The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

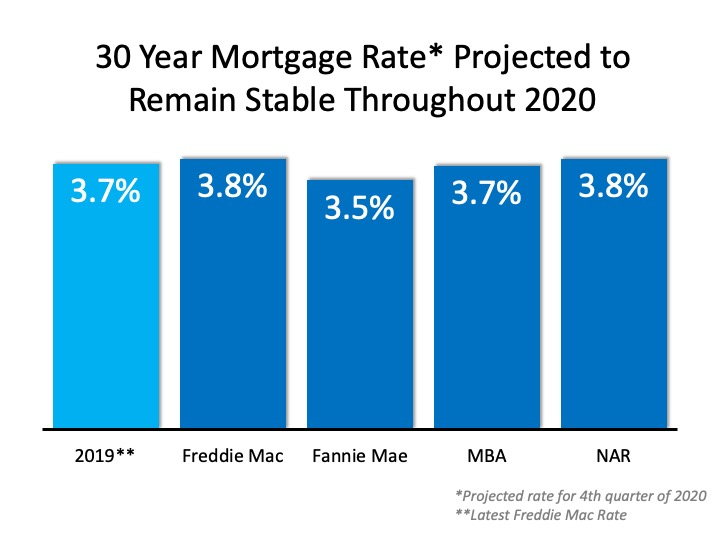

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

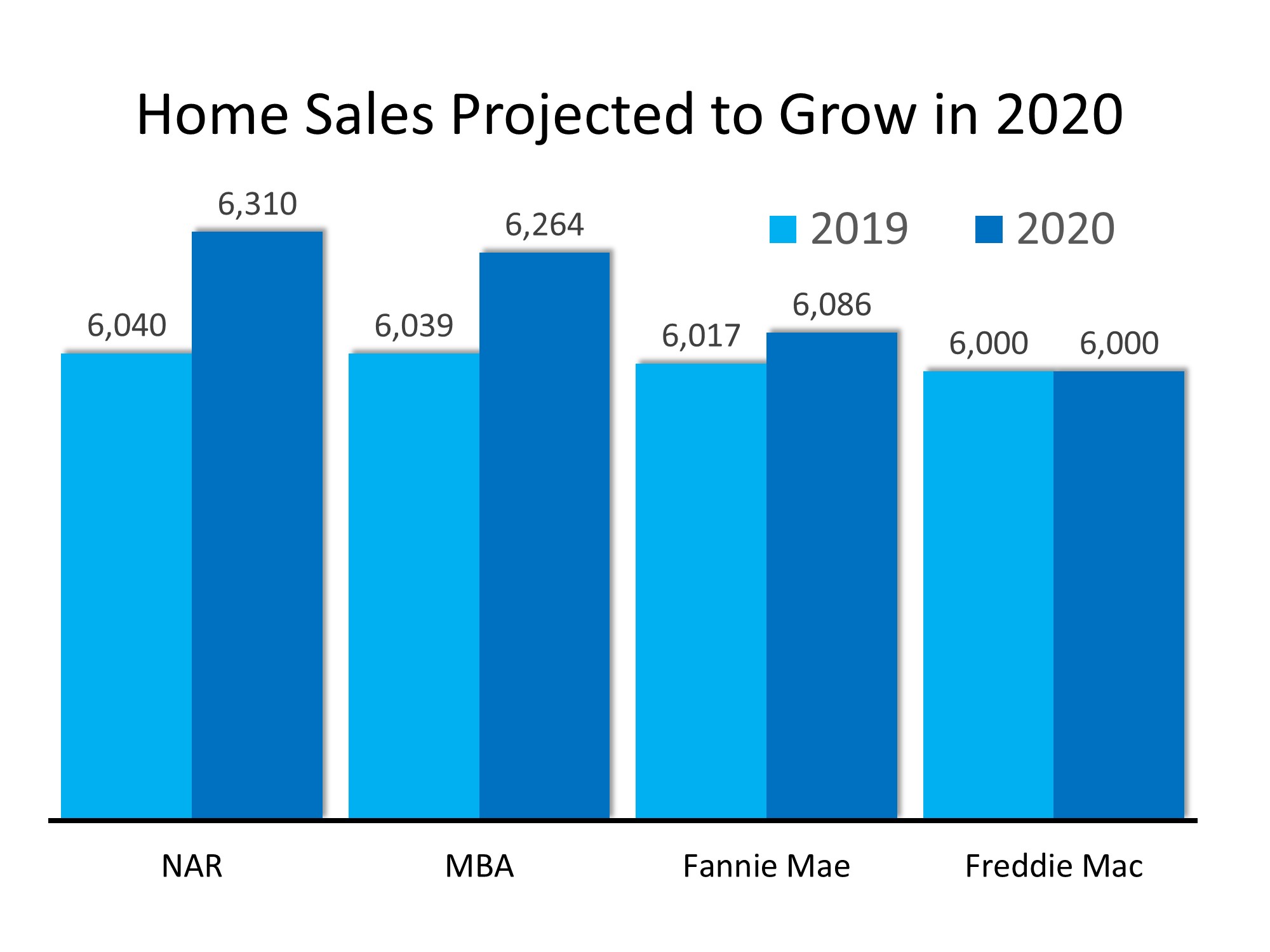

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

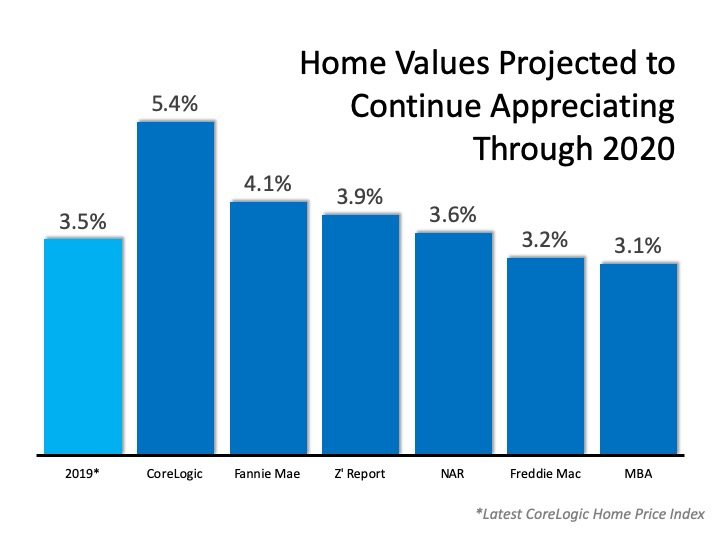

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

2025-27 Real Estate: Prices Rise 3.5% Yearly, Building Slows

US home prices are forecast to ↑ 3.5% annually through 2027, the slowest since 2011. Tariffs are expected to reduce construction of budget homes, with 90% of analysts predicting fewer builds

Could a Rate Cut Free Housing’s ‘Stuck Pig’?

Despite Fed rate cuts, 2025’s housing market remains a “stuck pig,” trapped by affordability and structural issues. Median home prices remain 4.2x median income; price gains forecast between 0.6% and 6.1% for 2025.

Utah 2025: Boomtowns Adjust to New Normal

Salt Lake City prices likely to flatten or dip as post-pandemic migration slows. New builds and resale listings ease supply crunch seen in boom years.

Essential Steps to Take for Financial Success Before Buying a Home

Buying a home is a significant milestone that requires careful financial preparation. Before starting the process, assess your financial situation, pay down high-interest debt, and establish an emergency fund. Check your credit score and get pre-approved for a...

5 smart ways to use $100,000 in home equity right now

