The year 2024 has begun with a bang, as the Federal Housing Administration (FHA) and conventional loan limits have increased. This means that potential homebuyers and refinancers now have even more opportunities to secure funding for their dream homes or make improvements to their existing properties. In this article, we will dive into the details of these new loan limits and discuss how they can benefit you. So, let’s get started on your journey to homeownership or financing your next venture!

Understanding The New Loan Limits For 2024

With the turn of the year, major changes have taken place in the loan industry, particularly with regard to the Federal Housing Administration (FHA) and conventional loan limits. These changes have been eagerly anticipated by homebuyers, real estate agents, and lenders alike. The new loan limits for 2024 have increased, and prospective homebuyers need to understand what this means for their borrowing power.

The FHA loan program, managed by the Department of Housing and Urban Development (HUD), ensures that more Americans have access to affordable housing options. FHA loans are favored by first-time homebuyers due to their low down payment requirements and flexible credit guidelines. The loan limits for FHA loans vary by county, taking into account local housing market conditions. For 2024, these loan limits have seen a considerable increase across the country.

Counties in the State of Utah where the median home value is below the national average, the FHA loan limit has been raised to $498,257. Counties that have a cap of $498,257 are Beaver, Cache, Carbon Daggett, Duchesne, Emery, Garfield, Iron, Kane, Millard, Piute, Sanjuan, Sanpete, Sevier, and Unitah Counties. Other counties have caps that are as follows: Grand County $607,200, Juab County $601,450, Rich County $579,600, Salt Lake County $619,850, Utah County $601,450, Washington County $593,400, Weber County $744,050 Wasatch County and Summit County $1,149,825, Morgan County $744,050, and Davis County $744,050.

The conventional loan market has also seen an increase in loan limits for 2024. Conventional loans are not insured or guaranteed by a government agency like FHA loans, and they typically require higher credit scores and down payments. However, they offer more flexibility in terms of loan amount and property types.

For single-unit properties, the loan limit for conventional loans has been raised to $647,200. This means that borrowers can now secure a conventional loan up to this amount without having to resort to jumbo loans, which often carry higher interest rates and stricter qualification criteria. In certain areas with higher construction costs or high demand, the loan limit can be even higher, allowing more buyers to afford homes in these locations.

Understanding the new loan limits for 2024 is crucial for prospective homebuyers as it directly impacts their borrowing power and the type of loan they can qualify for. The increased loan limits make homeownership more accessible and affordable for a broader range of individuals and families.

However, it’s important to note that while the new loan limits have increased, other factors such as credit scores, debt-to-income ratios, and employment history still play a significant role in determining a borrower’s eligibility for a home loan. Lenders will still evaluate these factors to ensure that borrowers have the financial ability to repay the loan.

While the higher loan limits offer larger loan amounts, potential homebuyers should carefully consider their financial capabilities and budget before taking on a larger loan. It’s crucial to strike a balance between borrowing as much as possible and maintaining a comfortable monthly payment that aligns with one’s financial goals and lifestyle.

In conclusion, the new loan limits for 2024 have increased for both FHA and conventional loans, providing opportunities for more homebuyers to enter the market and purchase their dream homes. The expanded loan limits reflect the growing cost of housing across the country and aim to make homeownership more attainable for a wider range of individuals. However, it’s essential to approach borrowing with caution and factor in personal financial circumstances to ensure responsible homeownership and long-term financial stability.

Exploring The Increased FHA Loan Limits

The Federal Housing Administration (FHA) recently announced an increase in loan limits for 2024, bringing good news for homebuyers who are considering applying for an FHA loan. These new limits are set to take effect on January 1st, 2024, and are designed to keep pace with the increasing cost of housing in various markets across the United States.

The FHA loan program has been an essential resource for many first-time homebuyers, as it offers more lenient qualification requirements and lower down payment options compared to conventional loans. With the increased loan limits, potential homebuyers will have greater access to affordable financing, allowing them to purchase homes in higher-priced markets.

For a better understanding of the impact of these increased loan limits, let’s explore what this means for homebuyers considering an FHA loan:

1. Enhanced Buying Power: With higher loan limits, potential homebuyers will have more buying power in high-cost areas like California, New York, and Massachusetts. It means that borrowers can secure a larger loan amount, enabling them to consider a wider range of properties within their desired location.

2. Increased Access to Affordable Housing: One of the main goals of the FHA loan program is to assist low- and moderate-income borrowers in accessing affordable housing. By raising the loan limits, more borrowers will qualify for FHA loans, potentially opening up additional opportunities for homeownership in areas where the median home prices are higher.

