2020 Luxury Market Forecast

By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger or more expensive home in the luxury space. That said, now is a perfect opportunity to take a look at the forecast for the 2020 luxury market.

Three Things to Think About in the 2020 Luxury Housing Market

1. Prices

The U.S. economy is strong today, with buying opportunities throughout the luxury end of the market. Thomas Veraguth, Strategist at UBS Global Wealth Management, says in Barrons.com,

“There’s a good link between luxury real estate prices and [economic] growth.”

Available inventory is a key element that can impact home prices. At the upper range, the inventory is greater in comparison to the entry-level market, making moving up to a luxury home a growing reality for many buyers right now.

2. Activity in the Market

With more buying opportunities at the higher end, we should start to see an increase in activity. The same article states,

“Affluent homebuyers will start to come out of the woodwork as they find rising luxury rents less appealing and sellers get even more negotiable on price.”

Buyers looking in the luxury market are taking the opportunity to negotiate on price in a segment where there are more choices, too. According to the Luxury Market Report, homes sold for an average of 96.94% of the list price in December.

Buyers are also getting more for their money with greater purchasing power due to the current low interest rates.

3. Buyers Are Coming Back

Keep in mind, buyers are often sellers too, especially those looking to move up. Homeowners with an entry-level home can take advantage of the inventory shortage at the lower end of the market, thus driving higher sales prices for their current homes. Combined with growing equity in the homes they’re listing, it’s a great time for those who are ready to make a luxury move.

The extra equity and greater purchasing power are bringing many buyers back to the market. The same article mentioned that,

“We’ve already seen buyers who’ve been on the sidelines for two years tread back into the market.”

Bottom Line

If you’re considering entering the luxury market, 2020 is shaping up to be a great year for those who are ready to make that move. Let’s get together to set your real estate plan for the year.

Key Benefits of Health Insurance in the U.S.

Health insurance covers essential medical expenses like doctor visits, hospital stays, and preventive care. It protects you from high out-of-pocket costs during unexpected medical emergencies.

Guide to downsizing for retirees’s

Single Level Living is the best choice for Retiree's Retirement marks a significant transition in life, often prompting reevaluation of one's living situation and possessions. Downsizing can offer a simplified, more manageable lifestyle that aligns with the needs of...

