The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

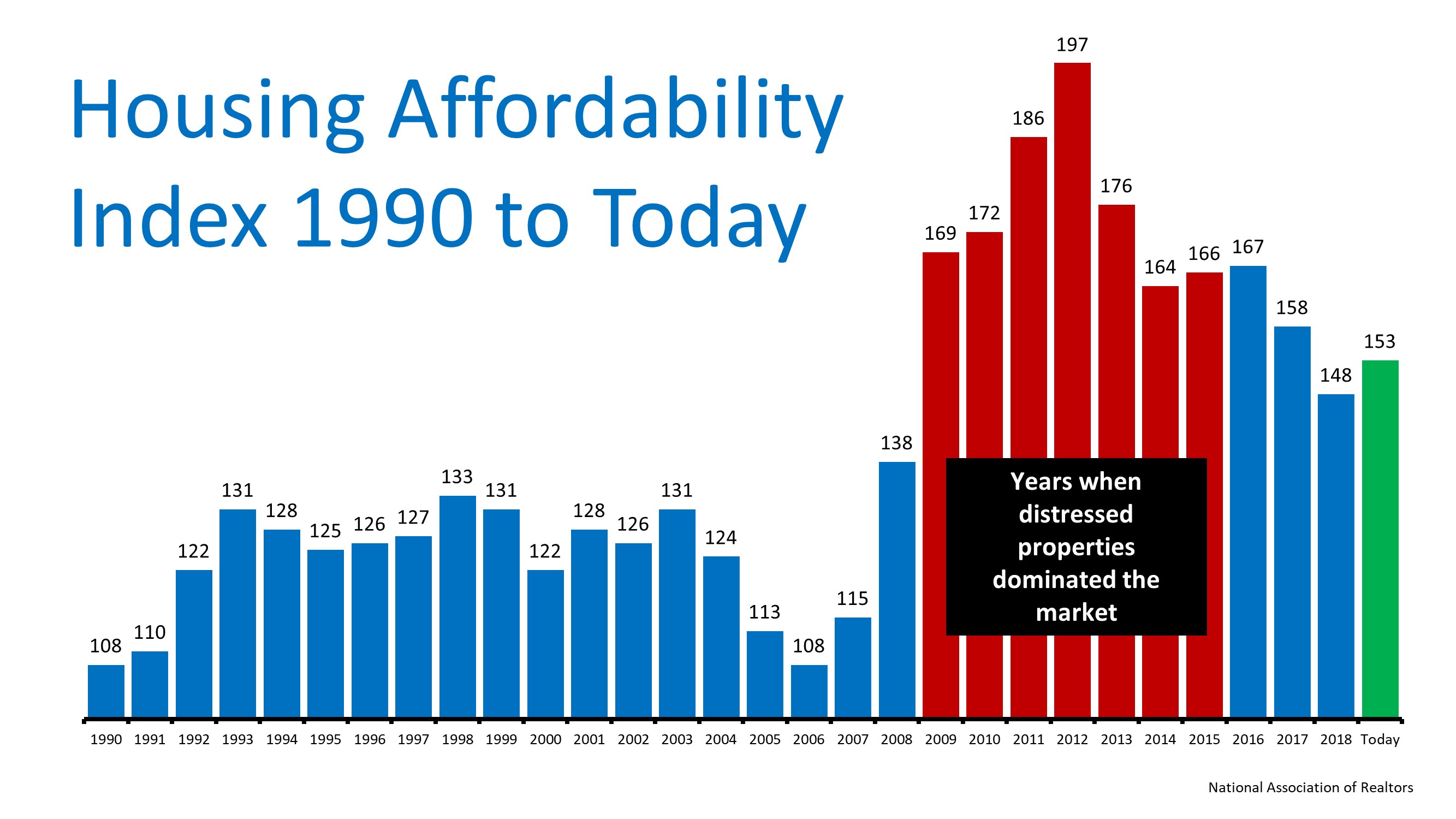

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

It Pays to Sell with a Real Estate Agent

It Pays to Sell with a Real Estate Agent Some HighlightsToday, it’s more important than ever to have an expert you trust to guide you as you sell your house.From your safety throughout the process to the complexity of negotiating...

