Buying a Home Early Can Significantly Increase Future Wealth

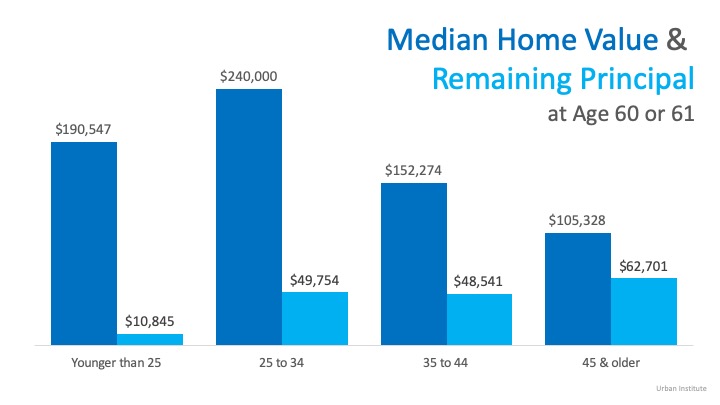

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

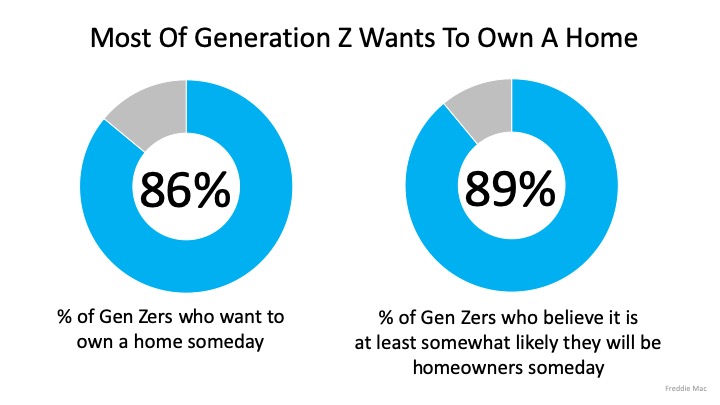

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...

Forecast Signals Confident Buyers, Steady Prices by Late-2025

Slide 1 Total home sales in 2025 are forecast at 4.74 million units. Slide 2 Mortgage rates expected to finish 2025 at 6.5%, dipping to 6.1% by 2026. Slide 3 Forecast revisions are modest, keeping housing sales stable despite economic uncertainties. Slide 4 Fannie Mae...

Multifamily Housing Starts Surge 21% in Q2 2025

Multifamily housing starts reached 109K units in Q2 2025, with 102,000 built-for-rent, ↑ 21% yearly. Rental units made up 94% of multifamily starts, far above the long-term avg of 80% and the historical low of 47% during the 2005 condo boom. Condo construction starts...

The 8 best real estate markets in the country right now

WalletHub ranked 300 U.S. cities to identify the strongest housing markets in 2025, considering factors like home-price appreciation, foreclosure rates, affordability, job growth, and new home construction. With rising mortgage rates and a seller-friendly market,...

Are 2027 Trends Favoring Long-Term Gains?

Home prices are projected to rise 4% in 2027, reaching 10.8% cumulative growth since 2024. Experts forecast continued moderate gains in 2027, following slower increases in 2025 and 2026.

Utah: Hottest Spots for New Home Builds

Utah is one of the top states in the country for new home builds. Utah ranks No. 4 nationally, building 18.6 new homes per 1,000 existing.

Utah: Among States With High Home Values by 2030

Slide 1: "Utah’s Silicon Slopes drive home prices toward $673K by 2030." Slide 2: Limited housing and zoning challenges keep prices rising fast."

4 Smart Ways To Find a Reliable Real Estate Agent

Homebuyers and sellers can benefit from working with reliable real estate agents, as 89% of recent homebuyers chose to do so. To find a trustworthy agent, consider these strategies: 1. Research recent property sales in your area to identify active agents. 2. Call...

5-Year Forecast Favors Buying Over Renting

Buying isn’t just a home — it’s a wealth-building move for your future. Example: Buy a $300K home with 5% down = $82K equity in 5 years.

Do New Roofs Save Money and Energy?

Impact-resistant shingles and metal roofs extend roof life while safeguarding against costly storm damage. Solar-compatible roofs allow easier renewable energy adoption, even for homeowners not installing panels yet. Cool roofing systems lower household cooling bills...

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...

Forecast Signals Confident Buyers, Steady Prices by Late-2025

Slide 1 Total home sales in 2025 are forecast at 4.74 million units. Slide 2 Mortgage rates expected to finish 2025 at 6.5%, dipping to 6.1% by 2026. Slide 3 Forecast revisions are modest, keeping housing sales stable despite economic uncertainties. Slide 4 Fannie Mae...

Multifamily Housing Starts Surge 21% in Q2 2025

Multifamily housing starts reached 109K units in Q2 2025, with 102,000 built-for-rent, ↑ 21% yearly. Rental units made up 94% of multifamily starts, far above the long-term avg of 80% and the historical low of 47% during the 2005 condo boom. Condo construction starts...

The 8 best real estate markets in the country right now

WalletHub ranked 300 U.S. cities to identify the strongest housing markets in 2025, considering factors like home-price appreciation, foreclosure rates, affordability, job growth, and new home construction. With rising mortgage rates and a seller-friendly market,...

Are 2027 Trends Favoring Long-Term Gains?

Home prices are projected to rise 4% in 2027, reaching 10.8% cumulative growth since 2024. Experts forecast continued moderate gains in 2027, following slower increases in 2025 and 2026.

Utah: Hottest Spots for New Home Builds

Utah is one of the top states in the country for new home builds. Utah ranks No. 4 nationally, building 18.6 new homes per 1,000 existing.

Utah: Among States With High Home Values by 2030

Slide 1: "Utah’s Silicon Slopes drive home prices toward $673K by 2030." Slide 2: Limited housing and zoning challenges keep prices rising fast."

4 Smart Ways To Find a Reliable Real Estate Agent

Homebuyers and sellers can benefit from working with reliable real estate agents, as 89% of recent homebuyers chose to do so. To find a trustworthy agent, consider these strategies: 1. Research recent property sales in your area to identify active agents. 2. Call...

5-Year Forecast Favors Buying Over Renting

Buying isn’t just a home — it’s a wealth-building move for your future. Example: Buy a $300K home with 5% down = $82K equity in 5 years.

Do New Roofs Save Money and Energy?

Impact-resistant shingles and metal roofs extend roof life while safeguarding against costly storm damage. Solar-compatible roofs allow easier renewable energy adoption, even for homeowners not installing panels yet. Cool roofing systems lower household cooling bills...

[mlcalc default=”mortgage_only”]