The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

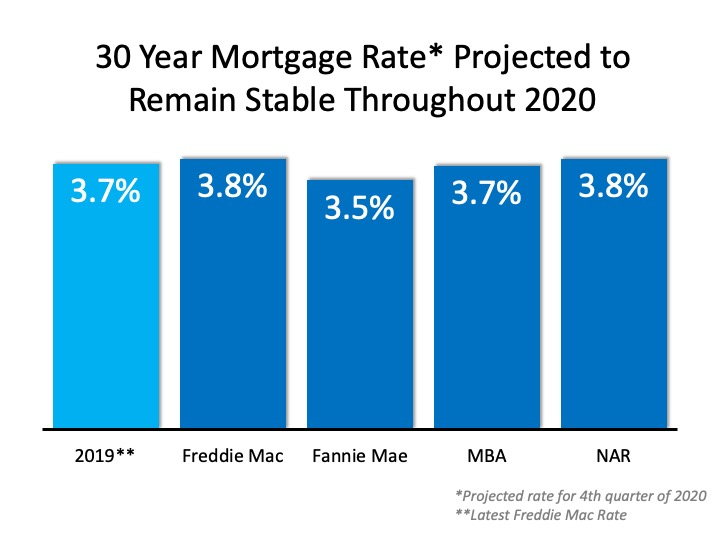

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

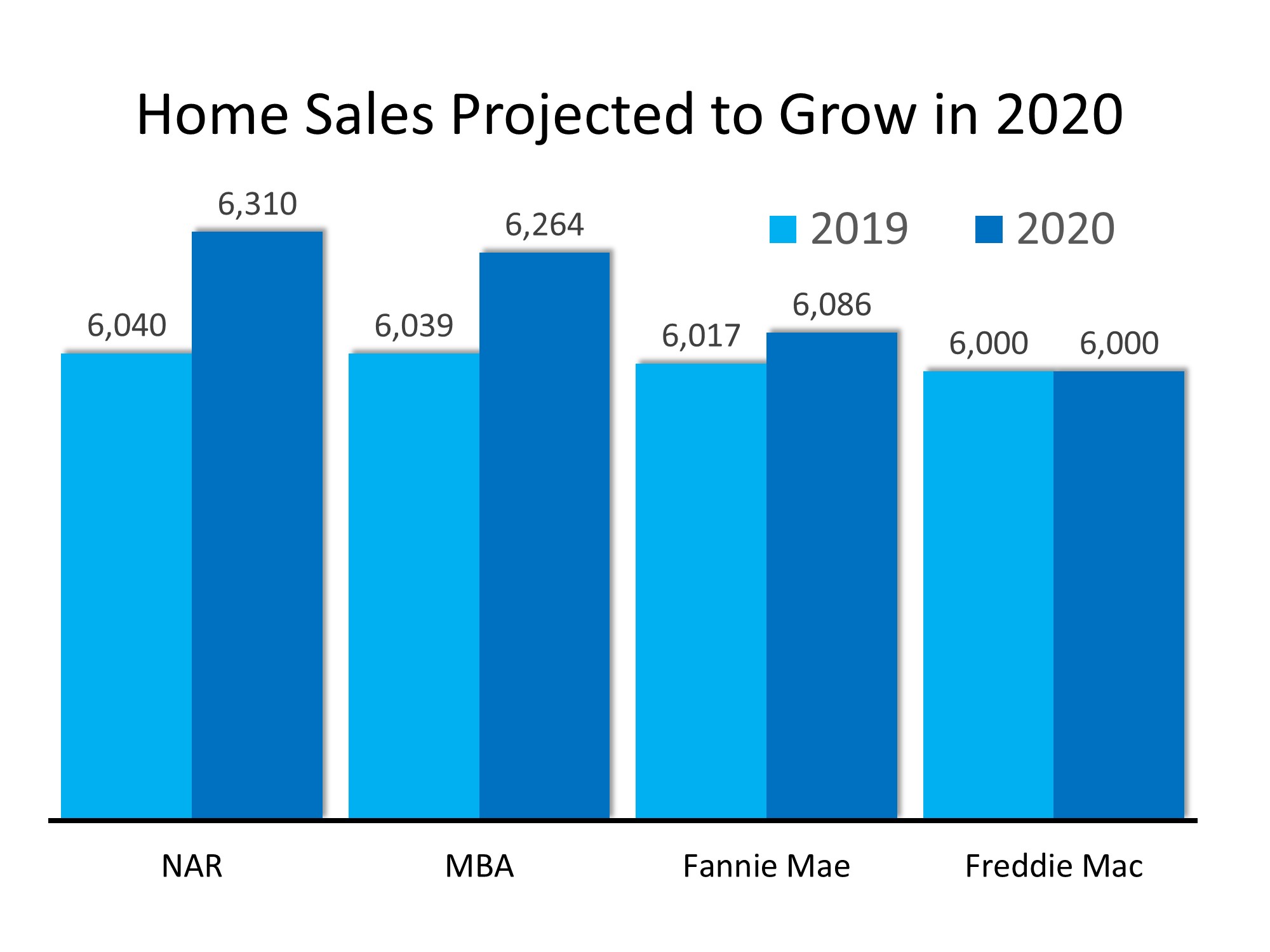

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

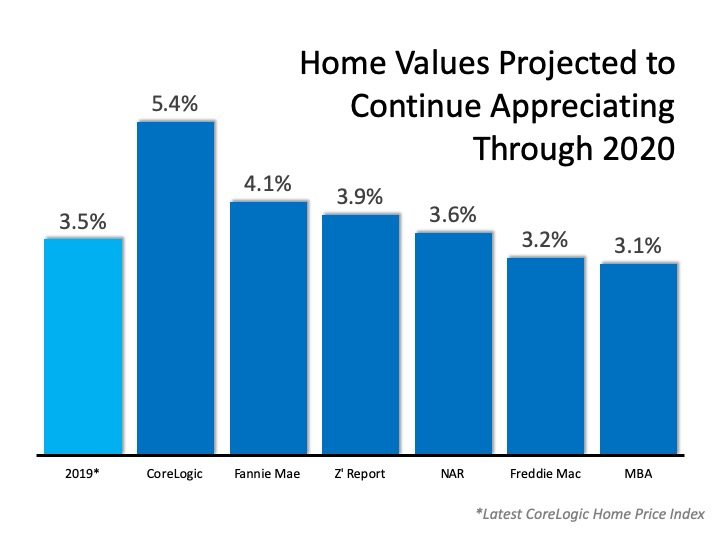

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

How the Appraisal and Inspection Empower You as a Homebuyer

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Where Are Mortgage Rates Headed?

Where Are Mortgage Rates Headed? There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don't ever try and forecast...

Why a Real Estate Professional Is Key When Selling Your House

Why a Real Estate Professional Is Key When Selling Your House With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly...

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Using Your Tax Refund To Achieve Your Homeownership Goals This Year If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re...

The Future of Home Price Appreciation and What It Means for You

The Future of Home Price Appreciation and What It Means for You Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15...

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice...

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

What’s Happening with Mortgage Rates, and Where Will They Go from Here? Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more...

The Many Benefits of Homeownership

The Many Benefits of Homeownership The past two years have taught us the true value of homeownership, especially the stability and the feeling of accomplishment it can provide. But homeownership has so much more to offer. Here’s a look at a few of the non-financial...

Why It’s Critical To Price Your House Right

Why It’s Critical To Price Your House Right When you make a move, you want to sell your house for the highest price possible. That might be why many homeowners are eager to list in today’s sellers’ market. After all, with record-low inventory and high buyer demand,...

This Spring Presents Sellers with a Golden Opportunity

This Spring Presents Sellers with a Golden Opportunity If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next...