The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

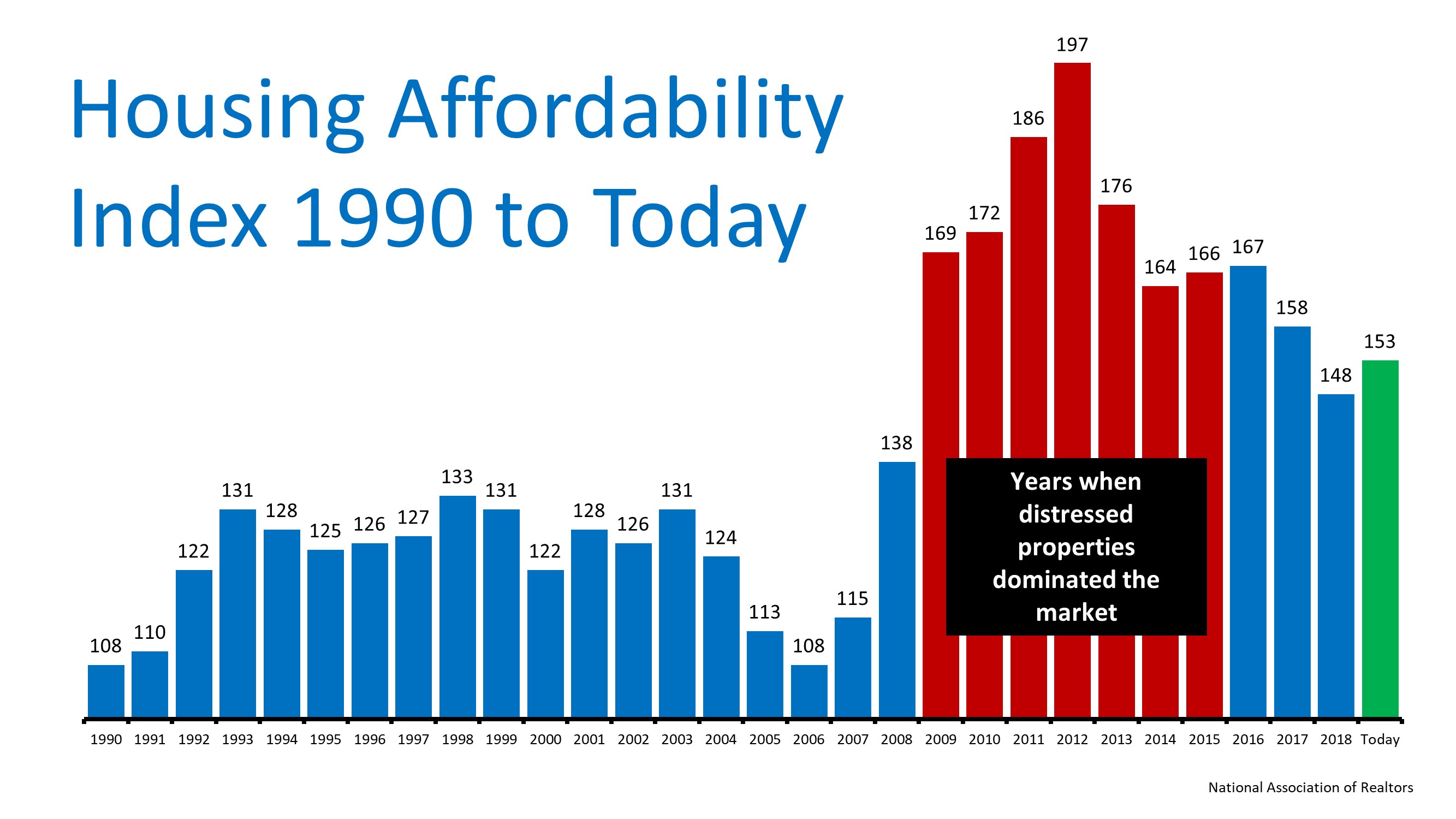

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours!