3. Reduced Down Payment Requirements: FHA loans require a minimum down payment of 3.5% compared to the 5% or more required by conventional loans. With the increased loan limits, borrowers can take advantage of this lower down payment requirement while still being able to purchase a home in a more expensive market.

4. Potentially Lower Interest Rates: FHA loans often come with competitive interest rates, which can be particularly beneficial for borrowers who may have lower credit scores. With the increased loan limits, more borrowers will be eligible for FHA loans, potentially driving down interest rates due to increased demand for these loans.

5. Streamlined Refinancing Options: For homeowners with existing FHA loans who are looking to refinance, the increased loan limits also bring potential advantages. Higher loan limits can provide an opportunity to refinance into a larger loan, allowing homeowners to tap into their home equity and potentially secure a lower interest rate.

It is important to note that while the FHA loan limits have been increased, borrowers must still meet the FHA’s qualifying criteria, including creditworthiness, income requirements, and debt-to-income ratios. Additionally, loan limits will vary based on location, as they are determined by housing market data.

In conclusion, the increased FHA loan limits for 2024 are undoubtedly a positive development for prospective homebuyers, particularly those looking to purchase homes in high-cost areas. By expanding the loan limits, the FHA aims to provide a greater opportunity for affordable homeownership and bridge the gap for individuals who may have previously struggled to secure financing. Whether you’re a first-time homebuyer or looking to refinance an existing FHA loan, these increased loan limits open up new possibilities and make homeownership an achievable dream for many.

Unveiling The Expanded Conventional Loan Limits

Most of Utah has a conventional loan limits of $766,550. Summit and Wasatch Counties are $1,149,825, with Wayne County at $997,050.

With the new year comes new opportunities, especially in the world of home financing. The Federal Housing Administration (FHA) and conventional loan limits for 2024 have increased, providing potential homebuyers with expanded options and greater purchasing power. In this article, we will focus on the expanded conventional loan limits and how they can benefit those in the market for a new home.

Conventional loans, as opposed to government-backed loans like FHA loans, are mortgages that are not insured or guaranteed by a government agency. These loans are often sought after by borrowers with strong credit profiles and the ability to make a larger down payment. With the recent increase in conventional loan limits, borrowers now have a greater capacity to secure financing for their dream homes.

So, what exactly do the expanded conventional loan limits mean for homebuyers? Essentially, these limits determine the maximum amount that can be borrowed in a specific geographic area, without surpassing the boundaries set by loan type and property size. The higher the loan limit in a given area, the more purchasing power borrowers have when it comes to securing a conventional loan.

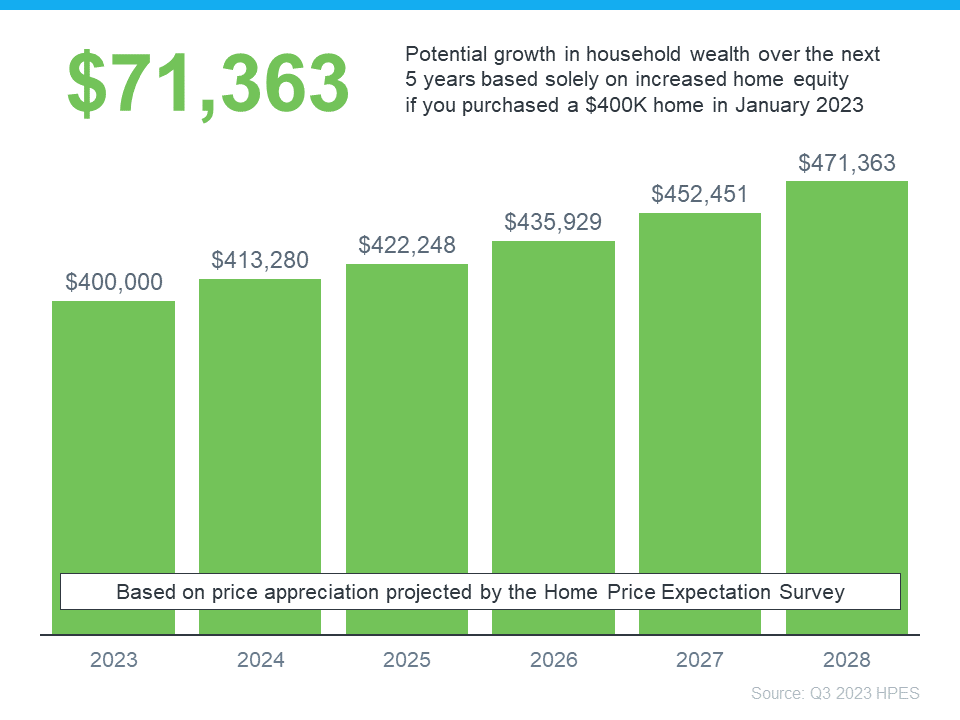

The conventional loan limits for 2024 have been adjusted to reflect the ongoing trends in the housing market and the rising cost of real estate. This increase allows borrowers to access larger loan amounts, which can be advantageous for those residing in high-cost areas or seeking to invest in pricier properties. In fact, in certain expensive urban areas, the expanded loan limits can help bridge the gap between the price of homes and the financing options available, making homeownership more achievable for many.

