The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

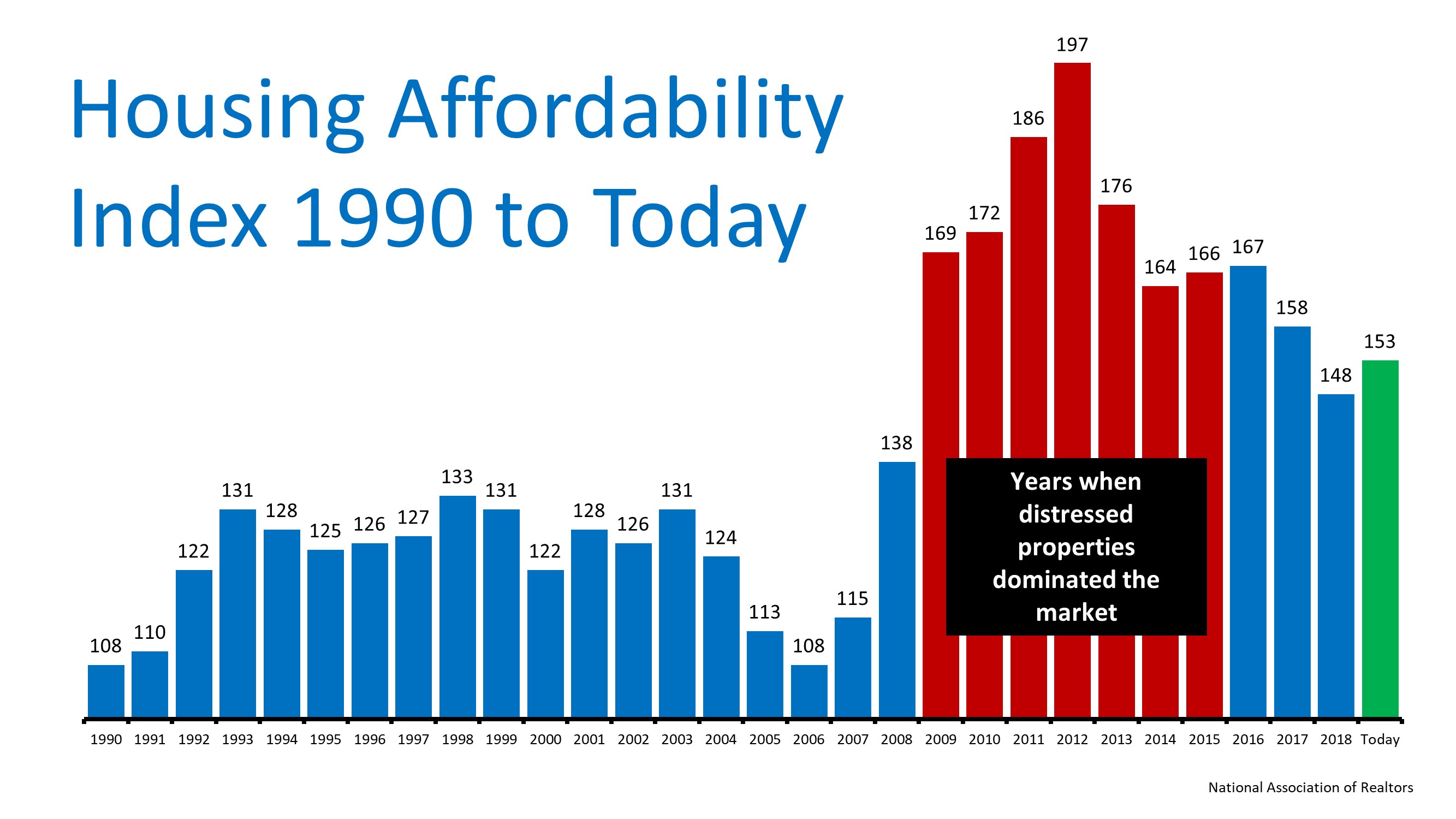

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

The 2020 Homebuyer Wish List

The 2020 Homebuyer Wish List Some HighlightsThe word “home” is taking on a whole new meaning this year, and buyers are starting to look for new features as they re-think their needs and what’s truly possible.From more outdoor space to virtual classrooms for their...

It’s Not Just About the Price of the Home

It’s Not Just About the Price of the HomeWhen most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the...

