The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

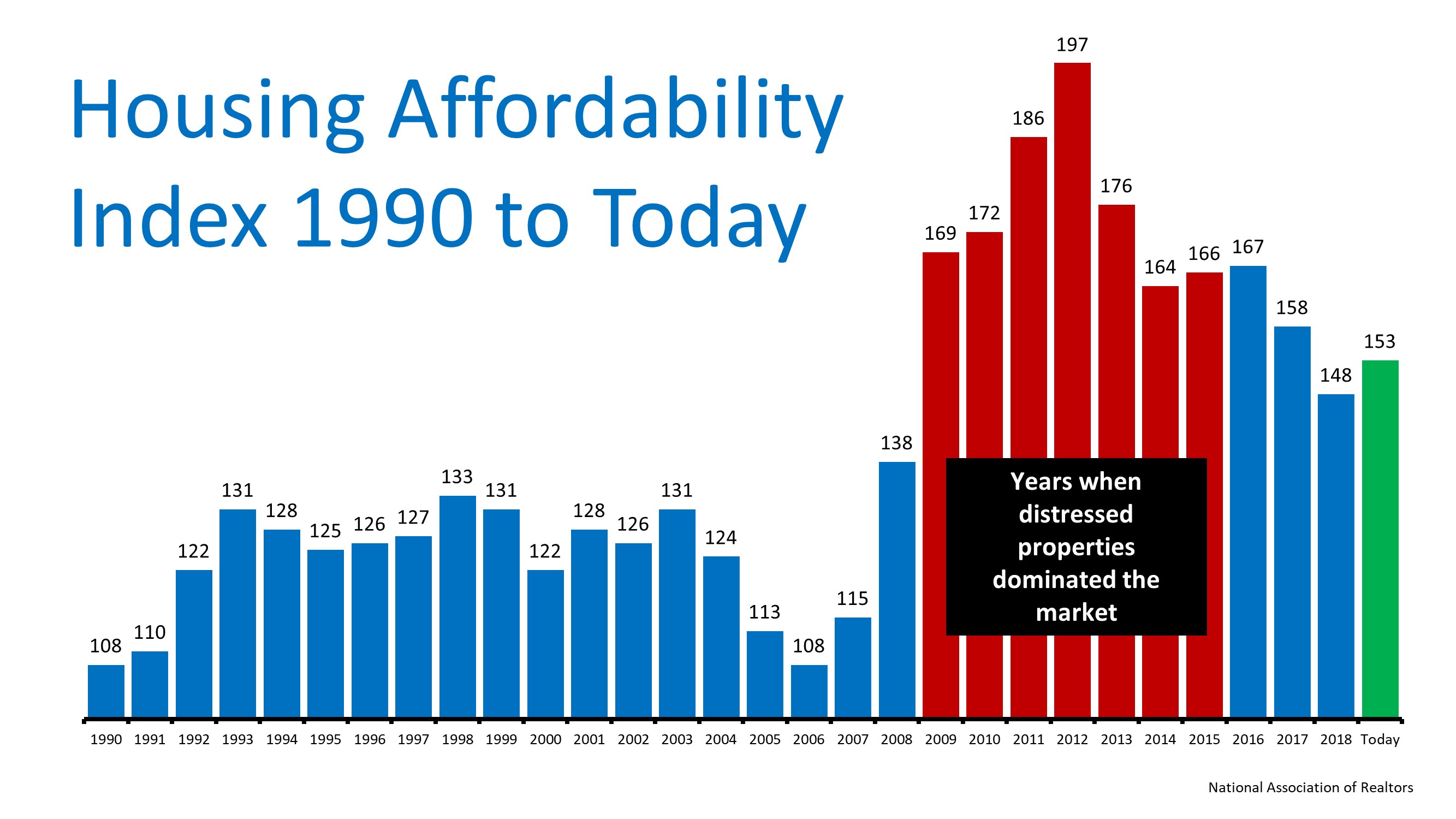

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

A Real Estate Pro Is More Helpful Now than Ever

A Real Estate Pro Is More Helpful Now than Ever Some HighlightsA recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.Expertise and professionalism are highly valued and can save buyers...

Two Reasons We Won’t See a Rush of Foreclosures This Fall

Two Reasons We Won’t See a Rush of Foreclosures This FallThe health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result,...

Thinking of Selling Your House? Now May be the Right Time. Utah Realty Can Help

Thinking of Selling Your House? Now May be the Right Time. Experienced Realtors at Utah Realty Can Help! Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there...

Mortgage Rates Fall to 50 year low

Mortgage Rates Fall Below 3% Some Highlights Mortgage rates hit another all-time low, falling below 3% this week. If you’re ready to buy a home, now is a great time to truly get more for your money at this historic moment. Let’s connect today to determine your best...

Real Estate is a Top Investment

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

Mortgage Rates Hit Record Lows for Three Consecutive WeeksOver the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the...

Buyers: Are You Ready for a Bidding War?

Utah Buyers: Are You Ready for a Bidding War?Hiring an Expert with 34 Years of experience might just be what you need to rise to the top! With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated...

Americans Rank Real Estate Best Investment for 7 Years Running

Americans Rank Real Estate Best Investment for 7 Years Running Some Highlights Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years. The belief in the stability of housing as a long-term...

Best Time to Sell? When Competition Is at an All-Time Low

Best Time to Sell? When Competition Is at an All-Time Low In a recent survey of home sellers by Qualtrics, 87% of respondents said they were concerned their home won’t sell because of the pandemic and resulting economic recession. Of the respondents, 51% said they are...

Taking Advantage of Homebuying Affordability in Today’s Market

Taking Advantage of Homebuying Affordability in Today’s MarketEveryone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may...