For instance, let’s say you are looking to purchase a home in a metropolitan area where property prices have steadily risen over the years. With the expanded conventional loan limits, you now have the opportunity to obtain a larger loan amount, provided you meet the necessary requirements. This means being able to access additional funds to put towards your down payment, making it easier to afford a home that might have previously been out of reach.

Moreover, the expanded conventional loan limits can also have a positive impact on the real estate market as a whole. By raising the loan limits, potential buyers are given the ability to invest in higher-priced properties, which can spur growth and stability in certain neighborhoods. Additionally, this increase may attract more investors and homebuyers, injecting vitality into the housing industry and providing a boost to the local economy.

However, it’s important to remember that the expanded conventional loan limits do not guarantee loan approval. Borrowers must still meet specific criteria related to creditworthiness, income, and employment history. Lenders will assess each individual’s financial situation and determine their eligibility based on these factors, in addition to the loan limits set for their specific area.

In conclusion, the expanded conventional loan limits for 2024 offer a significant opportunity for homebuyers to afford properties that were previously out of their reach. With the higher loan limits, borrowers can access larger loan amounts, making homeownership in high-cost areas a possibility for many. This increase in purchasing power not only benefits individual buyers but also has a positive impact on the real estate market as a whole. As always, it is crucial to consult with a trusted lender or mortgage professional to explore the best loan options available and determine the borrowing capacity within the expanded loan limits.

How These Changes Impact Homebuyers And Real Estate Market

The recent increase in loan limits for FHA and conventional loans in 2024 has brought about several key changes that directly impact homebuyers and the real estate market as a whole. These adjustments have the potential to affect various aspects of the homebuying process, including affordability, loan options, and market dynamics.

One of the primary ways in which these changes impact homebuyers is by increasing their ability to qualify for larger loan amounts. The higher loan limits mean that potential buyers can now access more funds to purchase a home, allowing them to consider properties that may have previously been out of their financial reach. This expansion of loan options presents an opportunity for individuals and families to explore a broader range of housing options that better suit their needs and preferences.

Moreover, the increased loan limits also address the issue of housing affordability by helping to bridge the gap between rising home prices and buyers’ purchasing power. Many housing markets across the country have experienced significant price appreciation over the past few years, making it challenging for some homebuyers to enter the market. With the higher loan limits, more buyers may have the opportunity to purchase homes in areas that were previously unaffordable. This could potentially contribute to a more robust and inclusive real estate market by offering a greater range of possibilities to a broader segment of the population.

In addition to individual homebuyers, the real estate market as a whole is also impacted by these loan limit increases. The availability of larger loan amounts can stimulate demand for homes in certain markets, leading to increased competition among buyers. As a result, sellers may find themselves in a more favorable position, with the potential for multiple offers and quicker property turnover. This heightened level of activity can create a dynamic market environment, encouraging homeowners to list their properties and contributing to overall market growth.

Furthermore, the increased loan limits can also facilitate the financing of higher-priced properties. In certain areas where property values are already high, the previous loan limits may have been restrictive, limiting the pool of potential buyers. With the new limits, more buyers can access financing for properties in these areas, which could, in turn, drive home prices higher as demand increases. This effect might be particularly noticeable in competitive markets where supply is limited, potentially leading to further price appreciation.

It’s worth noting that while the increase in loan limits brings many benefits, it is essential for homebuyers and industry professionals to proceed with caution and consider their financial capabilities. A larger loan amount may allow for more extensive purchasing power, but it also means taking on a higher level of debt. As with any mortgage, borrowers should carefully evaluate their finances, budget, and personal circumstances before committing to a higher loan amount. Consulting with a qualified mortgage advisor or financial professional is always recommended to ensure that the loan is both suitable and manageable.

Overall, the new loan limits for 2024 FHA and conventional loans have created opportunities and potential challenges for homebuyers and the wider real estate market. The increased access to financing empowers buyers to consider a broader range of properties and promotes housing affordability, while also driving market dynamics and influencing property values. It is crucial for all parties involved to navigate these changes judiciously, considering their individual financial situations and market conditions to make informed decisions that align with their long-term goals.