3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

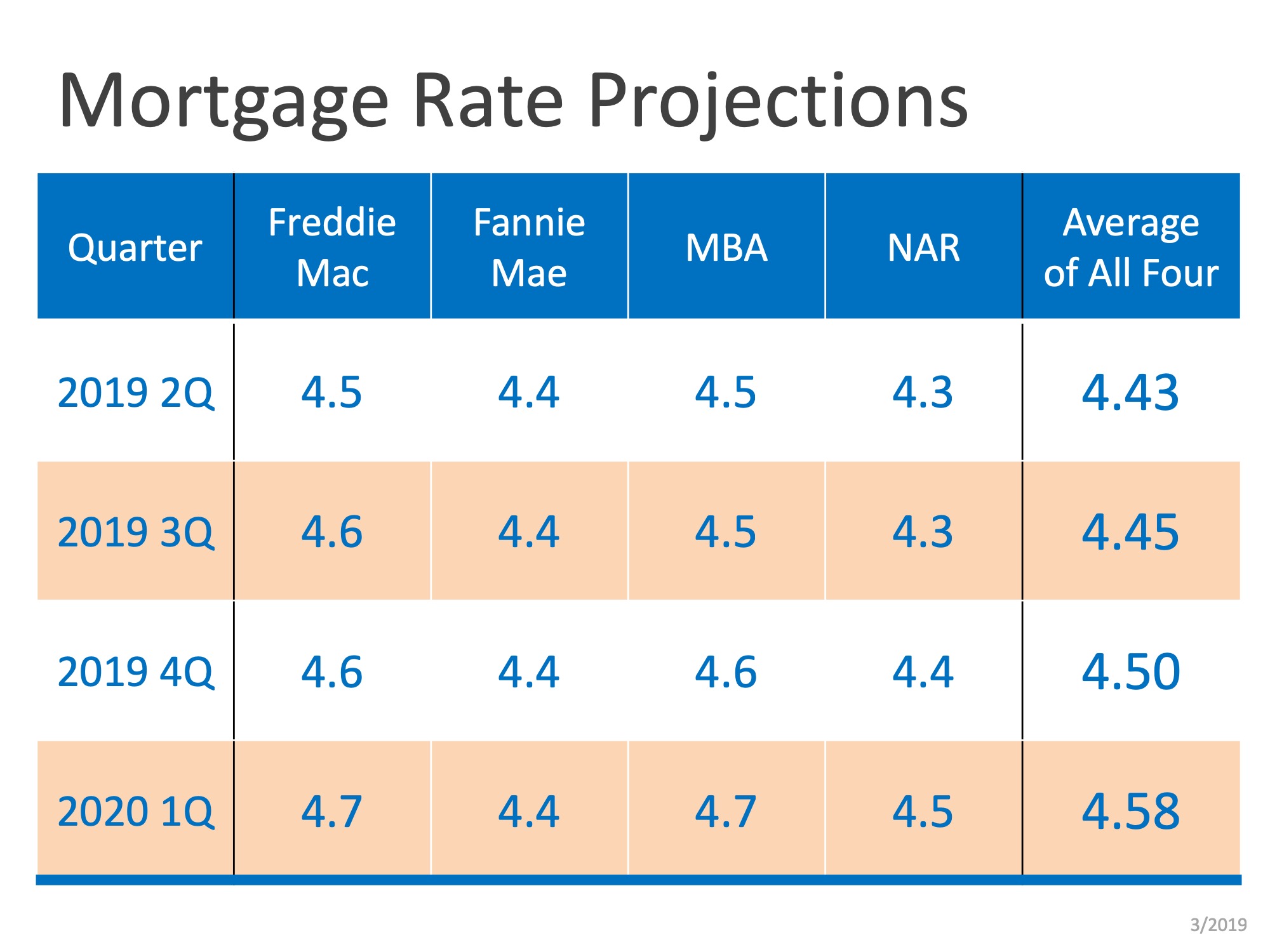

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

8 Tips for First-Time Home Buyers

First-time homebuyers should save for a down payment, typically 20%, and budget for additional costs like fees, moving, and furniture. Choose a neighborhood that fits long-term needs, prioritize must-haves, and get a home inspection to avoid surprises. Use a mortgage...

5 Reasons Enticing Me to Buy a Home Before 2025 Ends

Slide 1 Mortgage rates dropped to around 6%, down from the 7.79% peak in 2023. Slide 2 Housing supply rose 15.7% in 2025, giving buyers 1.55 million homes to choose from. Slide 3 Home prices are still high but rising slower, with just 2.9% annual growth mid-2025....

22 Real Estate Investment Strategies

Real estate investing offers strategies for wealth building, passive income, and portfolio diversification, including buy-and-hold, fix-and-flip, REITs, and rental property diversification. REITs have shown stability and often outperform stocks over time, while...

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...

Forecast Signals Confident Buyers, Steady Prices by Late-2025

Slide 1 Total home sales in 2025 are forecast at 4.74 million units. Slide 2 Mortgage rates expected to finish 2025 at 6.5%, dipping to 6.1% by 2026. Slide 3 Forecast revisions are modest, keeping housing sales stable despite economic uncertainties. Slide 4 Fannie Mae...

Multifamily Housing Starts Surge 21% in Q2 2025

Multifamily housing starts reached 109K units in Q2 2025, with 102,000 built-for-rent, ↑ 21% yearly. Rental units made up 94% of multifamily starts, far above the long-term avg of 80% and the historical low of 47% during the 2005 condo boom. Condo construction starts...

The 8 best real estate markets in the country right now

WalletHub ranked 300 U.S. cities to identify the strongest housing markets in 2025, considering factors like home-price appreciation, foreclosure rates, affordability, job growth, and new home construction. With rising mortgage rates and a seller-friendly market,...

Are 2027 Trends Favoring Long-Term Gains?

Home prices are projected to rise 4% in 2027, reaching 10.8% cumulative growth since 2024. Experts forecast continued moderate gains in 2027, following slower increases in 2025 and 2026.

Utah: Hottest Spots for New Home Builds

Utah is one of the top states in the country for new home builds. Utah ranks No. 4 nationally, building 18.6 new homes per 1,000 existing.

Utah: Among States With High Home Values by 2030

Slide 1: "Utah’s Silicon Slopes drive home prices toward $673K by 2030." Slide 2: Limited housing and zoning challenges keep prices rising fast."