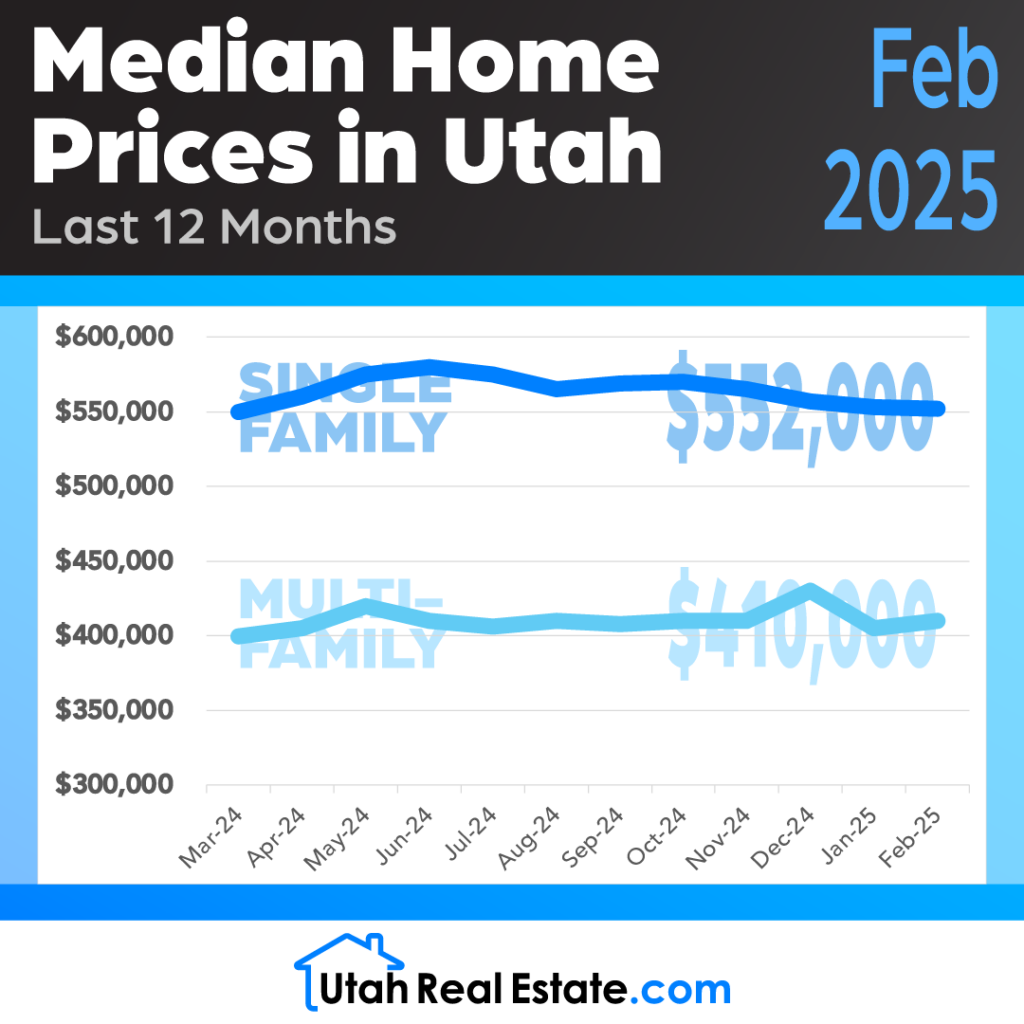

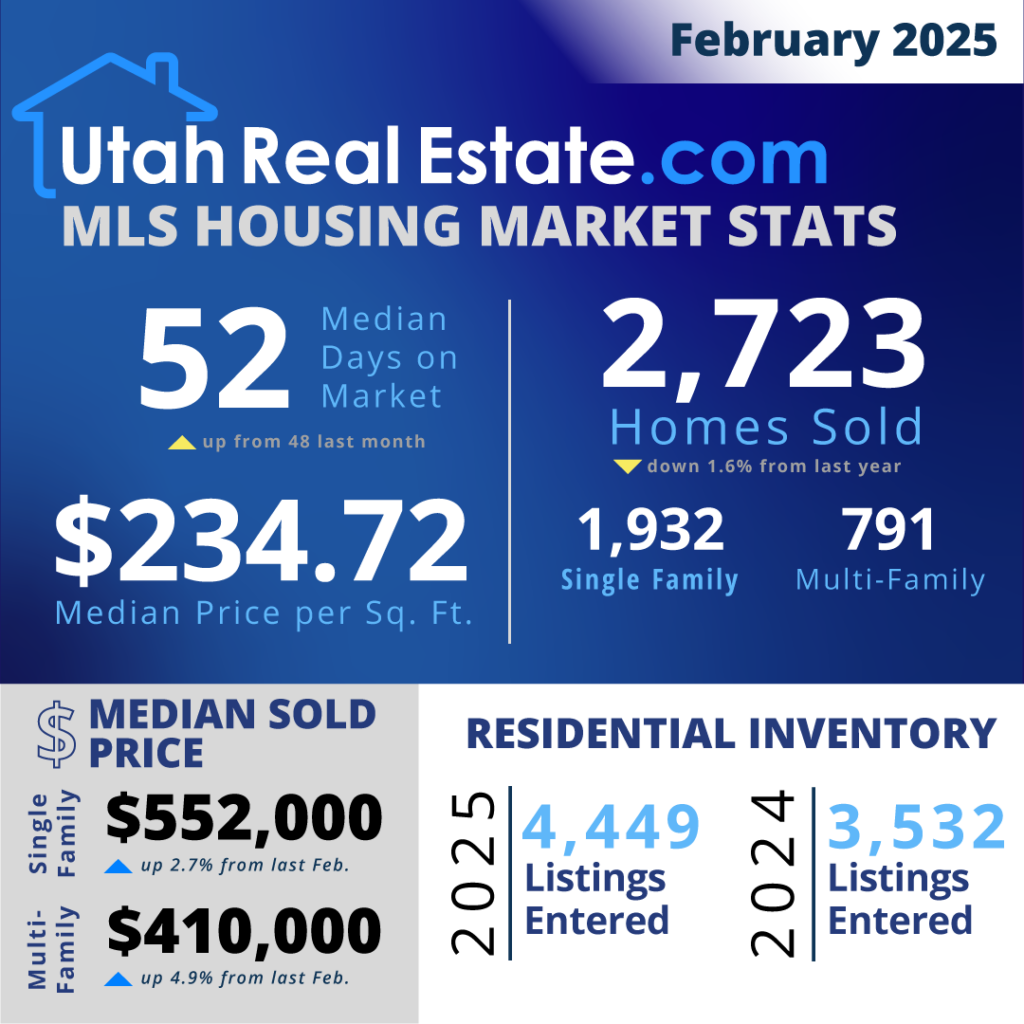

Median Home Prices February 2025

February 2025 Stats

Plans to Build 3 Million New Houses

Selling and leasing a small portion of federal land could lead to the construction of over three million houses in Western states, according to a right-leaning think tank. The Bureau of Land Management holds 267,000 square miles, and selling just 850 miles could...

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.