3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

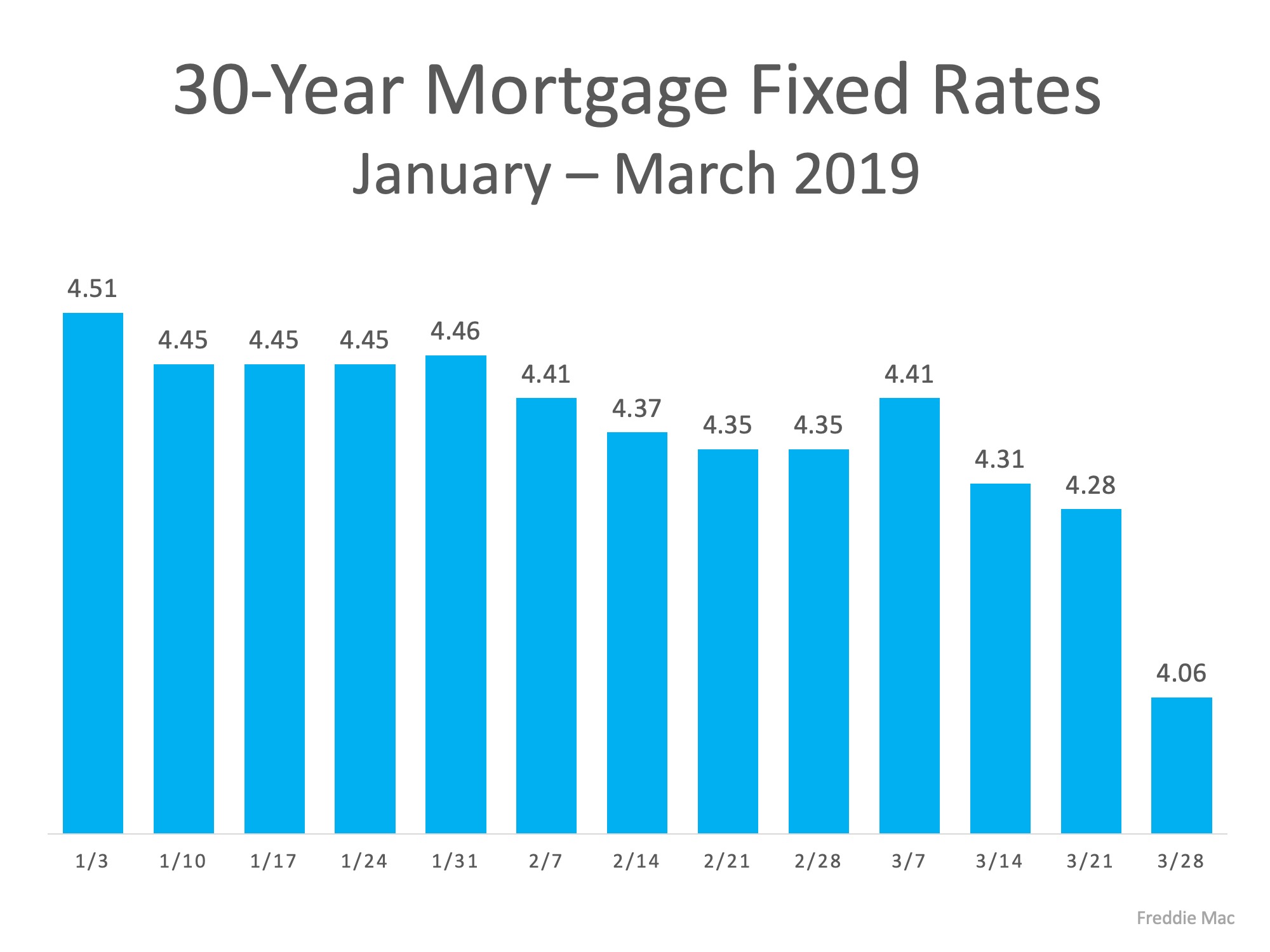

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

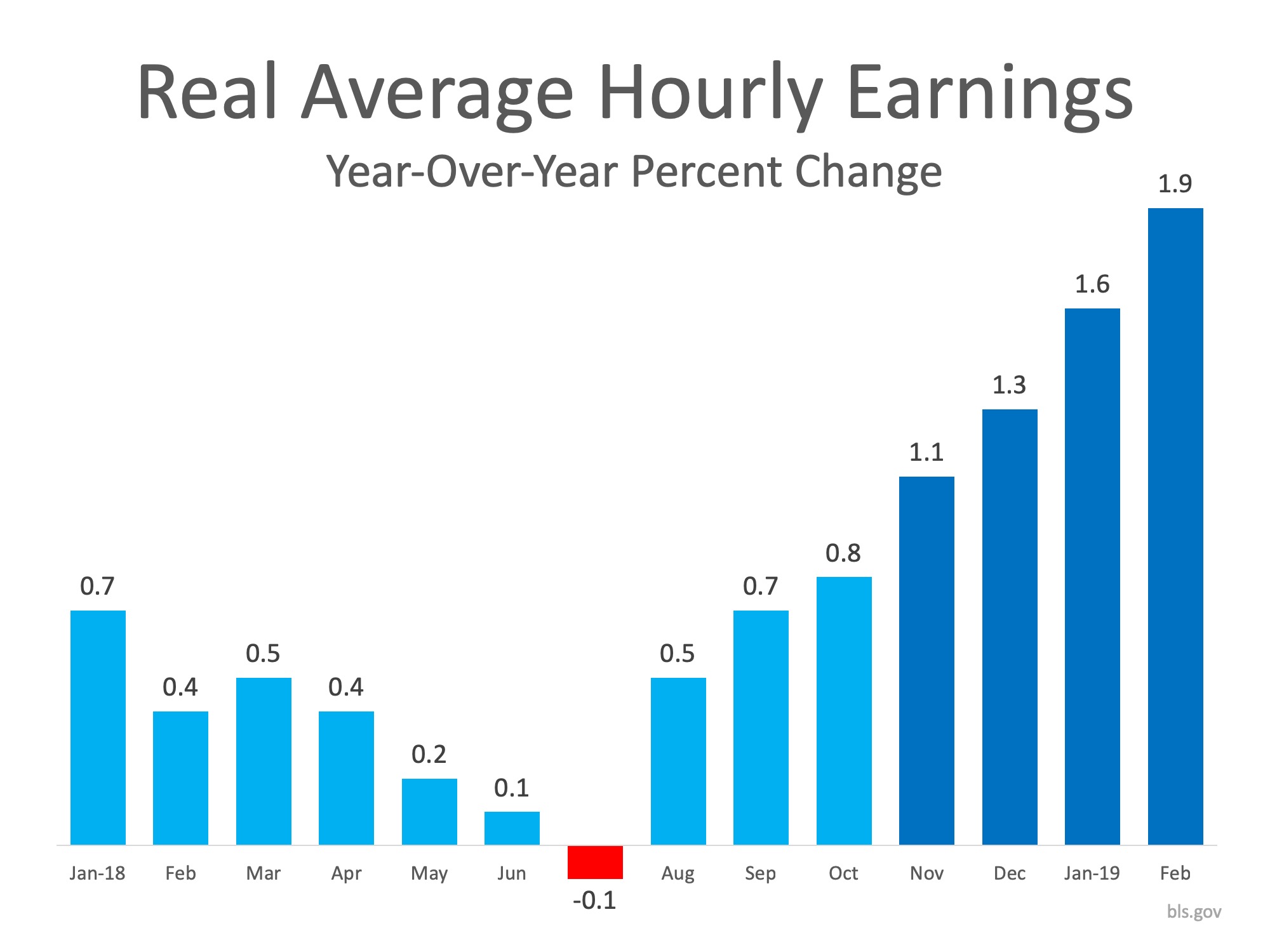

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

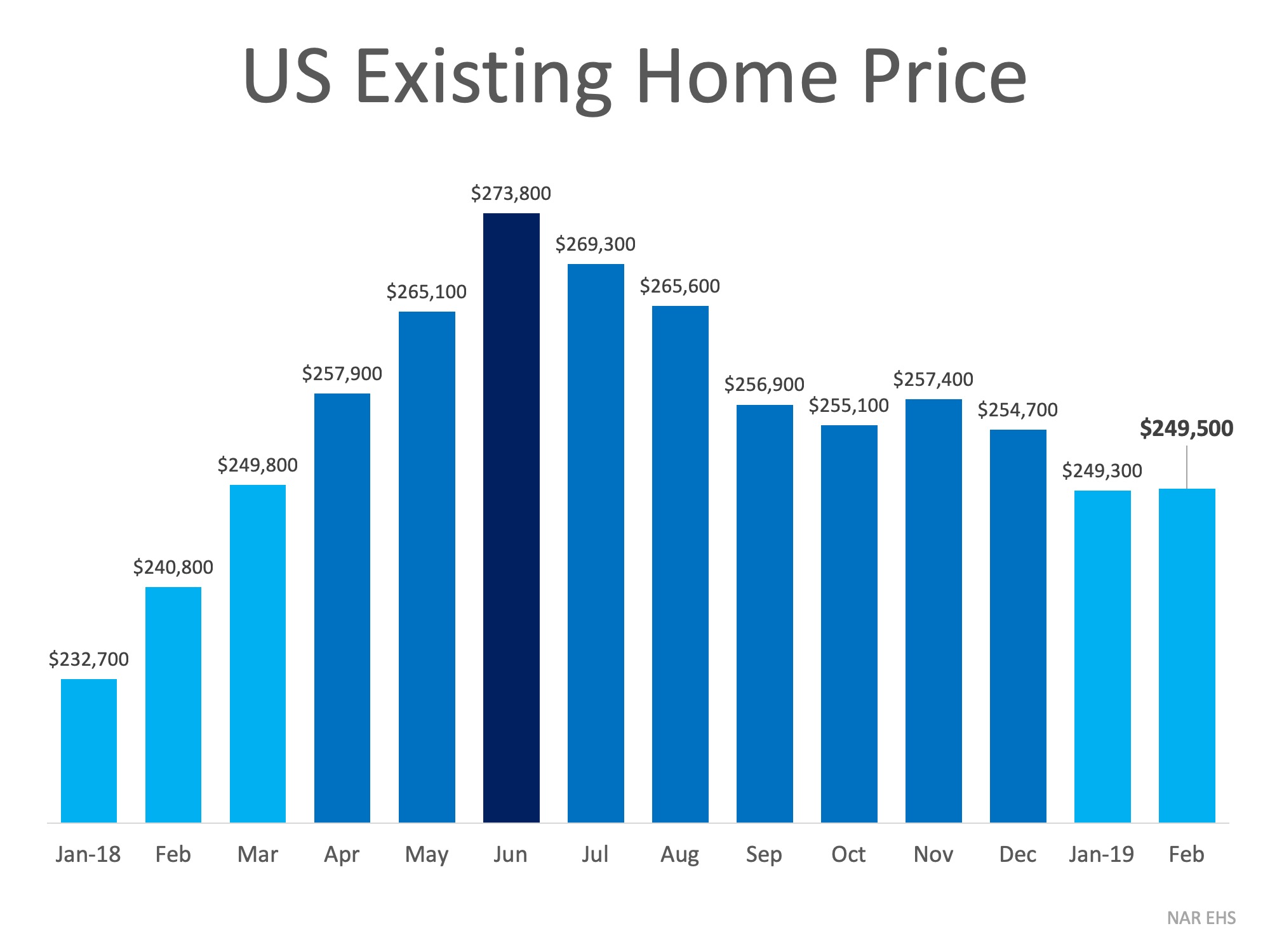

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Why the Price of Your House Matters When Selling

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

Home Prices Forecast To Climb over the Next 5 Years

Home Prices Forecast To Climb over the Next 5 Years Some Highlights If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house...

The Dramatic Impact of Homeownership on Net Worth

The Dramatic Impact of Homeownership on Net Worth If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision. Every three years, the Federal...

Avoid These Common Mistakes After Applying for a Mortgage

Avoid These Common Mistakes After Applying for a Mortgage If you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. But before you get too far down the emotional path, there are some key things to...

What are your Goals for 2024?

What are your Goals for 2024?

What Lower Mortgage Rates Mean for Your Purchasing Power

What Lower Mortgage Rates Mean for Your Purchasing Power If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly...

Achieving Your Homebuying Dreams in 2024

Achieving Your Homebuying Dreams in 2024 [INFOGRAPHIC] Some Highlights Planning to buy a home in 2024? Here’s what to focus on. Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you. Let’s connect so you have...

Why Pre-Approval Is Your Homebuying Game Changer

Why Pre-Approval Is Your Homebuying Game Changer If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future...

Thinking About Buying a Home? Ask Yourself These Questions

Thinking About Buying a Home? Ask Yourself These Questions If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media,...

Things To Consider If Your House Didn’t Sell

Things To Consider If Your House Didn’t Sell If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to...