U.S. homeowners have about $300,000 in tappable home equity, offering borrowing options at around 8% interest, much lower than credit card rates above 21%. Smart uses for $100,000 in equity include paying off high-rate debt, strategic home renovations, investing in...

How Can You Set the Stage for Winning Offers?

Provide a comprehensive disclosure package before listing: Include seller disclosures, inspections, HOA documents, and a FAQ to inform buyers upfront.Promote open house opportunities: Utilize MLS tools to list open house dates and times, making it easier for buyers to...

2025 Sale Secrets: Best & Worst Times

Listing in late spring, especially Mid-Q2, yields the highest sale premiums for home sellers. The holiday season is the weakest period — December 24, 26, and 31 show the lowest returns.

What Is The Cost Of Living In Provo-Orem?

To maintain your standard of living in Provo-Orem, you'll need a household income of $71,851. - Home Price: $604K - Apartment Rent: $1,531 - Total Energy: $164

Maximizing Returns: How to Refinance Your Investment Property

Buying a second home involves stricter mortgage rules and higher rates. Refinancing can optimize cash flow and change terms, rates, or release equity on rental properties. Conventional loans are required for cash-out refinancing on investment properties. Leveraging...

Salt Lake County property tax bills could see a slight drop this year

Salt Lake County's certified property tax rate decreased from 0.1297% to 0.1253% to adjust for inflation, keeping revenue stable without raising taxes. New growth added $3.76 million in revenue, though slightly below projections. Some residents will see different...