The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

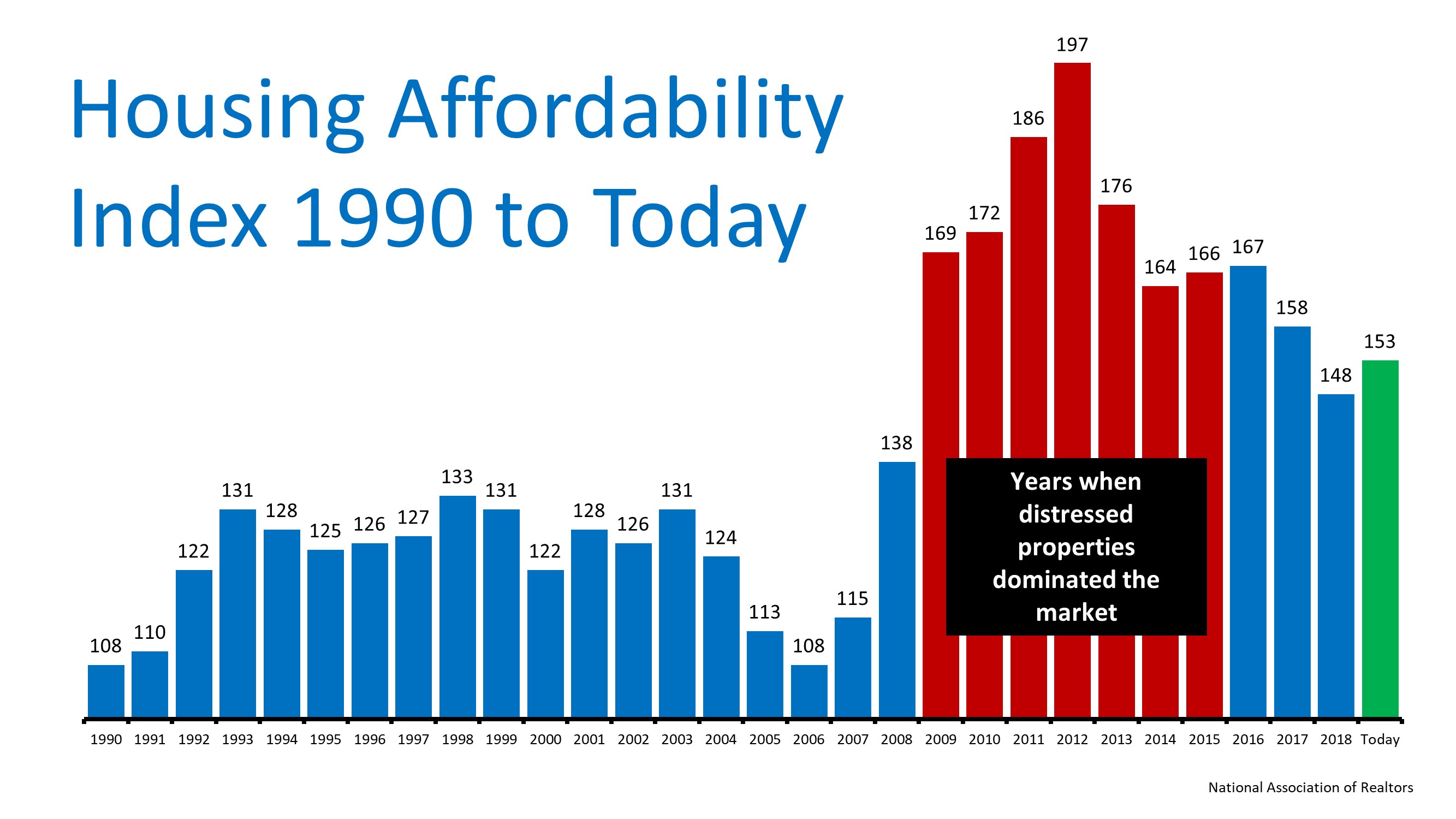

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Utah 2025: Boomtowns Adjust to New Normal

Salt Lake City prices likely to flatten or dip as post-pandemic migration slows. New builds and resale listings ease supply crunch seen in boom years.

Essential Steps to Take for Financial Success Before Buying a Home

Buying a home is a significant milestone that requires careful financial preparation. Before starting the process, assess your financial situation, pay down high-interest debt, and establish an emergency fund. Check your credit score and get pre-approved for a...

5 smart ways to use $100,000 in home equity right now

U.S. homeowners have about $300,000 in tappable home equity, offering borrowing options at around 8% interest, much lower than credit card rates above 21%. Smart uses for $100,000 in equity include paying off high-rate debt, strategic home renovations, investing in...

How Can You Set the Stage for Winning Offers?

Provide a comprehensive disclosure package before listing: Include seller disclosures, inspections, HOA documents, and a FAQ to inform buyers upfront.Promote open house opportunities: Utilize MLS tools to list open house dates and times, making it easier for buyers to...

2025 Sale Secrets: Best & Worst Times

Listing in late spring, especially Mid-Q2, yields the highest sale premiums for home sellers. The holiday season is the weakest period — December 24, 26, and 31 show the lowest returns.

What Is The Cost Of Living In Provo-Orem?

To maintain your standard of living in Provo-Orem, you'll need a household income of $71,851. - Home Price: $604K - Apartment Rent: $1,531 - Total Energy: $164

Maximizing Returns: How to Refinance Your Investment Property

Buying a second home involves stricter mortgage rules and higher rates. Refinancing can optimize cash flow and change terms, rates, or release equity on rental properties. Conventional loans are required for cash-out refinancing on investment properties. Leveraging...

Salt Lake County property tax bills could see a slight drop this year

Salt Lake County's certified property tax rate decreased from 0.1297% to 0.1253% to adjust for inflation, keeping revenue stable without raising taxes. New growth added $3.76 million in revenue, though slightly below projections. Some residents will see different...

Rising Tariffs: Will Renters Face the Cost?

Apartment construction slowing down could lead landlords to raise rents due to limited supply. U.S. asking rents have stabilized, but tariffs may disrupt the rental market and drive prices up.

How to Get Your Property Sale-Ready in 5 Steps

Enhance curb appeal: A well-maintained exterior creates trust and attracts buyers from the moment they arrive. Declutter and depersonalize: Remove personal items to allow buyers to imagine themselves in the space.