of the current economic landscape, market trends, and individual financial goals. This article aims to provide homeowners with a...

Are Home Prices Going To Come Down?

Are Home Prices Going To Come Down? Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking...

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...