Utah Realty has an exciting topic for our fall Season blog.

As the leaves change colors and the temperatures start to cool, we find ourselves eagerly anticipating the shifts and trends that will shape the real estate landscape in one of Utah’s most vibrant and sought-after areas. Whether you’re a homeowner, a buyer, or simply someone interested in the local market trends, join us as we explore the ins and outs of the Greater Salt Lake City housing market this season and uncover the possibilities that lie ahead.

Supply And Demand: Impact On Salt Lake City Housing Prices

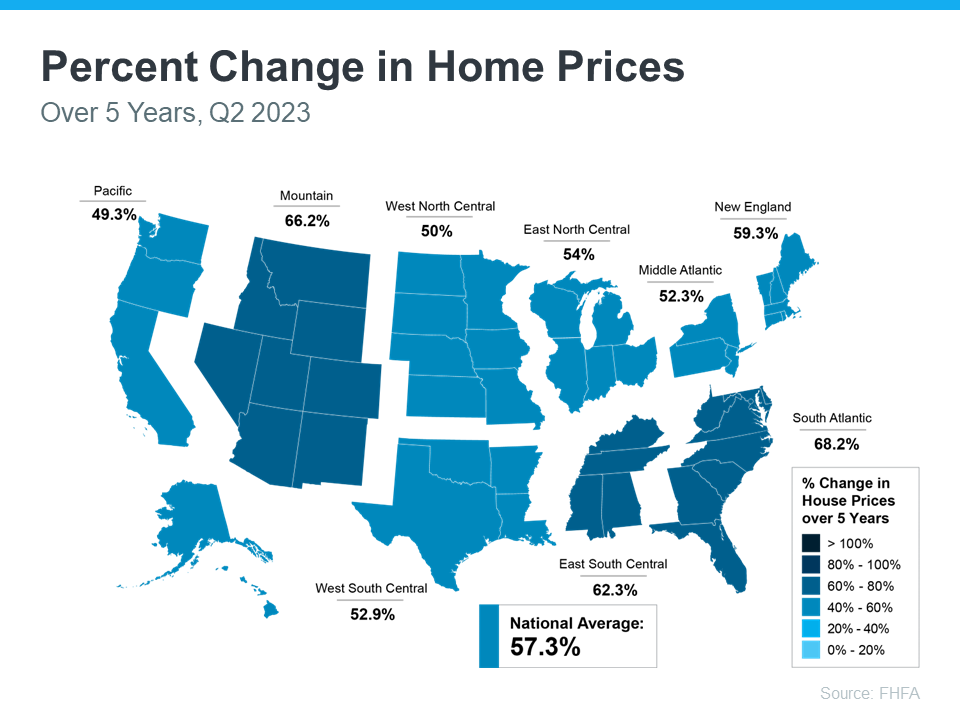

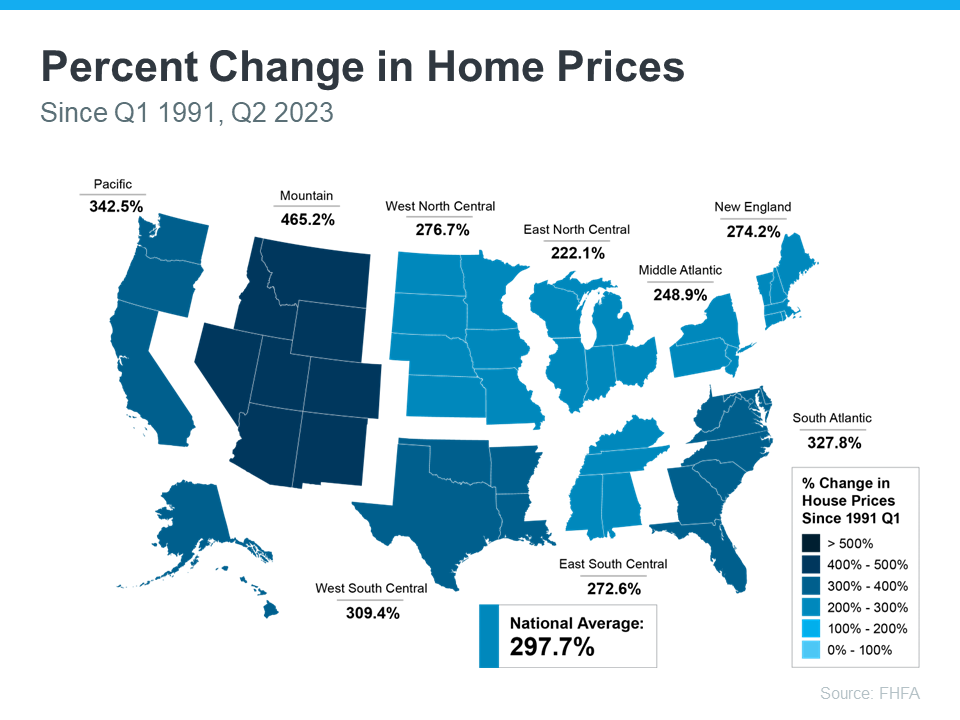

The Greater Salt Lake City housing market has experienced significant fluctuations over the past few years, with a notable increase in demand and soaring prices. However, as we transition into the fall season, it is essential to examine the dynamics of supply and demand and their potential impact on housing prices in the area.

Supply and demand play a critical role in shaping the real estate market, and Salt Lake City is no exception. When the demand for homes outweighs the number of available properties, prices tend to rise. Conversely, when the supply of homes exceeds the demand, prices may stabilize or even decline.

Over the past year, the Salt Lake City housing market has witnessed tight inventory levels, placing significant pressure on potential buyers. The combination of population growth, a strong economy, and past low interest rates has led to increased demand for housing in the region. As a result, prices have skyrocketed, making it challenging for many first-time buyers to enter the market.

The supply of homes in Salt Lake City has struggled to keep pace with the rate of demand growth. Limited land availability, strict zoning regulations, and a slower rate of new home construction have contributed to this supply-demand imbalance. While the COVID-19 pandemic initially caused a brief decrease in buyer demand, the rebound has been swift and robust.

Looking ahead to the fall season, indications suggest a continuation of the current supply-demand dynamics, albeit with some potential shifts. The low supply of homes is expected to persist, primarily due to ongoing factors such as limited land availability and construction challenges. This scarcity is likely to keep prices elevated, making it challenging for buyers to find affordable options.

However, there are a few factors that may influence the Salt Lake City housing market this fall. Firstly, as the economy recovers from the pandemic-induced recession, there could be an increase in new home construction activity. Builders may seize the opportunity to meet the growing demand and alleviate the inventory shortage. This increase in supply could have a moderating effect on prices, providing some relief for buyers.

