The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

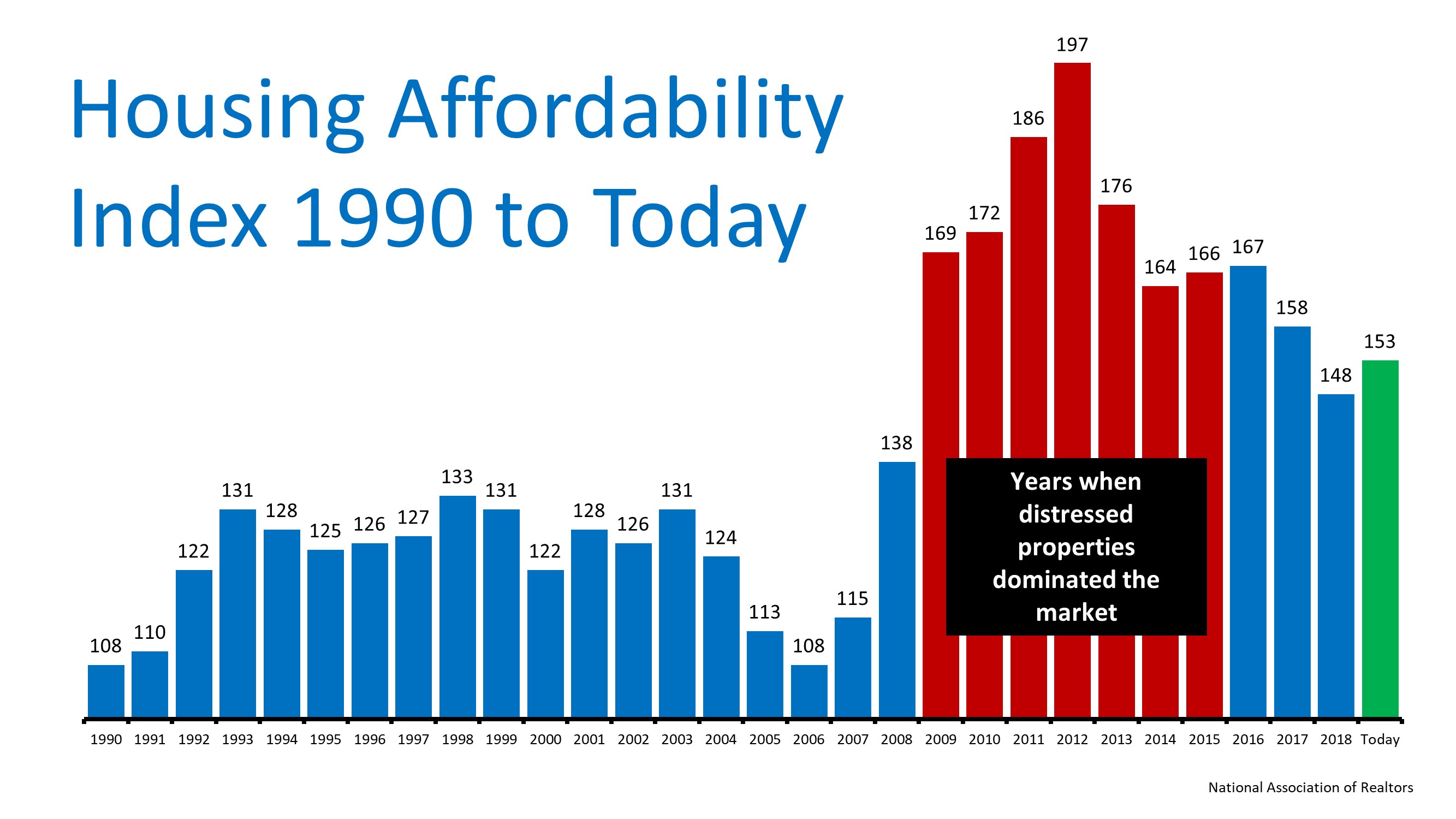

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Why Is This Spring a Great Time to Sell Your House?

Why Is This Spring a Great Time to Sell Your House?

Your House Could Be the Oasis in an Inventory Desert

Your House Could Be the Oasis in an Inventory DesertHomebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices...

It’s Not Too Late To Apply For Forbearance

It’s Not Too Late To Apply For Forbearance Over the past year, the pandemic made it challenging for some homeowners to make their mortgage payments. Thankfully, the government initiated a forbearance program to provide much-needed support. Unless they’re extended once...

Americans Have Their Hearts Set on Homeownership

801-205-3500

Are Interest Rates Expected to Rise Over the Next Year?

Are Interest Rates Expected to Rise Over the Next Year?So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into...

Single Family Inventory on The Rise for May

It’s a Great Time for Your House to Shine

It's a Great Time for Your House to Shine April 30, 2021 Today's housing market makes it easy to win as a seller. Let's connect if you're ready to make a move this year.

Utah Housing This Isn’t a Bubble. It’s Simply Lack of Supply

This Isn’t a Bubble. It’s Simply Lack of Supply. [INFOGRAPHIC] Some Highlights In a recent article, Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), discussed the state of today’s housing market. When addressing whether or not today’s high...

Endless Utah Real Estate Possibilities

Top 4 Reasons to Own a Home

Top 4 Reasons to Own a Home Owning a home can have an incredible impact on your quality of life. Let's connect if you're ready to make your dream of homeownership a reality.