3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

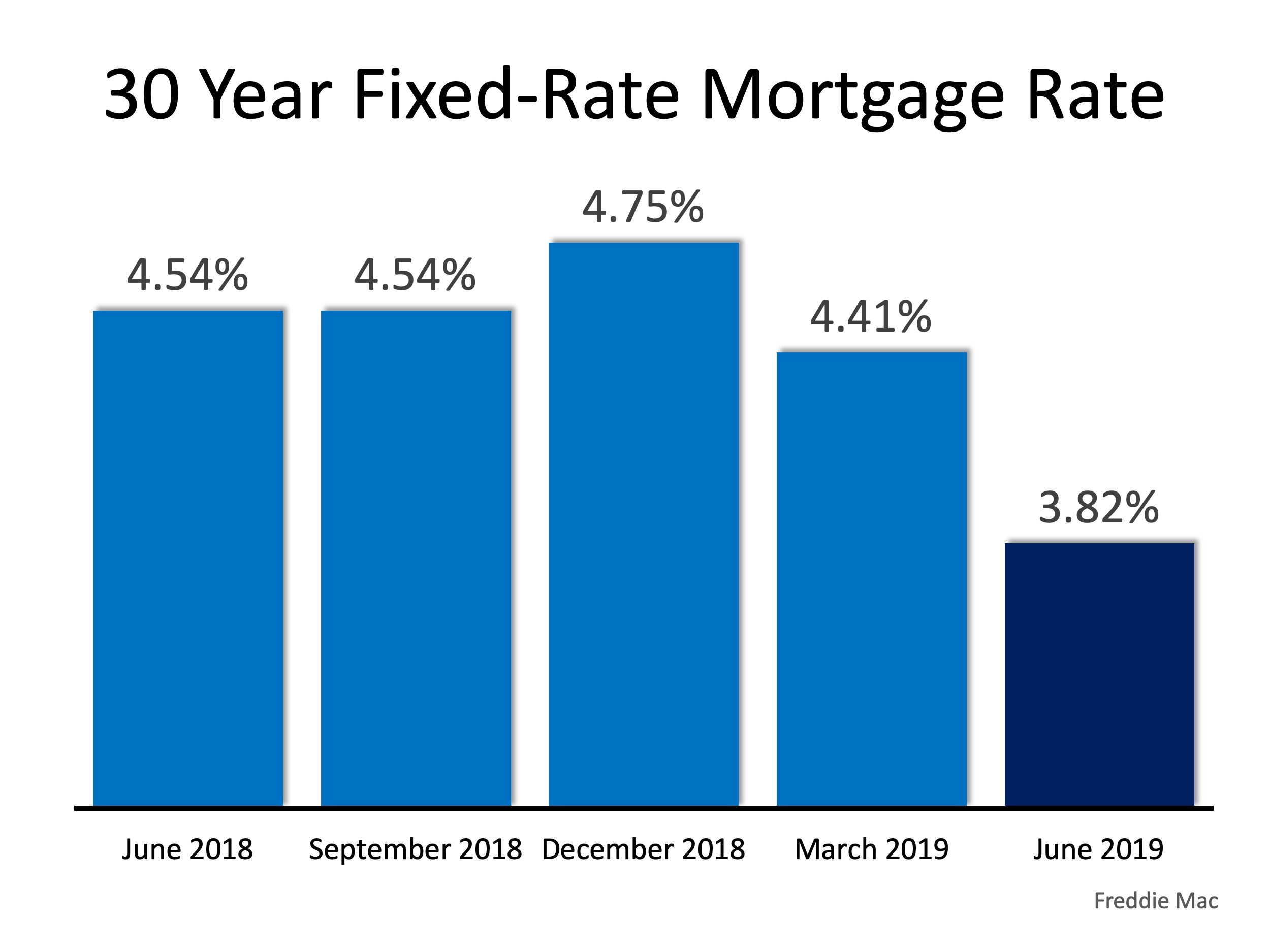

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

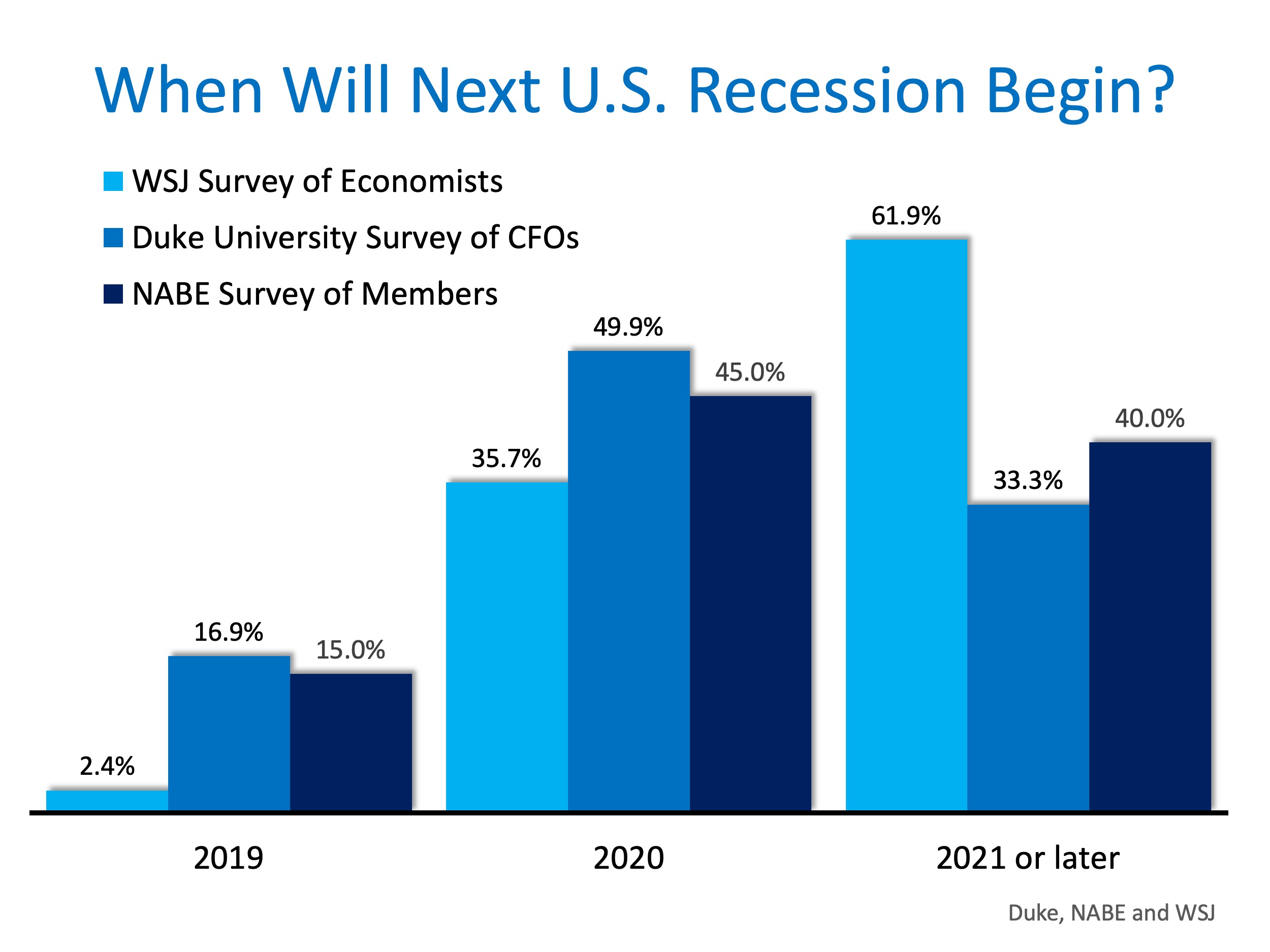

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.

New Year, New Home: Buying & Selling Tips

Start Early: Sellers should begin the process early, evaluating their home and preparing for the market.Home Preparation: Sellers should invest in updates, cleaning, and professional staging to increase appeal.

How Insurance Can Help With Retirement Planning

Long-term care insurance shields retirement funds by covering care costs like home care or assisted living. Cash-value life insurance offers tax-deferred growth, ideal for those maximizing retirement plans and seeking additional savings.

How to Protect Your Belongings With Insurance

Ensure your coverage includes extended or guaranteed replacement cost to cover spikes in repair costs. Don’t skip flood insurance—99% of counties faced flooding between 1996-2019, according to FEMA.

3 buildings in Utah among hundreds of federal properties ‘designated for disposal’

Three federal properties in Utah, including the IRS Service Center in Ogden, the St. George Federal Building, and the Wallace F. Bennett Federal Building in Salt Lake, are among hundreds designated for disposal by the GSA. These buildings are considered “non-core” and...

How Stable Is Utah’s Housing Market?

Utah's housing market has a 20.7% chance of a 5% price drop over the past 25 years, lower than the US 26.4% avg. Since 2000, the median home price ↑ 210%, higher than the national ↑ 196%.