Salt Lake Home Sales Climb to Record High in July 2020

Salt Lake Home Sales Climb to Record High in July Salt Lake County home sales reached an all-time high in July at 2,093 homes sold, 15 percent higher than July 2019. It's the first time monthly sales surpassed 2,000 closings since the MLS began keeping records....

Utah Real Estate Tip – there are no “easy” transactions.

Real Estate Legal Tip - there are no "easy" transactions.Some people say that when the market is hot, "I can sell my home myself," or "I don't need an experienced agent because it costs money," or "how hard can it be?"Curtis Bullock From the Salt Lake Board of...

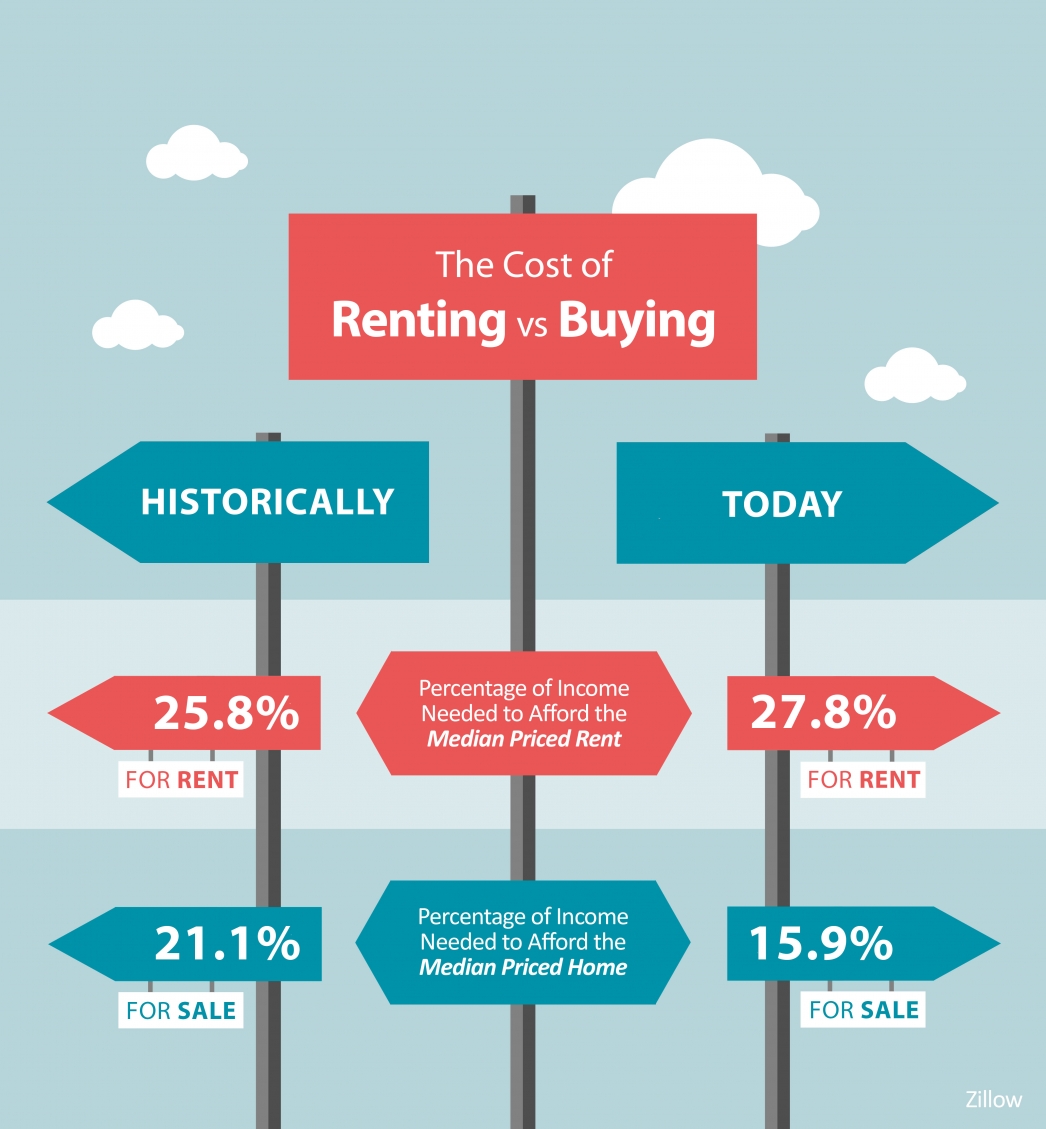

The Cost of Renting Vs. Buying a Home

The Cost of Renting Vs. Buying a HomeSome HighlightsThe percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.This is making buying a home an increasingly attractive option for many people, especially with...

