2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Wasatch County Cheap Homes

Bargain homes and other real estate in Wasatch County, Utah Search Wasatch County, Utah Bargain homes. See information on particular Bargain home or get Wasatch County, Utah real estate trend as you search. Besides our Bargain homes, you can find other...

Utah Realty News & Blog

South Jordan City Leisure Guide

[flipbook pdf="https://utahrealtyplace.com/wp-content/uploads/2018/01/South-Jordan-Leisure-Guide-Jan1_18.pdf"] Here are the events that South Jordan City is planning on for Januarary thru April . South Jordan Leisure Guide Jan1_18

It pays to hire professional Realtors

Do it yourself companies Utah Division of Real Estate HOMIE, INC., real estate brokerage, Draper, Utah. In a stipulated order dated October 18, 2017, Homie, Inc. admitted to offering a variety of services to individuals seeking to sell or buy real estate located in...

Grant Money for Down Payment

Grant Money you don't have to pay back? WOW! We will have several 5K grants that may be applied to the down payment. Grant money will be available in mid-January, so start lining up your clients. There will be a limited number and will be awarded...

Salt Lake County Top 10 Highest Price Cities

Price of Salt Lake Homes Hits New High The price of a single-family home has increased to its highest point ever before, according to the Salt Lake Board of Realtors®. In the July-August-September quarter, the median price of a Salt Lake...

How Long are Sellers Staying in Their Homes?

Welcome Tanna Barker New Associate with Utah Realty

Press Release, Utah Realty is incredibly pleased to announce that Tanna Barker, a new real estate agent has joined our team. We are excited to work with her and know you will be too. Tanna has over 20 years of experience working with...

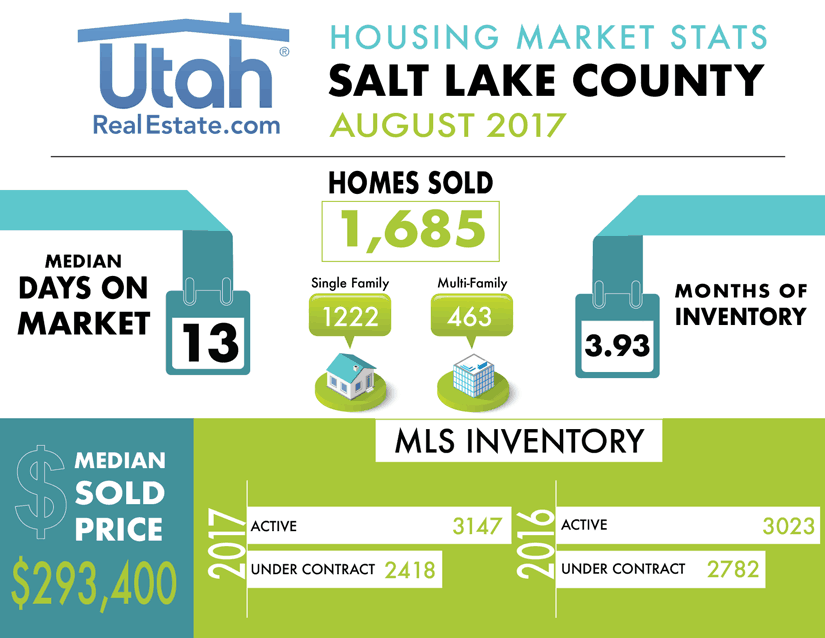

Salt Lake County Housing Stats for August 2017

Home Sales Tumble as Inventory Wanes

https://gateless.com/articles/get-listings/home-sales-tumble-as-inventory-wanes?CampaignId=492