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

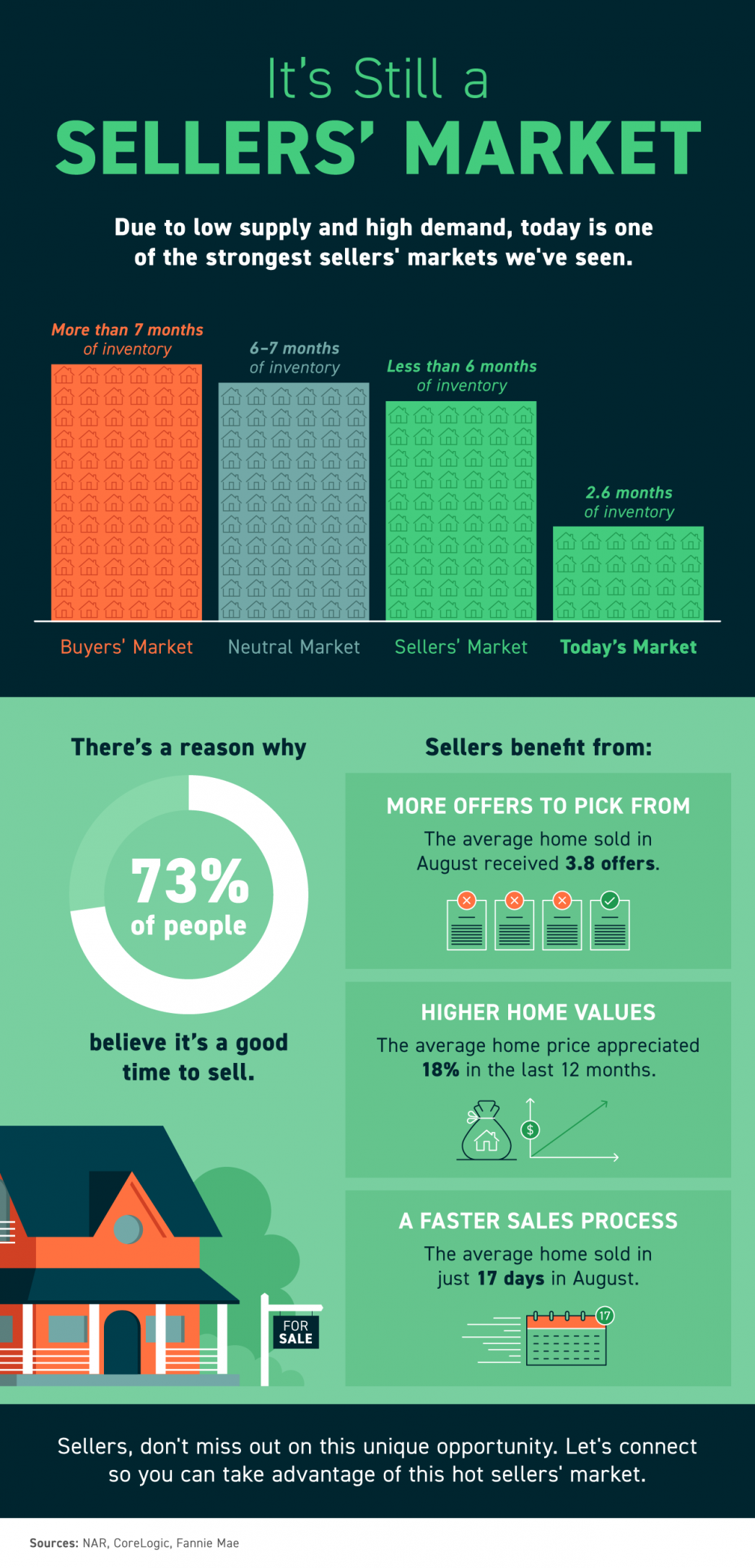

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

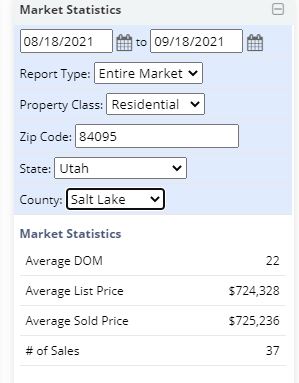

Market Stats for So Jo

South Jordan Market Update

Have You Ever Seen a Housing Market Like This?

Have You Ever Seen a Housing Market Like This? Some Highlights Whether you’re buying or selling – today’s housing market has plenty of good news to go around. Buyers can take advantage of today's mortgage rates to escape rising rents and keep monthly...

Is the Number of Homes for Sale Finally Growing?

Is the Number of Homes for Sale Finally Growing? Salt Lake County Active Single Family on September 1st was at 820 Units as of September 16th up slightly to 887 Utah County September 1st was at 664 as of September 16th down to 651 An important metric in today’s...

Reasons You Should Consider Selling This Fall

Reasons You Should Consider Selling This Fall If you're trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers' market we're in today won't last forever. If you’re thinking of making a move, here are four...

5 Reasons Today’s Housing Market Is Anything but Normal

5 Reasons Today’s Housing Market Is Anything but Normal There are many headlines out there that claim we’re reverting to a more normal real estate market. That would indicate the housing market is returning to the pre-pandemic numbers we saw from 2015-2019. But that’s...