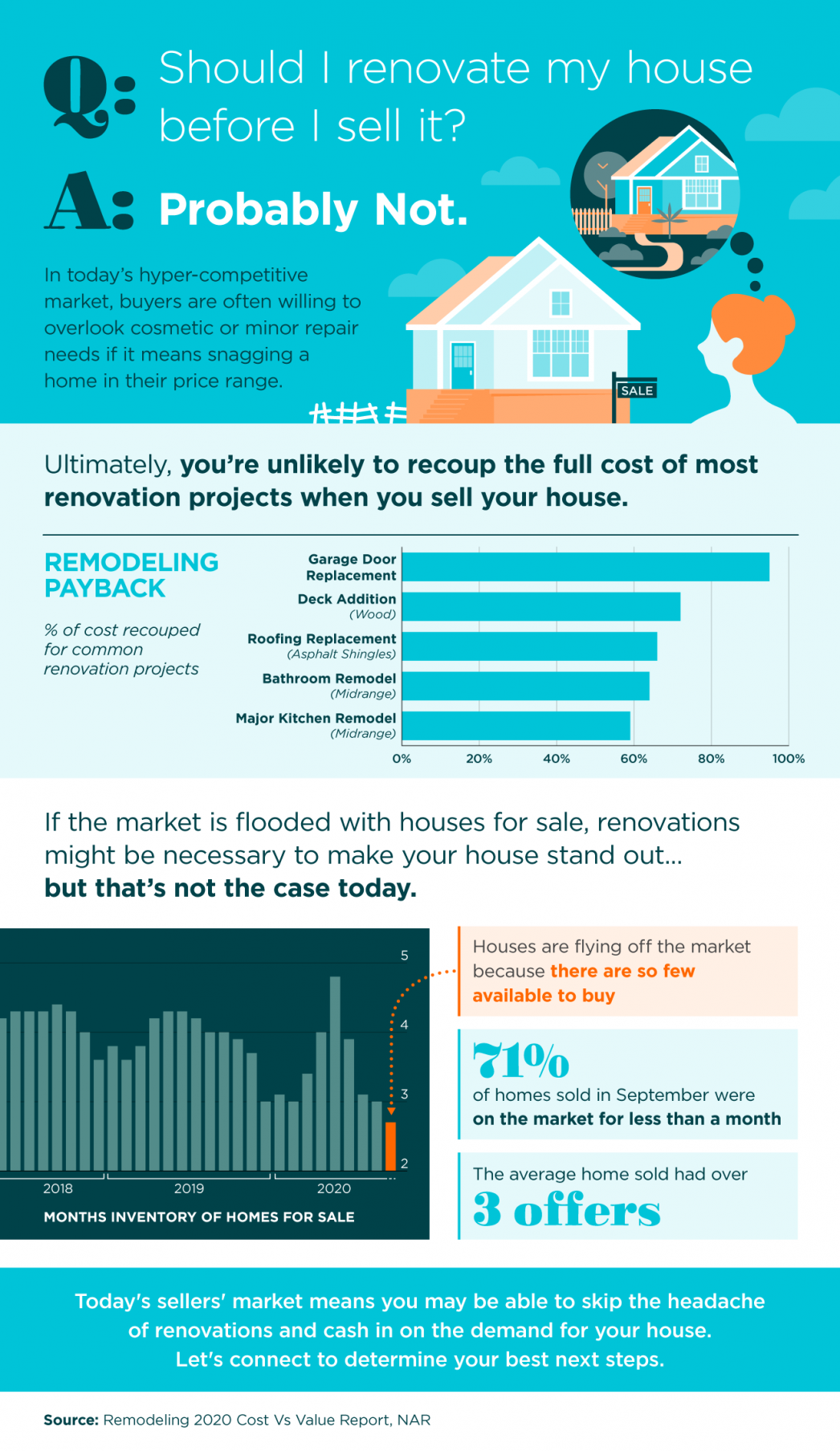

Should I Renovate My House Before I Sell It?

Should I Renovate My House Before I Sell It? Some HighlightsIn today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.With so few houses available for sale today, you may...

Don’t Fear the Real Estate Market

Don't Fear the Real Estate Market October 29, 2020 Fear should never be a factor when navigating the housing market. Whether you're buying or selling a home this fall, let's connect to make sure you're empowered to take the safest path.

Why Selling Your House Before Next Spring Is Key

Why Selling Your House Before Next Spring Is Key Today's housing market is empowering homeowners with the control they want when selling their house, but as home inventory begins to rise, this fair weather won't last forever. Let's connect to start the process of...

