Buying a Home Early Can Significantly Increase Future Wealth

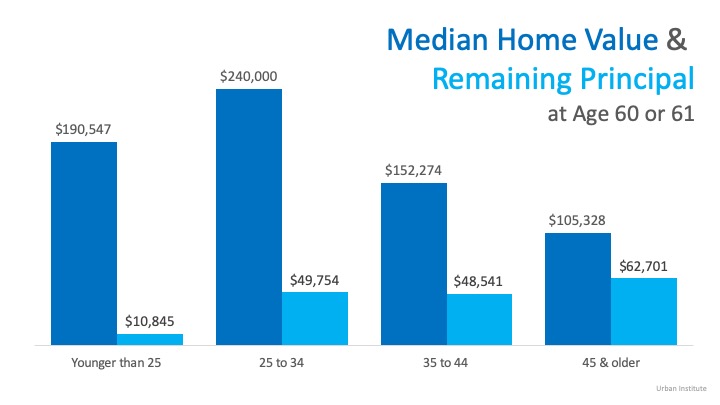

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

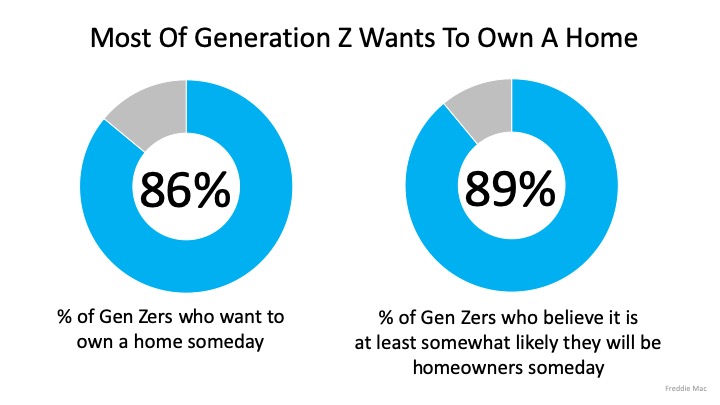

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.

New Year, New Home: Buying & Selling Tips

Start Early: Sellers should begin the process early, evaluating their home and preparing for the market.Home Preparation: Sellers should invest in updates, cleaning, and professional staging to increase appeal.

How Insurance Can Help With Retirement Planning

Long-term care insurance shields retirement funds by covering care costs like home care or assisted living. Cash-value life insurance offers tax-deferred growth, ideal for those maximizing retirement plans and seeking additional savings.

How to Protect Your Belongings With Insurance

Ensure your coverage includes extended or guaranteed replacement cost to cover spikes in repair costs. Don’t skip flood insurance—99% of counties faced flooding between 1996-2019, according to FEMA.

3 buildings in Utah among hundreds of federal properties ‘designated for disposal’

Three federal properties in Utah, including the IRS Service Center in Ogden, the St. George Federal Building, and the Wallace F. Bennett Federal Building in Salt Lake, are among hundreds designated for disposal by the GSA. These buildings are considered “non-core” and...

How Stable Is Utah’s Housing Market?

Utah's housing market has a 20.7% chance of a 5% price drop over the past 25 years, lower than the US 26.4% avg. Since 2000, the median home price ↑ 210%, higher than the national ↑ 196%.

Happy St. Patrick’s Day

St Patrick's Day is the day we all turn a bit Irish. 13 million pints of Guinness are consumed worldwide on St. Patrick's Day. Green is now the traditional color of St. Patrick's Day.

US Market Trends: Is Passive Investing Out?

Positive sentiment is growing, with lower interest rates fostering liquidity and selective investment opportunities.Investors must focus on active management and asset selection as the market evolves post-2024.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.

New Year, New Home: Buying & Selling Tips

Start Early: Sellers should begin the process early, evaluating their home and preparing for the market.Home Preparation: Sellers should invest in updates, cleaning, and professional staging to increase appeal.

How Insurance Can Help With Retirement Planning

Long-term care insurance shields retirement funds by covering care costs like home care or assisted living. Cash-value life insurance offers tax-deferred growth, ideal for those maximizing retirement plans and seeking additional savings.

How to Protect Your Belongings With Insurance

Ensure your coverage includes extended or guaranteed replacement cost to cover spikes in repair costs. Don’t skip flood insurance—99% of counties faced flooding between 1996-2019, according to FEMA.

3 buildings in Utah among hundreds of federal properties ‘designated for disposal’

Three federal properties in Utah, including the IRS Service Center in Ogden, the St. George Federal Building, and the Wallace F. Bennett Federal Building in Salt Lake, are among hundreds designated for disposal by the GSA. These buildings are considered “non-core” and...

How Stable Is Utah’s Housing Market?

Utah's housing market has a 20.7% chance of a 5% price drop over the past 25 years, lower than the US 26.4% avg. Since 2000, the median home price ↑ 210%, higher than the national ↑ 196%.

Happy St. Patrick’s Day

St Patrick's Day is the day we all turn a bit Irish. 13 million pints of Guinness are consumed worldwide on St. Patrick's Day. Green is now the traditional color of St. Patrick's Day.

US Market Trends: Is Passive Investing Out?

Positive sentiment is growing, with lower interest rates fostering liquidity and selective investment opportunities.Investors must focus on active management and asset selection as the market evolves post-2024.

[mlcalc default=”mortgage_only”]