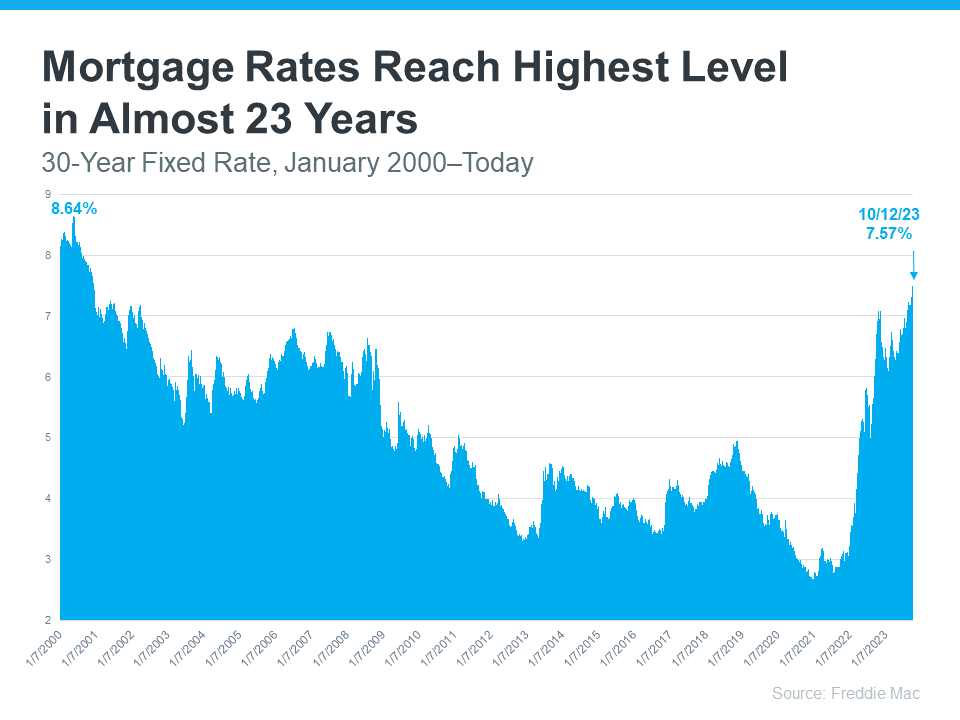

Secondly, interest rates continue to remain historically low. This favorable lending environment can stimulate demand and encourage prospective buyers to enter the market. However, it’s worth noting that rising interest rates in the future could potentially slow down the demand for housing, although it is difficult to predict the exact timing and extent of such a shift.

Additionally, as we progress towards the fall season, traditional market slowdowns may come into play. Historically, there tends to be a reduction in buyer activity during the colder months, as people focus on other priorities such as the holiday season. While this seasonality may provide a brief respite for buyers, it is important to remember that the underlying supply-demand dynamics will continue to shape the market.

In conclusion, the Salt Lake City housing market is likely to maintain its current trend of low supply and high demand into the fall season. While there may be slight fluctuations influenced by factors such as increased construction activity and interest rates, prices are expected to remain elevated. Buyers should be prepared for a competitive market, with limited inventory and the potential for multiple offers. Working with an experienced real estate agent and being flexible in their housing preferences can help prospective buyers navigate the challenging landscape and find their desired home within their budget.

Fall Trends: Analyzing The Greater Salt Lake City Housing Market

As the summer heat begins to fade and the leaves start turning shades of red and gold, it’s time to start thinking about what lies ahead for the Greater Salt Lake City housing market this fall. The real estate landscape in this vibrant metropolitan area has seen its fair share of ups and downs over the years. However, experts are projecting some exciting trends and opportunities for both buyers and sellers alike.

One of the key factors driving the current Salt Lake City housing market is the continued influx of people moving to the area. The city’s robust economy, coupled with its breathtaking natural surroundings and a fantastic quality of life, has attracted a growing number of individuals and families looking to call this place home. This steady population growth has contributed to the high demand for housing, resulting in a competitive market for buyers.