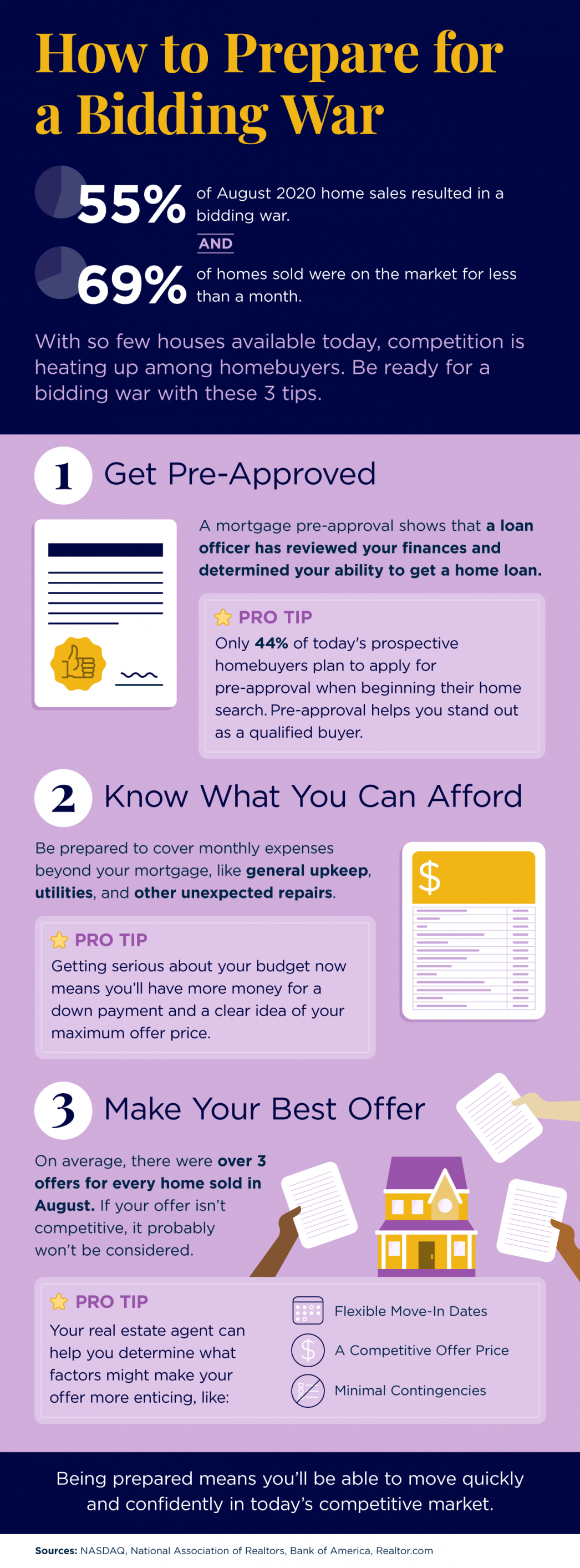

How to Prepare for a Bidding War

How to Prepare for a Bidding War Some HighlightsWith so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.From pre-approval to making your best offer, here are three tips to make sure you can act quickly...

2020 Housing Market on Track to Beat Last Year’s Success

Housing Market on Track to Beat Last Year’s SuccessBack in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions....

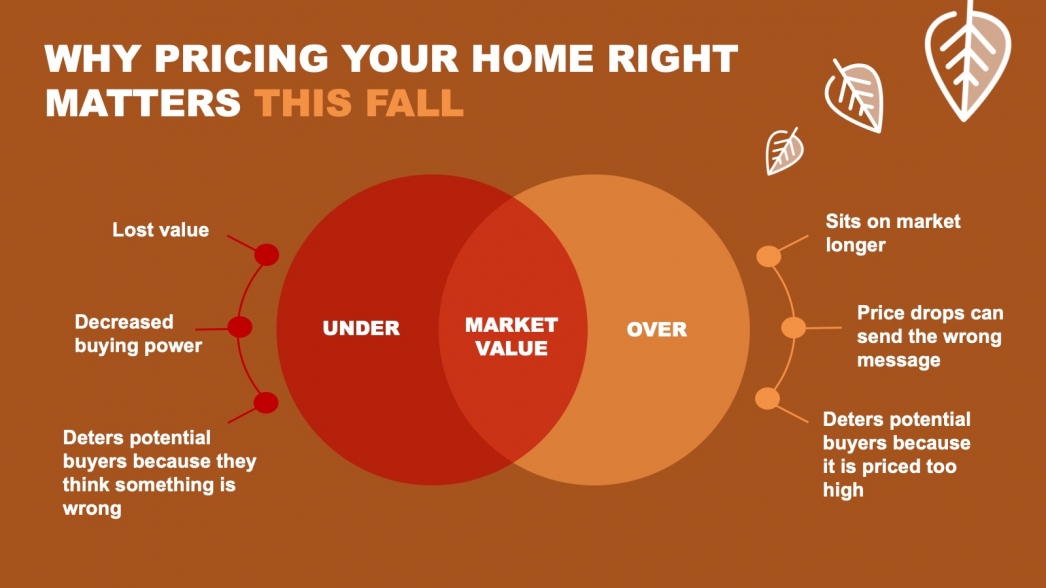

Why Pricing Your Home Right Matters This Fall

Why Pricing Your Home Right Matters This Fall Some HighlightsAs a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.To sell your home quickly and for the best possible price, you...

Ready to Sell? Homebuyer Traffic Is on the Rise.

Ready to Sell? Homebuyer Traffic Is on the Rise. Buyer activity is continuing to rise. Let's connect to discuss why selling your house now could get you the price and terms you've been waiting for.

Two New Surveys Indicate Urban to Suburban Lean

Two New Surveys Indicate Urban to Suburban LeanThere has been much talk around the possibility that Americans are feeling less enamored with the benefits of living in a large city and now may be longing for the open spaces that suburban and rural areas provide.In a...