The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

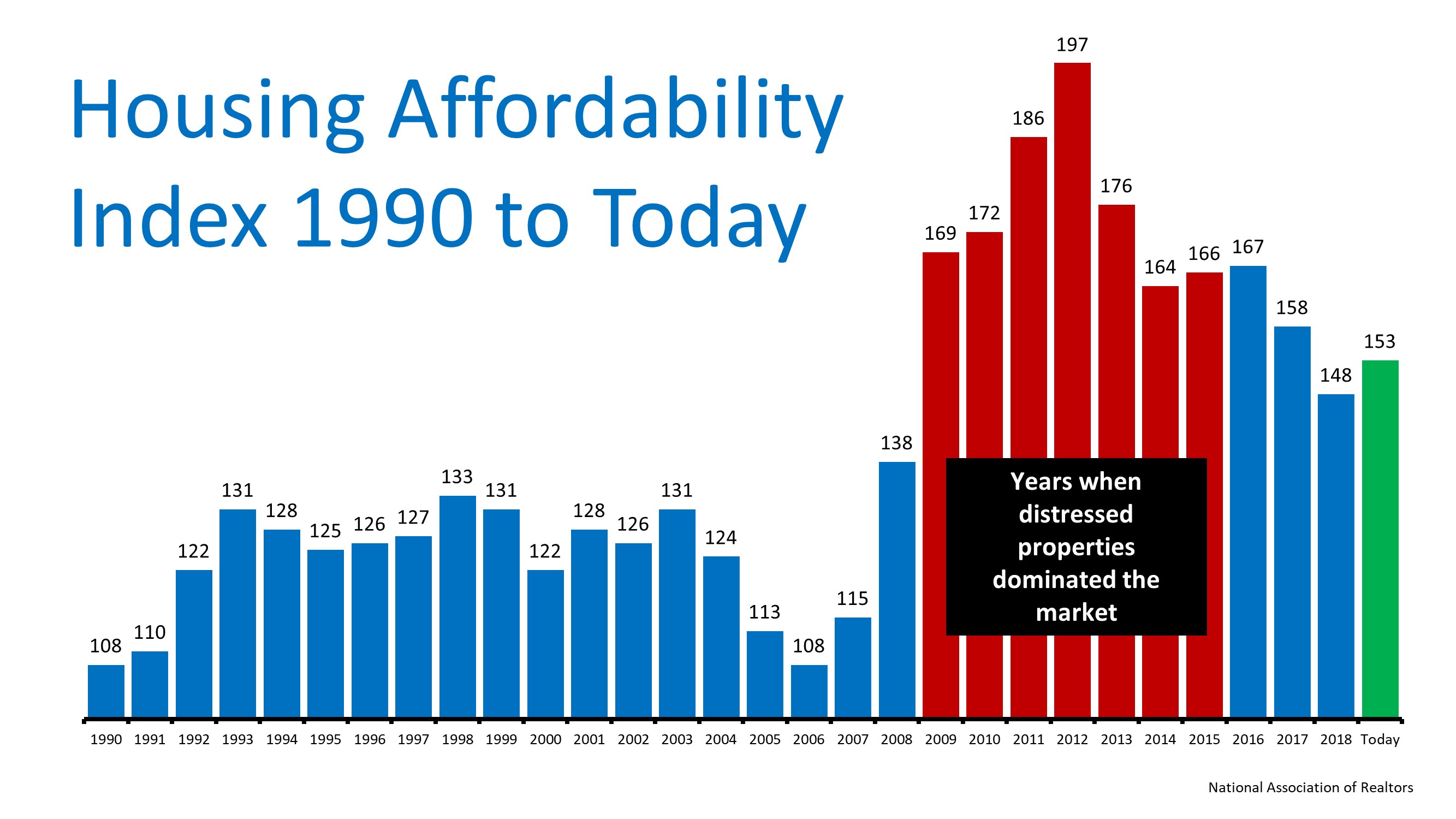

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

8 Tips for First-Time Home Buyers

First-time homebuyers should save for a down payment, typically 20%, and budget for additional costs like fees, moving, and furniture. Choose a neighborhood that fits long-term needs, prioritize must-haves, and get a home inspection to avoid surprises. Use a mortgage...

5 Reasons Enticing Me to Buy a Home Before 2025 Ends

Slide 1 Mortgage rates dropped to around 6%, down from the 7.79% peak in 2023. Slide 2 Housing supply rose 15.7% in 2025, giving buyers 1.55 million homes to choose from. Slide 3 Home prices are still high but rising slower, with just 2.9% annual growth mid-2025....

22 Real Estate Investment Strategies

Real estate investing offers strategies for wealth building, passive income, and portfolio diversification, including buy-and-hold, fix-and-flip, REITs, and rental property diversification. REITs have shown stability and often outperform stocks over time, while...

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...

Forecast Signals Confident Buyers, Steady Prices by Late-2025

Slide 1 Total home sales in 2025 are forecast at 4.74 million units. Slide 2 Mortgage rates expected to finish 2025 at 6.5%, dipping to 6.1% by 2026. Slide 3 Forecast revisions are modest, keeping housing sales stable despite economic uncertainties. Slide 4 Fannie Mae...

Multifamily Housing Starts Surge 21% in Q2 2025

Multifamily housing starts reached 109K units in Q2 2025, with 102,000 built-for-rent, ↑ 21% yearly. Rental units made up 94% of multifamily starts, far above the long-term avg of 80% and the historical low of 47% during the 2005 condo boom. Condo construction starts...

The 8 best real estate markets in the country right now

WalletHub ranked 300 U.S. cities to identify the strongest housing markets in 2025, considering factors like home-price appreciation, foreclosure rates, affordability, job growth, and new home construction. With rising mortgage rates and a seller-friendly market,...

Are 2027 Trends Favoring Long-Term Gains?

Home prices are projected to rise 4% in 2027, reaching 10.8% cumulative growth since 2024. Experts forecast continued moderate gains in 2027, following slower increases in 2025 and 2026.

Utah: Hottest Spots for New Home Builds

Utah is one of the top states in the country for new home builds. Utah ranks No. 4 nationally, building 18.6 new homes per 1,000 existing.

Utah: Among States With High Home Values by 2030

Slide 1: "Utah’s Silicon Slopes drive home prices toward $673K by 2030." Slide 2: Limited housing and zoning challenges keep prices rising fast."