Buying a Home Early Can Significantly Increase Future Wealth

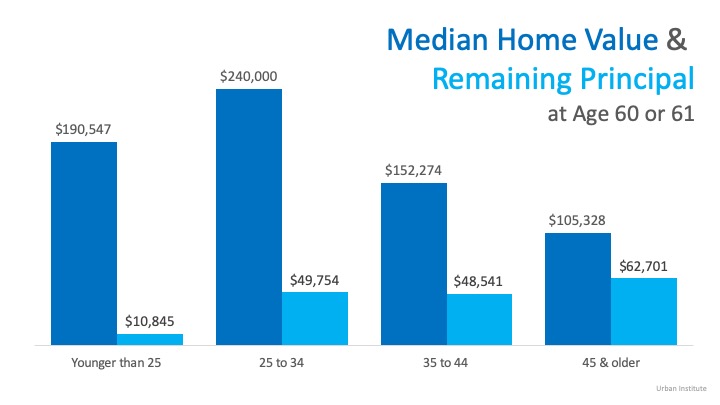

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

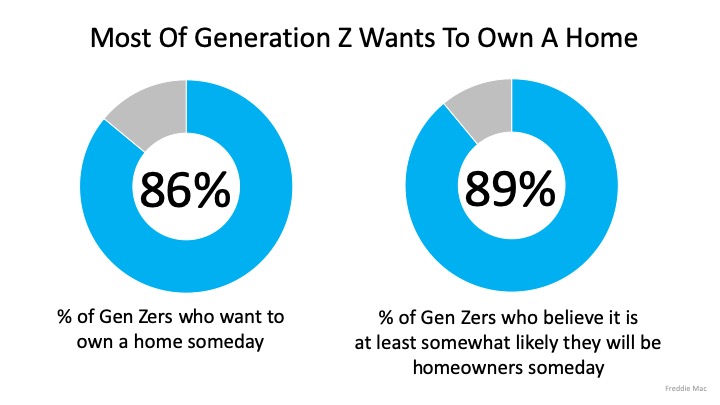

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day. In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints. Soon, All Saints'...

Relocation Trends: Why High-Net-Worth Buyers Are Choosing the Mountain West States

High-net-worth buyers are increasingly relocating to the Mountain West states—Idaho, Montana, Wyoming, Utah, and Colorado—attracted by tax advantages, privacy, natural beauty, and outdoor recreation. Luxury real estate has evolved from rustic cabins to sophisticated...

Buying or Selling: What’s Your Agent Strategy?

Visit Real Estate offices early and ask questions to gauge their professionalism and fit. Understand seller motivations to make offers with attractive terms that could win deals.

How to get a mortgage when you’re self-employed

Self-employed individuals can qualify for a home loan, but they may face additional challenges in proving income stability. To improve approval chances, consider non-conforming loans, make larger down payments, raise credit scores, and lower debts. Lenders require...

Most Affordable Cities to Buy a Home in Utah (2025)

Here is an overview of affordable cities in Utah for homebuyers in 2025, highlighting median prices, cost of living, and unique features for each city. This provides an at-a-glance guide to communities where your housing dollar might stretch further. Most Affordable...

Will the Housing Market Rebound? Predictions for 2025 and 2026

The U.S. housing market is expected to see gradual growth through late 2025 and into 2026, with no major price drops on the horizon. Existing-home sales rose 2% in July 2025, inventory is up 15.7% year-over-year, and the median price is holding steady at $422,400....

Global Real Estate: $19.5T by 2031

The global residential Real Estate market will reach USD 19.5T by 2031, growing at 9.2% CAGR. Urban growth in emerging nations will drive increased demand for residential Real Estate by 2030.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day. In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints. Soon, All Saints'...

Relocation Trends: Why High-Net-Worth Buyers Are Choosing the Mountain West States

High-net-worth buyers are increasingly relocating to the Mountain West states—Idaho, Montana, Wyoming, Utah, and Colorado—attracted by tax advantages, privacy, natural beauty, and outdoor recreation. Luxury real estate has evolved from rustic cabins to sophisticated...

Buying or Selling: What’s Your Agent Strategy?

Visit Real Estate offices early and ask questions to gauge their professionalism and fit. Understand seller motivations to make offers with attractive terms that could win deals.

How to get a mortgage when you’re self-employed

Self-employed individuals can qualify for a home loan, but they may face additional challenges in proving income stability. To improve approval chances, consider non-conforming loans, make larger down payments, raise credit scores, and lower debts. Lenders require...

Most Affordable Cities to Buy a Home in Utah (2025)

Here is an overview of affordable cities in Utah for homebuyers in 2025, highlighting median prices, cost of living, and unique features for each city. This provides an at-a-glance guide to communities where your housing dollar might stretch further. Most Affordable...

Will the Housing Market Rebound? Predictions for 2025 and 2026

The U.S. housing market is expected to see gradual growth through late 2025 and into 2026, with no major price drops on the horizon. Existing-home sales rose 2% in July 2025, inventory is up 15.7% year-over-year, and the median price is holding steady at $422,400....

Global Real Estate: $19.5T by 2031

The global residential Real Estate market will reach USD 19.5T by 2031, growing at 9.2% CAGR. Urban growth in emerging nations will drive increased demand for residential Real Estate by 2030.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.

[mlcalc default=”mortgage_only”]