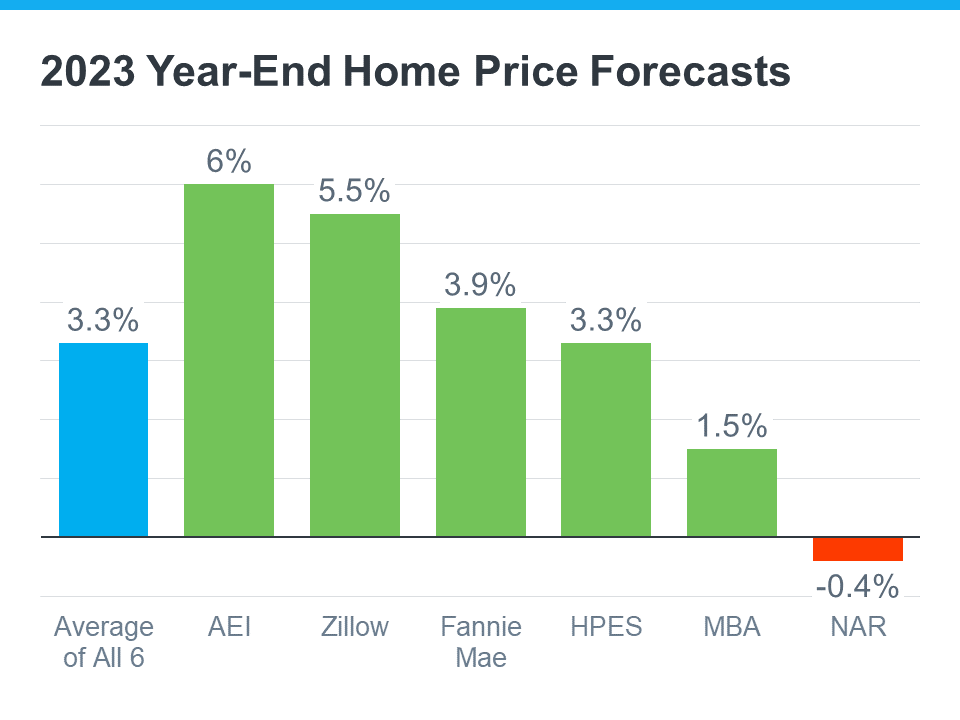

Despite this high demand, there have been signs of a slight cooling off in the housing market recently. As we transition into the fall season, experts predict that this trend will continue, but at a steadier pace. The rate of price appreciation is expected to moderate, providing a more balanced market environment for both buyers and sellers. This means that homeowners looking to sell their properties can still expect favorable returns, while homebuyers may find more reasonably priced options.

Another trend to watch out for this fall is the emergence of new construction projects in the Greater Salt Lake City area. With the demand for housing continuing to rise, developers have been quick to respond by introducing modern and well-designed residential communities. These new developments offer a wide range of housing options, from single-family homes to condominiums and townhouses, catering to various lifestyles and budgets. The expansion of housing inventory can help alleviate some of the supply constraints seen in recent years.

Furthermore, the fall season traditionally brings a more relaxed atmosphere in the real estate market. With the frenzy of the summer buying season subsiding, buyers may find fewer multiple offer situations and more room for negotiations. This doesn’t mean sellers should be discouraged, though. The market remains active, with motivated buyers still on the hunt for their dream homes. By strategically pricing their properties and making necessary upgrades or improvements, sellers can still attract interested buyers and secure favorable deals.

As we look ahead to this fall, it’s important to keep an eye on the broader economic landscape as well. Factors such as interest rates, job growth, and market stability can greatly influence the dynamics of the housing market. While most indicators suggest a steady and healthy real estate climate in Salt Lake City, it’s always wise to stay informed and adaptable to potential shifts.

The Greater Salt Lake City housing market is expected to showcase some exciting trends this fall. With a growing population, new construction projects, and an evolving market environment, both buyers and sellers have unique opportunities to take advantage of. By staying informed and working with knowledgeable real estate professionals, individuals can navigate this ever-changing market and make sound decisions for their housing needs.

Buyer’s Market Or Seller’s Market? Understanding Real Estate Dynamics

As the fall season approaches, homebuyers and sellers in the Greater Salt Lake City area may be wondering about the state of the local housing market. Real estate dynamics play a vital role in determining whether it is a buyer’s market or a seller’s market, ultimately shaping the experience for those looking to make a move. Understanding these dynamics is essential for both buyers and sellers to navigate the market successfully.

A buyer’s market occurs when there is more inventory than active buyers. In this scenario, buyers have the advantage of more choices and negotiating power. They can take their time to compare properties, negotiate on price, and potentially secure more favorable terms. For sellers, a buyer’s market means they may need to price their homes competitively and offer incentives to attract potential buyers.

