Buying a Home Early Can Significantly Increase Future Wealth

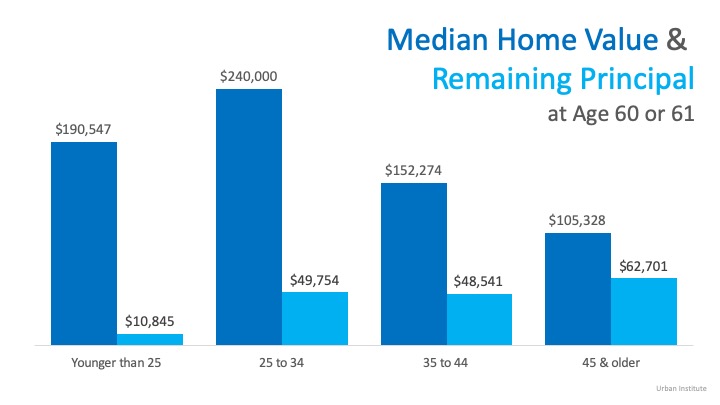

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

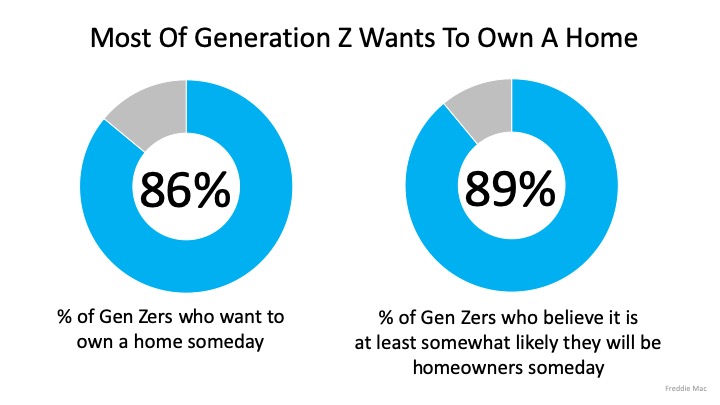

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

The True Cost of Selling Your House on Your Own

The True Cost of Selling Your House on Your Own Selling your house is no simple task. While some homeowners opt to sell their homes on their own, known as a FSBO (For Sale by Owner), they often encounter various challenges without the guidance of a real estate agent....

Why Buying or Selling a Home Helps the Economy and Your Community

Why Buying or Selling a Home Helps the Economy and Your Community If you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community. The National Association of Realtors (NAR) releases a report...

Are Home Prices Going Up or Down? That Depends…

Are Home Prices Going Up or Down? That Depends… Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different...

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market Some Highlights Comparing housing market metrics from one year to another can be challenging in a normal housing market – and the last few years have been anything but normal. In a way, they were...

This Real Estate Market Is the Strongest of Our Lifetime

This Real Estate Market Is the Strongest of Our Lifetime When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the...

The Main Reason Mortgage Rates Are So High

The Main Reason Mortgage Rates Are So HighToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be...

The True Value of Homeownership

The True Value of Homeownership Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership...

Keys to Success for First-Time Homebuyers

Keys to Success for First-Time Homebuyers Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of...

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate....

Remember and Honor Those Who Gave All

Remember and Honor Those Who Gave All We remember and honor those who gave all. Some Highlights

The True Cost of Selling Your House on Your Own

The True Cost of Selling Your House on Your Own Selling your house is no simple task. While some homeowners opt to sell their homes on their own, known as a FSBO (For Sale by Owner), they often encounter various challenges without the guidance of a real estate agent....

Why Buying or Selling a Home Helps the Economy and Your Community

Why Buying or Selling a Home Helps the Economy and Your Community If you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community. The National Association of Realtors (NAR) releases a report...

Are Home Prices Going Up or Down? That Depends…

Are Home Prices Going Up or Down? That Depends… Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different...

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market Some Highlights Comparing housing market metrics from one year to another can be challenging in a normal housing market – and the last few years have been anything but normal. In a way, they were...

This Real Estate Market Is the Strongest of Our Lifetime

This Real Estate Market Is the Strongest of Our Lifetime When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the...

The Main Reason Mortgage Rates Are So High

The Main Reason Mortgage Rates Are So HighToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be...

The True Value of Homeownership

The True Value of Homeownership Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership...

Keys to Success for First-Time Homebuyers

Keys to Success for First-Time Homebuyers Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of...

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate....

Remember and Honor Those Who Gave All

Remember and Honor Those Who Gave All We remember and honor those who gave all. Some Highlights

[mlcalc default=”mortgage_only”]