Forbearance Numbers Are Lower Than Experts Forecasted

Forbearances have stayed well under the rate experts initially forecasted. Let's connect if you have questions about your options.

Top Reasons People Are Moving This Year In 2020

The Top Reasons People Are Moving This YearToday, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate...

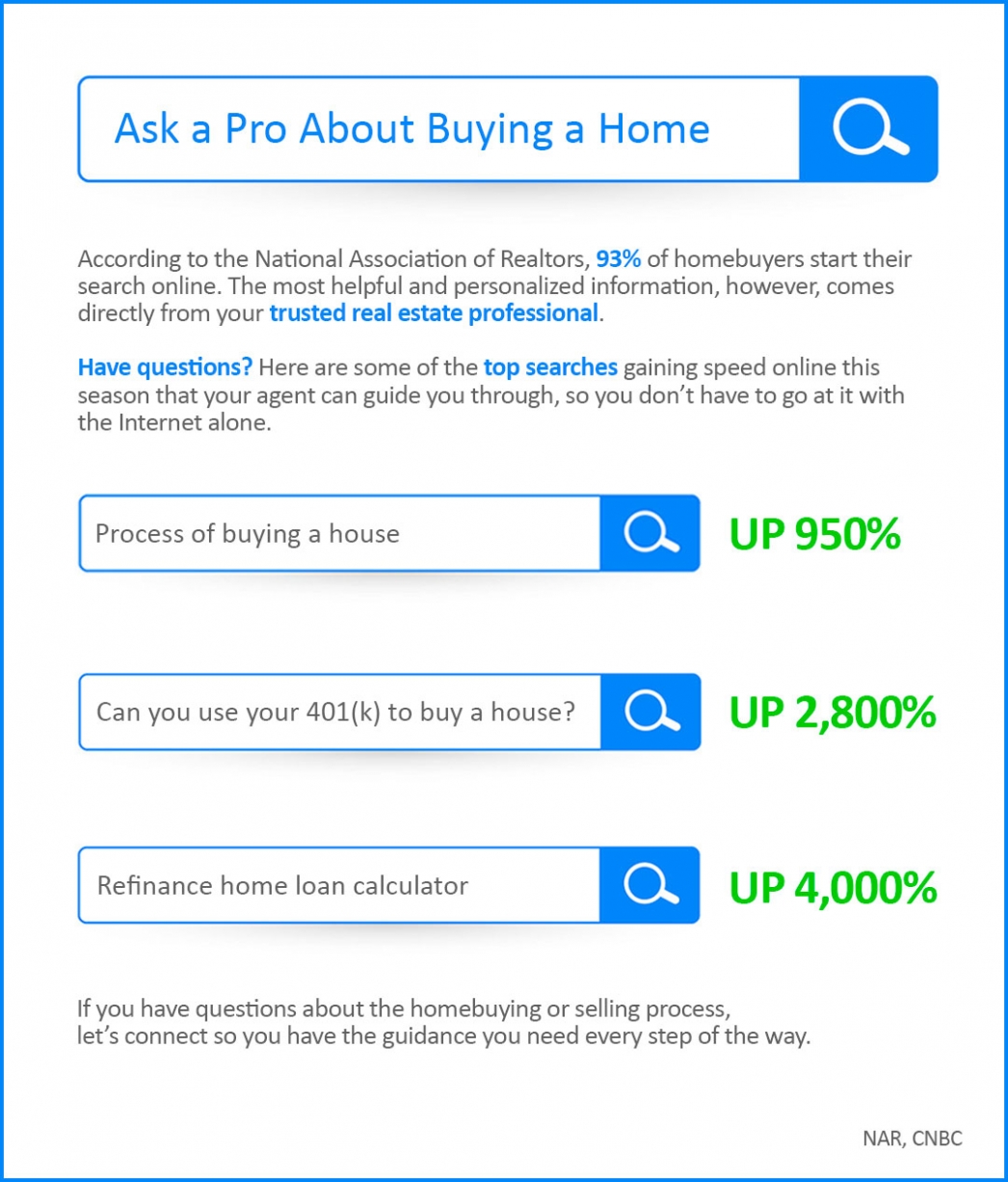

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...