On the other hand, a seller’s market arises when there are more active buyers than available inventory. This drives competition among buyers, often leading to multiple offers and a quicker sale process. Sellers in a seller’s market often have the upper hand in negotiations, with the possibility of receiving offers over the asking price. However, it’s important to note that even in a seller’s market, pricing a property too high or neglecting necessary repairs can deter buyers.

So, what can we expect in the Greater Salt Lake City housing market this fall? To get a better understanding, it’s crucial to analyze some key factors that drive real estate dynamics.

First and foremost, supply and demand play a significant role in determining whether it’s a buyer’s or seller’s market. Currently, the Salt Lake City area is experiencing a shortage of housing inventory, leading to high demand from buyers. This low supply of available homes gives sellers the upper hand. Multiple offers and bidding wars have become increasingly common, resulting in a greater likelihood of homes selling above the asking price.

The overall economic conditions in the Greater Salt Lake City area also impact the housing market dynamics. The region has seen steady job growth and a thriving economy, making it an attractive place to live. This influx of people moving to the area has increased the demand for housing, further amplifying the seller’s market conditions.

As a prospective buyer or seller in the Greater Salt Lake City area, it’s essential to stay informed and work with knowledgeable real estate professionals who can guide you through the intricacies of the market. Based on the current trends, it is crucial for buyers to be prepared to act fast, make competitive offers, and be open to compromises. Sellers, on the other hand, should work closely with their agents to price their homes strategically and leverage their advantages in negotiations.

In conclusion, the Greater Salt Lake City housing market this fall is undoubtedly favoring sellers, with a shortage of inventory and high demand from buyers. This seller’s market is driven by factors like low interest rates, job growth, and a thriving local economy. However, market conditions can fluctuate, and potential changes in supply, demand, and interest rates may bring more balance to the market in the future. Staying informed and working with experienced professionals can empower both buyers and sellers to make informed decisions in the ever-changing real estate landscape.

Predictions And Recommendations: Navigating The Greater Salt Lake City Housing Market This Fall

As we enter the fall season, many homeowners and potential buyers in the Greater Salt Lake City area are eager to understand the current state of the housing market and what lies ahead. With the changing economic landscape and ongoing shifts in buyer preferences, it is crucial to stay informed and make well-informed decisions. In this section, we will delve into the predictions and offer recommendations to help you navigate the Greater Salt Lake City housing market this fall.

1. Continued Price Growth:

One of the notable trends in the Salt Lake City housing market is the steady increase in home prices. This trend is expected to continue into the fall months, driven by existing low inventory levels and high demand. With eager buyers looking to secure their dream homes before interest rates rise, sellers can expect multiple offers and potentially higher selling prices. This signifies a favorable market for sellers, but it also means that buyers need to be prepared to compete and make quick decisions.

2. Inventory Challenges:

While strong demand persists, the Greater Salt Lake City area continues to face a shortage of available housing options. This scarcity of inventory is mainly due to a combination of factors, including limited new construction, a reluctance among existing homeowners to sell, and an influx of out-of-state buyers. Consequently, buyers are likely to encounter intense competition and may need to act swiftly when they find a property of interest. It is essential for buyers to work closely with experienced real estate agents who can alert them to new listings and promptly navigate the process.

3. Evolving Buyer Preferences:

The preferences and needs of homebuyers have shifted over the past year due to the global pandemic. Buyers are now placing greater emphasis on features like home offices, outdoor spaces, and more versatile living arrangements. The fall season may see continued demand for properties that offer these features, as remote work and lifestyle changes continue to influence the market. Sellers who can highlight these desirable characteristics in their listings may attract more interest and potentially command higher offers.

4. Expert Guidance:

Given the dynamic nature of the Greater Salt Lake City housing market, seeking expert guidance from real estate professionals is crucial. Working with experienced agents who possess extensive knowledge of the local market can provide valuable insights. These professionals can assist both buyers and sellers in navigating the complexities, identifying opportunities, and tailoring strategies to maximize their objectives.

The Greater Salt Lake City housing market is poised for an active and robust fall season.