The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

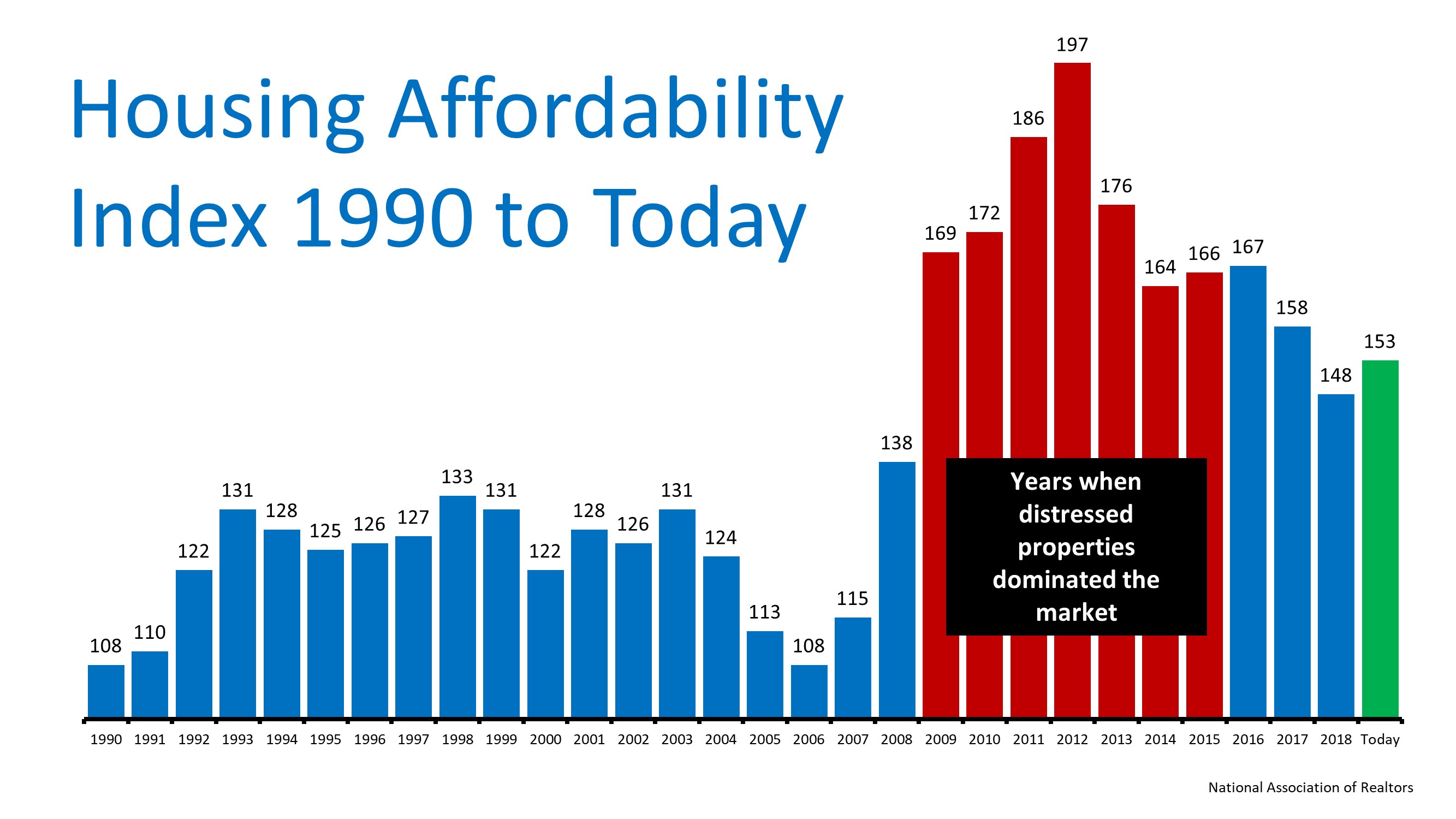

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Saving for a Down Payment

Saving for a Down Payment? Here’s What You Should Know. As you set out to buy a home, saving for a down payment is likely top of mind. But you may still have questions about the process, including how much to save and where to start. If that sounds like you, your down...

How an Expert Can Help You Understand Inflation & Mortgage Rates

How an Expert Can Help You Understand Inflation & Mortgage Rates If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one. Inflation and the Housing Market This...

The True Strength of Homeowners Today

The True Strength of Homeowners Today The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are...

Fall Home Selling Checklist

Fall Home Selling Checklist Some Highlights When it comes to selling your house, you want it to look its best inside and out so it catches the attention of buyers. A real estate professional can help you decide what to do to make that happen. Focus on tasks that can...

Top Reasons Homeowners Are Selling Their Houses Right Now

Top Reasons Homeowners Are Selling Their Houses Right Now Some people believe there’s a group of homeowners who may be reluctant to sell their houses because they don’t want to lose the historically low mortgage rate they have on their current home. You may even have...

Getting Your House Ready To Sell? Work with an Agent for Expert Advice

Getting Your House Ready To Sell? Work with an Agent for Expert Advice In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional...

Watching the Stock Market? Check the Value of Your Home for Good News.

Watching the Stock Market? Check the Value of Your Home for Good News. While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner,...

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling...

Your Guides to Buying or Selling a Home This Fall

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Forecasts on Mortgage Rates

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues...