4 Tips for Making Your Best Offer on a Home

4 Tips for Making Your Best Offer on a Home

Are you planning to buy a home this spring? Though things are more balanced than they were at the height of the pandemic, it’s still a sellers’ market. So, when you find the home you want to buy, remember these four tips to make your best offer.

1.Lean on a Real Estate Professional

Rely on an agent who can support your goals. As Bankrate notes:

“. . . select the best real estate agent for your needs. They will be a critical part of your home buying process.”

Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for in an offer. It may seem simple, but catering to what a seller needs can help your offer stand out.

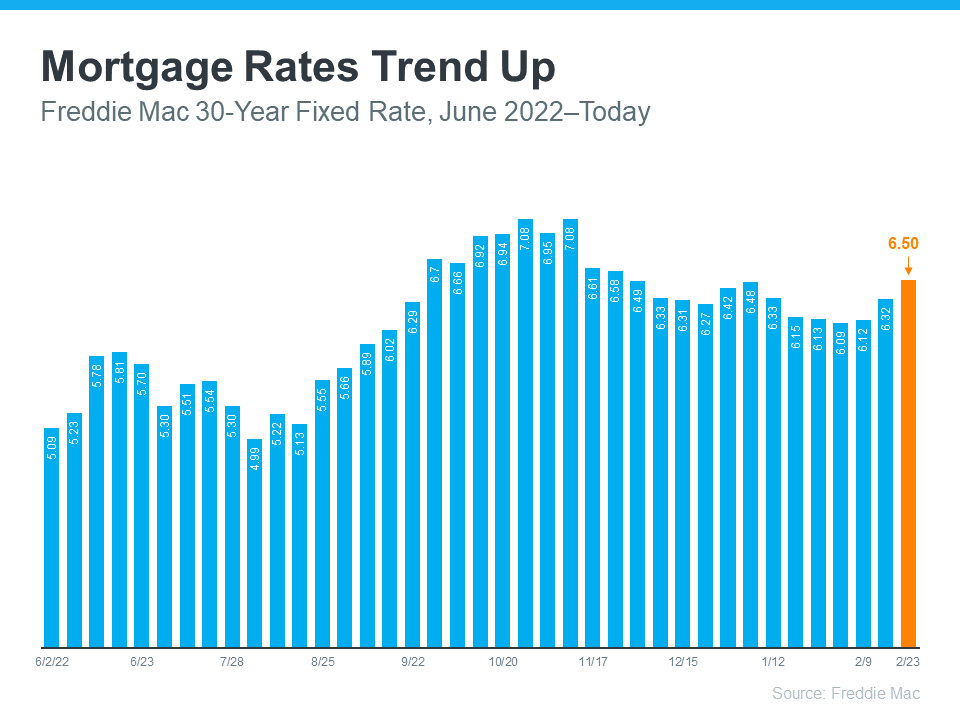

2.Know Your Budget

Understanding your budget is especially important right now. As Sandy Higgins, Senior Wealth Advisor at Capstone Financial Advisors, puts it:

“Understand your current budget … what are your expenses, how’s your spending, would you need to make changes?”

The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. It helps you be more financially confident, and it shows sellers you’re serious. That can give you a competitive edge.

3.Think Through Everything Before Making an Offer

Today’s market isn’t moving at the record pace it did during the pandemic. That means you may have a bit more time to think before you need to make an offer. According to Danielle Hale, Chief Economist at realtor.com:

“In general, you likely have more time to make an offer, although that’s certainly not a guarantee. If you’re on the fence about a home or its asking price doesn’t quite fit your budget, you might want to keep an eye on it, and if it doesn’t sell right away, you may have some room to negotiate with the seller.”

While it’s still important to stay on top of the market and be prepared to move quickly, there can be more flexibility today. Lean on the advice of your agent as you explore the options in your market.

4. Work with Your Advisor To Negotiate

During the pandemic, some buyers skipped home inspections or didn’t ask for concessions from the seller in order to submit the winning bid on a home. Fortunately, today’s market is different, and you may have more negotiating power than before. When putting together an offer, your trusted real estate advisor will help you think through what levers to pull.

Bottom Line

When you buy a home this spring, let’s connect so you have the guidance to make your best offer.

Marty Gale

Buy or Sell with Marty Gale

"Its The Experience"

Principal Broker and Owner of Utah Realty™

Licensed Since 1986

CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM)

PSA (Pricing Strategy Advisor)

General Contractor 2000 (in-active)

e-pro (advanced digital marketing) 2001

Certified Residential Specialist 2009

Certified Negotiation Expert 2014

Master Certified Negotiation Expert 2014

Certified Probate Specialist Since 2018

Senior Real Estate Specialist

Certified Divorce Specialist CDS

Contact me!