Buying a Home Early Can Significantly Increase Future Wealth

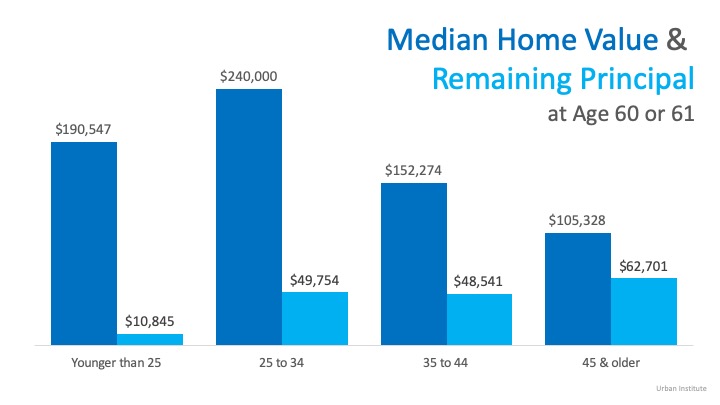

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

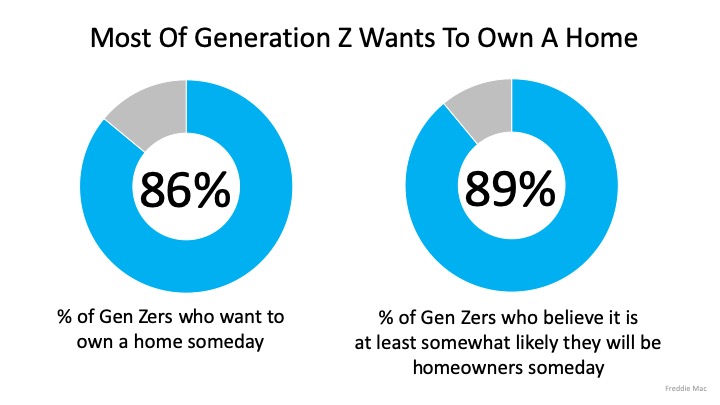

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...

2.25% Fed Rate: Coming by 2027?

Fed projects a 2% in rate cuts by end of 2027. Forecast: Fed funds rate to decline to 2.25%–2.50% by late 2027. Despite tariff-driven inflation bumps, slowing growth will push Fed to cut further. 10-year Treasury yield forecast to fall to 3.25% by 2028, down from 4.2%...

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.

Will 2026 Finally Jumpstart Home Sales?

High mortgage rates in 2025 slowed home sales, but improvement is expected starting in 2026. Experts predict existing home sales may ↑ 10–15% as conditions improve in 2026.

Homebuyers, Don’t Wait for a Miracle Rate

Mortgage rates increased after five weeks of declines, driven by stronger-than-expected economic indicators. Experts forecast minimal rate relief through late 2025 despite Federal Reserve predictions of future cuts. Waiting for rate drops may backfire as housing...

Slight Dip Ahead for U.S. Home Prices

U.S. home prices are projected to decline by 0.9% by Early-Q2 2026. The forecast reverses earlier predictions of price increases, signaling a cooling housing market.

Mortgage Rate Predictionsfor Q3 2025

Long Forecast predicts slight drops: July 6.84%, August 6.79%, September 6.74%. MBA expects 6.7% average in Q3; NAR, Realtor.com see 6.2%–6.4% by year-end. 15-year fixed rates forecasted to drop from 6.01% in July to 5.88% in September. Experts expect gradual rate...

Are mortgage rates falling? What homebuyers need to know

Mortgage rates for 30-year fixed loans have dropped to around 6.63%, the lowest since April, due to a weaker-than-expected jobs report causing Treasury yields to fall. Experts suggest this dip may be temporary but advise buyers to act now rather than wait for perfect...

The Salt Lake metro area is shifting to a renter’s market after an apartment construction boom.

Apartment vacancy rates rose to 7.1% in July, signaling an overbuilt market with slowed rent growth. Despite high rents, the market favors renters, with rent days on market decreasing. Utah's average rent dropped to $1,399 in 2025, causing many to delay home...

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...

2.25% Fed Rate: Coming by 2027?

Fed projects a 2% in rate cuts by end of 2027. Forecast: Fed funds rate to decline to 2.25%–2.50% by late 2027. Despite tariff-driven inflation bumps, slowing growth will push Fed to cut further. 10-year Treasury yield forecast to fall to 3.25% by 2028, down from 4.2%...

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.

Will 2026 Finally Jumpstart Home Sales?

High mortgage rates in 2025 slowed home sales, but improvement is expected starting in 2026. Experts predict existing home sales may ↑ 10–15% as conditions improve in 2026.

Homebuyers, Don’t Wait for a Miracle Rate

Mortgage rates increased after five weeks of declines, driven by stronger-than-expected economic indicators. Experts forecast minimal rate relief through late 2025 despite Federal Reserve predictions of future cuts. Waiting for rate drops may backfire as housing...

Slight Dip Ahead for U.S. Home Prices

U.S. home prices are projected to decline by 0.9% by Early-Q2 2026. The forecast reverses earlier predictions of price increases, signaling a cooling housing market.

Mortgage Rate Predictionsfor Q3 2025

Long Forecast predicts slight drops: July 6.84%, August 6.79%, September 6.74%. MBA expects 6.7% average in Q3; NAR, Realtor.com see 6.2%–6.4% by year-end. 15-year fixed rates forecasted to drop from 6.01% in July to 5.88% in September. Experts expect gradual rate...

Are mortgage rates falling? What homebuyers need to know

Mortgage rates for 30-year fixed loans have dropped to around 6.63%, the lowest since April, due to a weaker-than-expected jobs report causing Treasury yields to fall. Experts suggest this dip may be temporary but advise buyers to act now rather than wait for perfect...

The Salt Lake metro area is shifting to a renter’s market after an apartment construction boom.

Apartment vacancy rates rose to 7.1% in July, signaling an overbuilt market with slowed rent growth. Despite high rents, the market favors renters, with rent days on market decreasing. Utah's average rent dropped to $1,399 in 2025, causing many to delay home...

[mlcalc default=”mortgage_only”]